Small Business: Adoption of Mobile Banking

- Date:December 02, 2015

- Author(s):

- Michael Moeser

- Report Details: 29 pages, 14 graphics

- Research Topic(s):

- Small Business

- Digital Banking

- PAID CONTENT

Overview

As smartphones and tablets become more pervasive in the U.S., it is no surprise that more and more small and micro businesses are using them in their businesses. In this report, Javelin examines the adoption of mobile devices for use in small business and specifically for mobile banking and payments. The report reviews the features that are most attractive to small and micro businesses that currently use mobile banking as well as the features that would encourage non-users to adopt mobile banking. The report rates the level of satisfaction users have with their primary bank’s mobile banking platform and, finally, identifies common barriers to mobile banking adoption.

Key questions this report will address:

- Do micro and small businesses use mobile devices in their businesses?

- What is the adoption level of mobile banking among small and micro businesses?

- How frequently do micro and small businesses log onto their mobile banking service?

- What mobile banking features are primarily used by small and micro businesses?

- Are businesses satisfied with the mobile banking services from their primary bank?

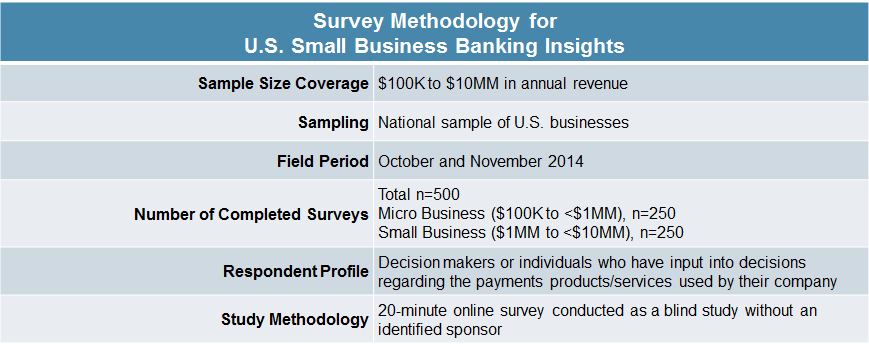

Methodology

Book a Meeting with the Author

Related content

The Invoicing Gap: How Small Businesses Get Paid, and Why Banks Are Missing Out

Invoicing is one of the most fundamental workflows in running a small business, sitting at the center of getting paid, managing cash flow, and maintaining customer relationships. Y...

2026 Small Business Banking Trends

Small businesses have always straddled two worlds. They expect the simplicity of consumer banking but often need the personalization and sophistication of corporate solutions. A tu...

CSI’s Acquisition of Apiture Creates a Formidable Full-Stack Player

CSI’s acquisition of Apiture in August is a game-changer for a company that has long been a trusted provider of core banking for community banks. CSI is positioned to gain a market...

Make informed decisions in a digital financial world