Treasury Automation: Adapting to Increased Expectations

- Date:February 26, 2022

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

The Automation of Treasury Management Software Solutions Is a Priority in Corporate Financial Operations

Automating treasury operations has been a steady goal in corporate finance since at least the mid-2000s. The increasing technology capabilities of the past several years, along with the pandemic, which has refocused the corporate world on liquidity, have combined to help shift treasury automation into a higher gear. In a new research report, Treasury Automation: Adapting to Increased Expectations, Mercator Advisory Group reviews the traditional and now changing role of treasury management into a more strategic resource for the CFO. Forward-thinking financial institutions, traditional treasury management solution providers, and latest generation fintechs are striving to assist their corporate clientele to optimize their capabilities in treasury operations. Companies are looking to their providers to help move them to a new level of effectiveness.

“Treasury management has traditionally been a specialized and lightly resourced area of corporate finance. This began to change after the global financial crisis as the role of treasury began to expand in the planning and execution of corporate financial imperatives,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service, author of the report. “That adaptation through technology advancements continues and, of course, received a boost from pandemic-generated issues when the recognition of digitized financial processes as a catalyst for improved financial operations became quite clear to many, especially lagging organizations.”

The document is 17 pages long and contains 4 exhibits.

Companies and other organizations mentioned in this report include: Cashforce, Citi, Coupa, Deliveroo, Financial Data Exchange, Finastra, FIS, Fiserv, FISPAN, GTreasury, HighRadius, HSBC, Infosys, ISO, IT2, Kyriba, Planixs, Serrala, SmartBear, SWIFT, TCS, Temenos, TIS, Treasury4, Trovata, Wells Fargo, Wipro

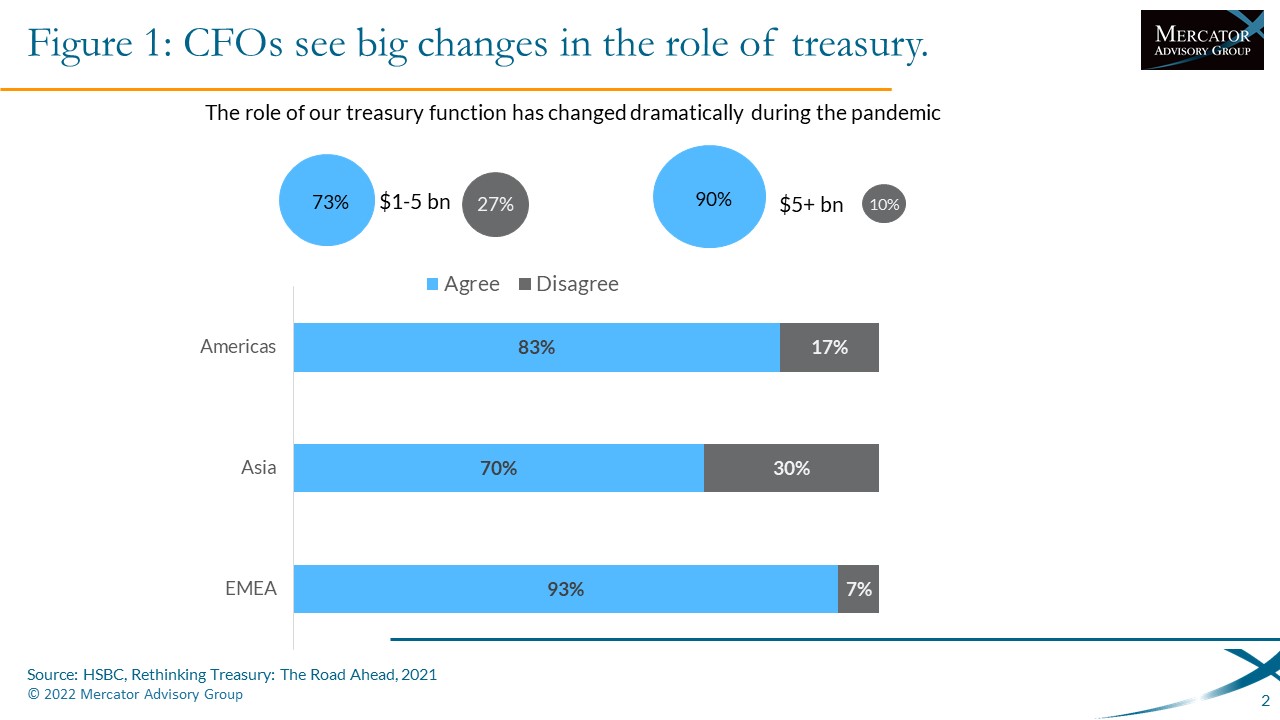

One of the exhibits included in this document:

Highlights of this document include:

- A detailed review of the traditional role of treasury management and the key functions of treasury operations.

- An analysis of the shifts occurring in strategic expectations around treasury management.

- A breakdown of four key technology trends that are impacting the efficiency and effectiveness of corporate financial operations.

- A case summary of how one institution used technology to become a more strategic partner for a corporate client.

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world