How to Serve Baby Boomers’ Unmet Financial Needs

- Date:March 12, 2019

- Author(s):

- Mark Schwanhausser

- Report Details: 25 pages, 5 graphics

- Research Topic(s):

- Mobile & Online Banking

- Digital Banking

- PAID CONTENT

Overview

- Do Baby Boomers rely on online banking because they’re resistant to change — or because mobile banking fails to offer a better way to bank?

- What are the historically complex financial challenges facing Boomers?

- What digital features could ease the Boomers’ financial headaches and unmet needs?

- How would banking relationships benefit from digital upgrades for Boomers?

- Would upgrades for Boomers apply to younger generations, too?

Methodology

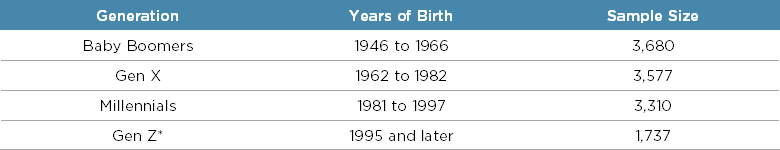

Consumer data in this report is based primarily on a random-sample survey of 10,375 respondents conducted online in June 2018. Data is weighted to reflect a representative sample of the adult U.S. population. For questions answered by all respondents, the maximum margin of error is 0.96 percentage point at the 95% confidence level. The margin of error is higher for questions answered by smaller segments of respondents.

*Because Javelin surveys only adults, the Gen Z data reflects consumers born 1995-2000 (ages 18-23) at the time the survey was conducted.

Population figures were sourced from the U.S. Census Bureau and filtered by Javelin's definitions of generations.

Data on the availability of digital banking features at U.S. FIs references Javelin’s 2018 Mobile and Online Banking Scorecards, which measure the availability of more than 400 criteria at 28 of the nation’s largest retail FIs ranked by total deposits.13 Data was collected from April to June 2018.

Statistics regarding the availability of digital banking features at Canadian banks reference data on the availability of more than 400 criteria at Canada’s seven largest retail banks, as measured by total assets. Data was collected from December 2018 to January 2019.

Book a Meeting with the Author

Related content

Growing Adoption, Low Satisfaction Raise Risks for Mobile Customer Service

Mobile banking has surged past online use, becoming the primary channel for everyday financial tasks. Yet as reliance grows, so do expectations for fast, intuitive support and mean...

Data Snapshot: Finances Are Shared, but Digital Banking Isn’t

Financial institutions, with digital banking experiences built largely for individuals, are missing the financial reality of most Americans. Consumers’ finances don’t exist in a va...

2026 Digital Banking Trends

This will be a year in which the industry’s attempts to add investing capabilities, boost digital sales, and simplify money movement will expose deep digital weaknesses and challen...

Make informed decisions in a digital financial world