Premium Travel Reward Credit Cards: High Profile but Unsustainable

- Date:July 25, 2017

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

The latest in premium credit card products, travel credit cards targeted to consumers with strong credit scores and above-average income, grab headlines with sky-high introductory rewards and fees. Consumers are attracted by rewards and the 24-karet gold-plated cards, but is this an unrealistic business model? Will customer attrition occur in the second year when $450 fees come due with only a fraction of the first-year benefits available?

Mercator Advisory Group’s latest research report, Premium Travel Reward Credit Cards: High Profile but Unsustainable, discusses the long-term proposition of these high-reward/high-fee cards and presents analysis pointing to four reasons the model will not stand the test of time:

- Top-tier issuers are already reducing their rewards. Points per dollar spent set at 100,000 one day are 50,000 the next, causing market confusion.

- Year-2 benefits are nowhere near as attractive as year-1 benefits, which will likely cause attrition.

- A potential shift from accounts transacting (cardholders paying off balances monthly) to revolving (cardholders paying over the course of time) could upset issuer revenue expectations.

- The reliance on interchange works in the U.S. market today, but if regulators follow the example of Australian, Canadian, or European regulators’ standards, the source for funding card rewards will end.

According to the report, U.S. households are adding new credit despite sky-high volumes of outstanding credit card debt as well as auto finance and student loans. Winning new customers and coming up with new payment tools is exciting, but issuers need to keep their eye on the ball particularly since the lending growth is outpacing household income growth.

“Everyone loves credit card rewards. They attract customers and drive product preference. But a $450 annual fee is a big commitment for a credit card, even if the first-year cost is offset by points per dollar spent,” commented Brian Riley, Director, Credit Advisory Service, Mercator Advisory Group. “Issuers need to think about the second year and beyond. Once the luster of that flashy metallic card is gone, will the cardholder commit to $450 the next year? When you consider that bank card accounting allows the expense to be allocated over seven years. If the customer leaves in year 2 or 3, that’s a pretty expensive proposition.”

This research report contains 17 pages and 5 exhibits.

Companies mentioned in this report include: American Airlines, American Express, Barclaycard, Capital One, City National, Citi, Discover, First Data, FIS, Fiserv, HSBC, M&S Bank, MasterCard, NatWest, Royal Bank of Canada, Royal Bank of Scotland, Santander, Tesco, TSYS, US Bank, USAA, and Visa.

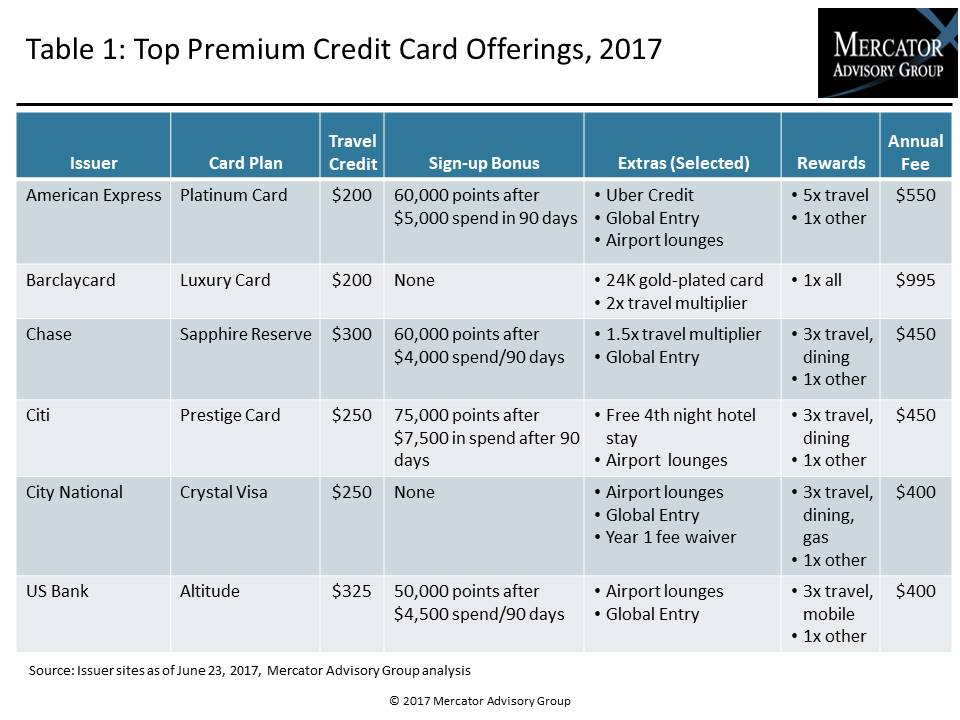

One of the exhibits included in this report:

- Discussion of reward revenue dynamics

- A review of why US interchange, among the highest in the world, could be decisive in unraveling premium reward cards.

- Market scan of top tier products

- Four reasons the business model is at risk

- How the industry should react to premium travel reward cards

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world