Mobile Payments Is Really Here

- Date:October 22, 2015

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group’s most recent Insight Report from the CustomerMonitor Survey Series reveals that as smartphone penetration increases, reaching 72% of U.S. adults, more consumers are using their phones to make payments. In fact, 42% of smartphone owners have used their mobile device to pay for goods and services in stores or online. Based on U.S. Census Bureau data, approximately 71.5 million U.S. adults used mobile payments in 2015, up from 61 million in 2014.

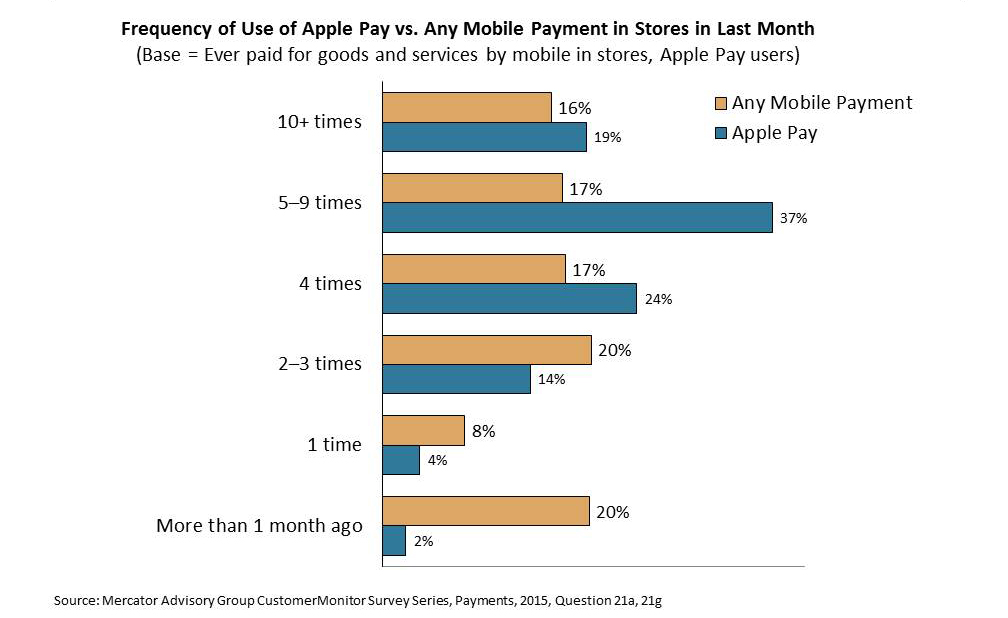

The introduction of Apple Pay on Apple iPhone 6 and 6Plus models with record-breaking sales has helped to foster the growth of mobile payments. Apple Pay users use mobile payments more frequently than average. While half of mobile payers report using mobile payments in stores at least once a week, 80% of Apple Pay users use Apple Pay at least once a week, and 19% of Apple Pay users used it 10 or more times in the previous month. Mobile payers appear to be using mobile payments as often as they can at stores they frequently visit.

Consumers are gaining familiarity with mobile banking and mobile payment, primarily for its convenience. Mobile Payments Is Really Here, the latest research report from Mercator Advisory Group, reveals mobile payments and mobile banking is of growing interest even for wearable technology in the form of wristbands, large-sized wristwatches and clip-on devices.

This study examines the demographic shift and changing landscape of Web-enabled mobile users, consumer use of mobile devices for making payments and shopping online and in stores, related payment features including e-couponing, e-receipting, e-loyalty as well as payment, balance, and fraud alerts, experience with Apple Pay compared to payment cards, and ownership, purchase plans and important features of wearable technology for payments.

The report findings are based on Mercator’s CustomerMonitor Survey Series online panel of 3,008 U.S. adult consumers surveyed in June 2015.

“Smartphone penetration is maturing, gaining broad-based market penetration as most U.S. consumers use their mobile to shop and increasingly buy goods and services in stores and online. Convenience is driving them to use mobile payments more often at the stores they visit, especially to redeem timely and useful e-coupons, discounts, and loyalty rewards,” states Karen Augustine, author of the report and manager of Primary Data Services at Mercator Advisory Group, which includes the CustomerMonitor Survey Series.

The report is 72 pages long and contains 34 exhibits

One of the exhibits included in this report:

Highlights of this report include:

- Year-over-year trends in smartphone and tablet ownership by screen size

- Year-over-year trends in use and interest in various methods of in-store and online mobile payments

- Use of mobile phones for shopping online and in stores

- Apple Pay use, payment cards loaded and used and satisfaction compared to payment card use

- Demographics of mobile users and mobile payment users and satisfaction with operability of mobile phones

- Challenges to mobile payment adoption and frustration with mobile-based coupon organization and redemption

- Shifts in use and delivery methods for six types of financial alerts

- Shifts in use and interest in e-couponing, e-receipting, and apps for coupon and receipt storage and management

- Use, interest, format, and importance of features for wearable technology including payments, mobile banking, and money transfers

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world