General Data Protection Regulation: The European Union’s Cross-Industry Approach to Data Protection

- Date:April 18, 2018

- Author(s):

- Brian Riley

- PAID CONTENT

Overview

Mercator Advisory Group’s latest research report, General Data Protection Regulation: The European Union’s Cross-Industry Approach to Data Protection, summarizes the specifics of the EU’s new privacy rules and risks to U.S. businesses that do not prepare for the latest EU mandates.

“Unlike the revised Payment Services Directive (PSD2), which has only a partial influence on U.S. card markets, the General Data Protection Regulation can cause non-European markets regulatory fines,” comments Brian Riley, Director, Credit Advisory Services, at Mercator Advisory Group, the author of the research report. “Keep in mind that compliance with PCI does not mean your organization satisfies GDPR’s privacy and data breach requirements. If there is even one EU citizen in your credit file, you need to ensure compliance.”

This research report contains 19 pages and 7 exhibits.

One of the exhibits included in this report:

- Comparison of U.S. and EU noncash payments

- Projected EU noncash payments in the EU market, 2013–2022

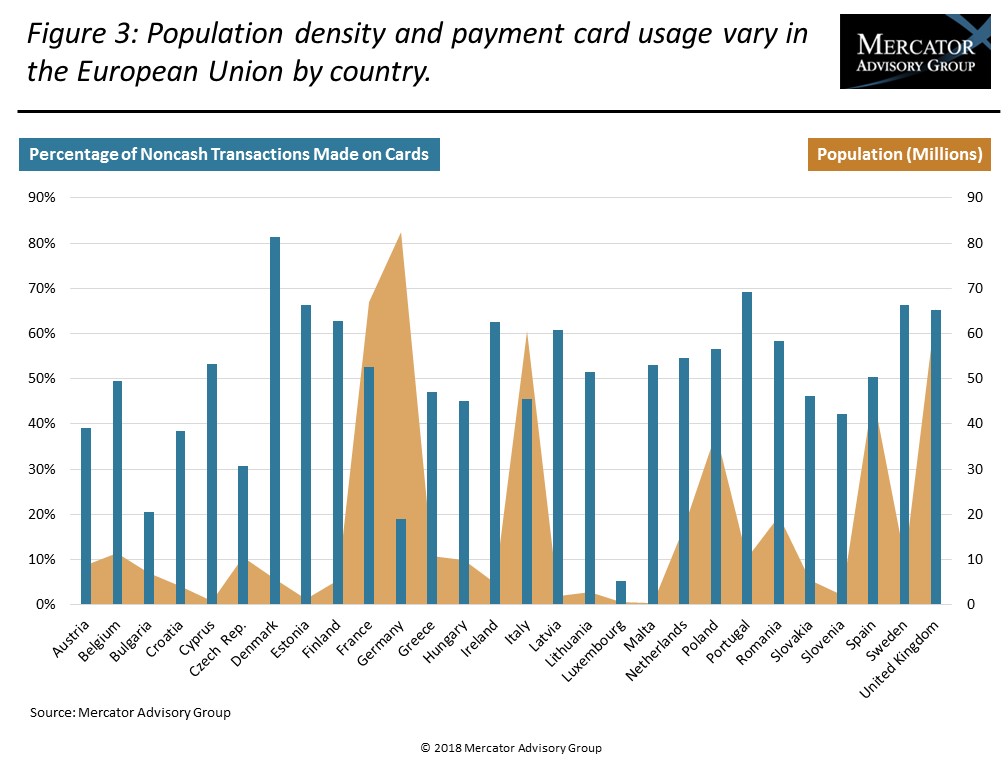

- Noncash usage in EU and population by country

- Six objectives of the General Data Protection Regulation

- Penalties for noncompliance

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world