Procure-to-Pay Digital Convergence Moving Forward

- Date:July 12, 2022

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

Procure-to-Pay Systems Strengthen Financial Operations Across the Board.

A new research report from Mercator Advisory Group, Procure-to-Pay Digital Convergence Moving Forward, reviews the trends in the procure-to-pay spectrum of systems and processes. There are core parts of the procure-to-pay flow, and there are those not directly connected but add to the overall value of digital initiatives across the cash cycle. The current and future states of the procure-to-pay technology landscape and some of the companies that are providing solutions in each of the key delivery areas are addressed. There is a growing convergence of these systems as vendors adapt to modern capabilities and increasingly seek to deliver a better experience for end users.

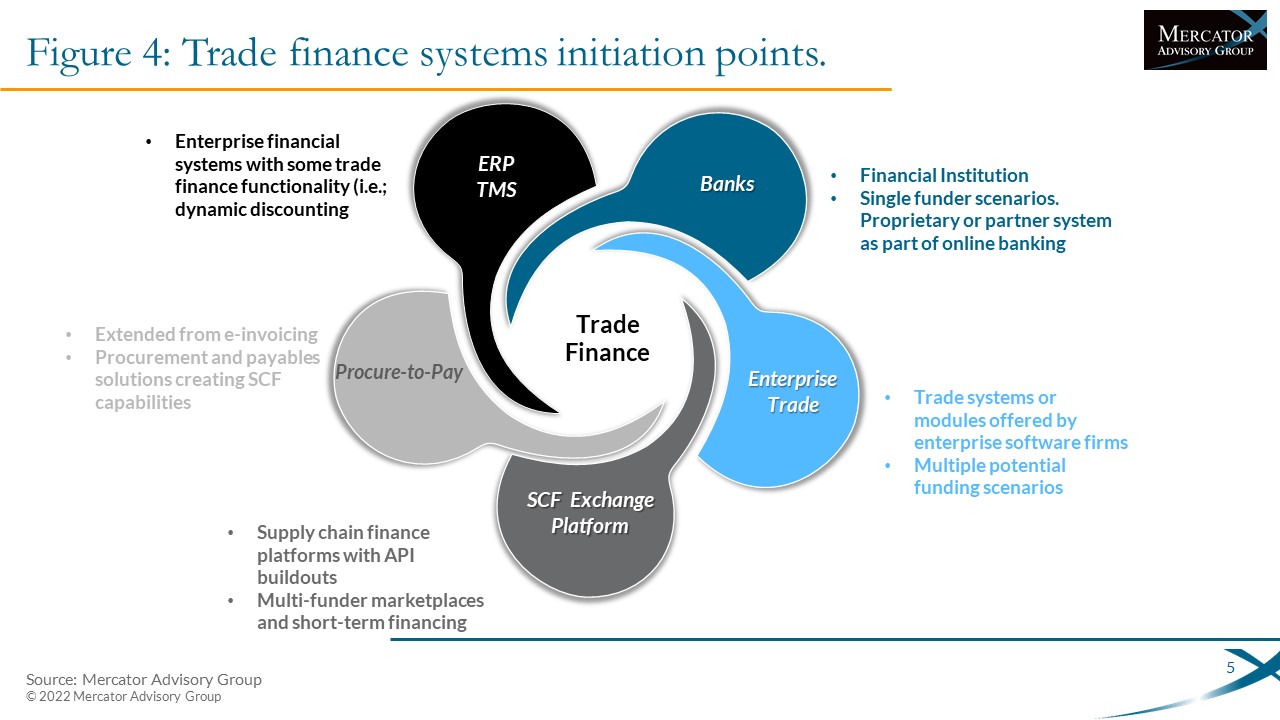

There are, of course, other back-office systems (sourcing, accounting, reconciliation), which in effect become part of the broader “source-to settle” timeframe, and front-office technology (most notably customer relationship management, or CRM) that supports business success. Accounts receivable still is separated from accounts payable in the typical large enterprise, and the two are unlikely to fully converge in the short term, and sourcing is an ongoing evaluation of potential suppliers. Trade finance is another area that can be brought into the flow as valuable enhancements to and opportunities in the automation effort.

"Procure-to-pay traditionally has been thought of as a series of point solutions that are loosely connected at a conceptual level. During the past decade, a concerted effort has pushed to take the key system elements of these disparate but related solutions and combine them into a suite of services." commented Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service, author of the report, "This effort has been successful to a degree, but due to technology advancements, the same suite can be delivered while continually adding value in core parts as well as peripheral solutions that combine to strengthen financial operations and options across the board."

This report is 14 pages long and has 4 exhibits.

Companies mentioned in this report include: ACI, AvidXchange, Basware, Bill.com, Bottomline Technologies, Broadridge, CGI, Citi, Corpay, Coupa, Crossinx, Digital Technologies, EBANX, Edicom, Esker, Finastra, FIS, Fiserv, GEP, HSBC, Ivalua, Jaggaer, JP Morgan Chase, Medius, Mineral Tree, Neopost, Open Text, Oracle, Pagero, Proactis, SAP, Sungard, TIBCO, Tipalti, Tungsten Network, Volante, Zycus.

One of the exhibits included in this report:

Highlights of this research report include:

- Procure-to-Pay Components

- Core Capabilities

- Related Solutions and Trends

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world