Supplier Enablement of Cards in B2B E-Payments Requires Persistence, Data, and Technology

- Date:December 22, 2016

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

In a new research report, Supplier Enablement of Cards in B2B E-Payments Requires Persistence, Data and Technology, Mercator Advisory Group discusses supplier enablement, recommending fundamental approaches for success, suggesting tools to enhance suppliers’ recognition of the value proposition of B2B e-payments, and reviewing innovative business/technology trends that will have an impact on the industry.

"While the commercial card industry continues to benefit from the ongoing shift away from cash and checks and the increase in purchase volume, vast opportunities still exist for growth in cards as payables tools,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “There is substantial untapped potential, given the size of the market. The effort to drive further adoption of virtual cards among suppliers is one of the key activities of commercial card issuers and their corporate clients.”

The note is 24 pages long and contains 10 exhibits.

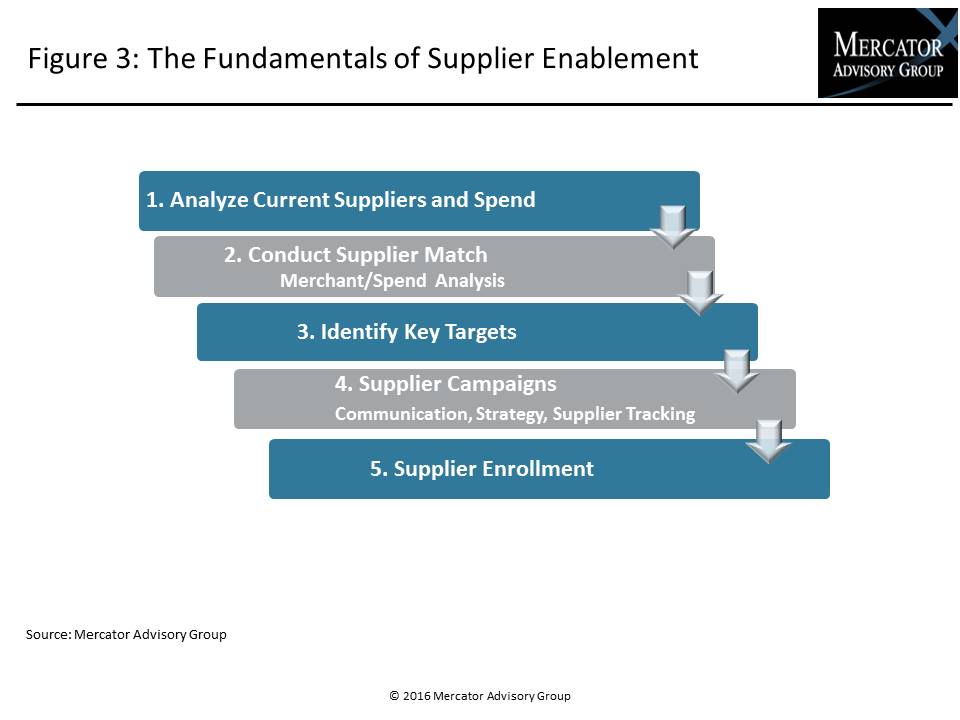

One of the exhibits included in this report:

- A step-by-step approach for fundamental success

- A discussion of the opportunities around driving revenue through scale versus interchange and rebates

- Methods to overcome the continuing greatest single hurdle, suppliers’ resistance to pricing

- A detailed review of the value proposition for suppliers

- A review of next-generation technology driving new business approaches that allow for flexible pricing and ease of card payments

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world