International Commercial Credit Cards: Market Review and Forecast, 2021-2026

- Date:May 26, 2022

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

This new research report reviews the commercial credit card industry in markets outside of North America.

The pandemic has taken a toll on the commercial credit card industry during the past two years, especially in regions outside of North America where business travel spending is the predominant source of revenue for the issuing participants. Improvements occurred during 2021 as domestic travel picked up and certain international routes also began to open, situations that continue into the first half of 2022. As such, a general spending recovery is expected by 2024, and potentially sooner depending upon the actual updated travel policies enacted and budgets approved by corporations across the globe.

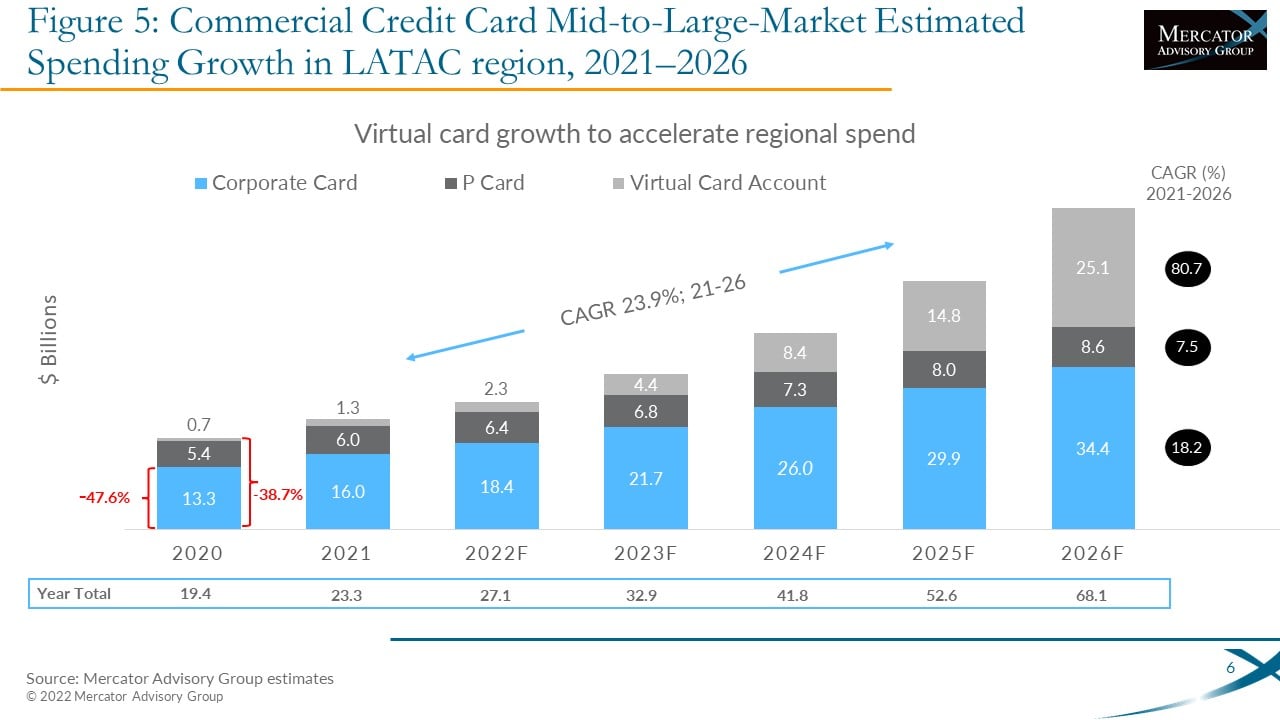

A new research report from Mercator Advisory Group, International Commercial Credit Cards: Market Review and Forecast, 2021-2026, reviews the current situation and outlook as the industry continues to recover and business travel improves. This is Mercator Advisory Group’s annual review of the commercial credit card industry in markets outside of North America (NA). This research report includes overviews and estimated commercial credit card spending for mid-to-large corporates in Western Europe (WE), Asia Pacific (APAC), Latin America and Caribbean (LATAC), and Central and Eastern Europe, Middle East, and Africa (CEEMEA).

"Commercial credit card participants in the mid-to-large market segments should continue to focus on broadening the appeal of payment instruments beyond the business travel use cases, as there are certain advantages to them that directly align with corporations’ renewed appreciation for working capital flexibility," commented Steve Murphy, Director of the Commercial and Enterprise Advisory Service at Mercator Advisory Group, the author of this report.

This report is 18 pages long and has 6 exhibits.

Companies mentioned in this report: American Express, Boost Payment Solutions, CardUp, Diners Club, EPI Interim Company, European Central Bank (ECB), Mastercard, Pharmarack, Plastiq, Reserve Bank of India (RBI), SGeBIZ, The Financial Services Commission (FSC), Visa, Whola

One of the exhibits included in this report:

Highlights of this research report include:

- Economic outlook in the indicative global markets

- Review of overall card spending trends and expectations across multiple regions

- Regional highlights of developments potentially impacting commercial card businesses

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world