Digitizing the Business Cash Cycle: Advancements and Partnerships

- Date:January 27, 2017

- Research Topic(s):

- Commercial & Enterprise

- PAID CONTENT

Overview

In a new research report, Digitizing the Business Cash Cycle: Advancements and Partnerships, Mercator Advisory Group discusses the latest technology solutions supporting the procure-to-pay space and methods for connecting the various tools continually being added. Procurement, e-invoicing, payments, and alternative financing are being digitized and integrated for optimal performance in managing working capital. The report explains why this is a critical need as companies move further into the era of a high-tech, global economy.

"As we have consistently advised during the past years, effective working capital management is a key to financial performance and company decision flexibility moving forward. This holds true in both slow-growth developed economies as well as developing economies, where high growth can mask control issues that are later uncovered as industries and systems mature,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “Industry-leading solution-providers are recognizing that providing a product with end-to-end capabilities requiring fewer client company resources to launch and support can increase customer stickiness.”

The report is 16 pages long and contains 7 exhibits.

Companies mentioned in this research note include ACI, Basware, Bill.com, Bottomline Technologies, Broadridge, Coupa, Demica, Esker, GCSF, Infor, Orbian, Prime Revenue, SAP Ariba, SciQuest, SunGard, Taulia, Tieto, Tradeshift, Transcepta, Traxpay, Tungsten, Zycus

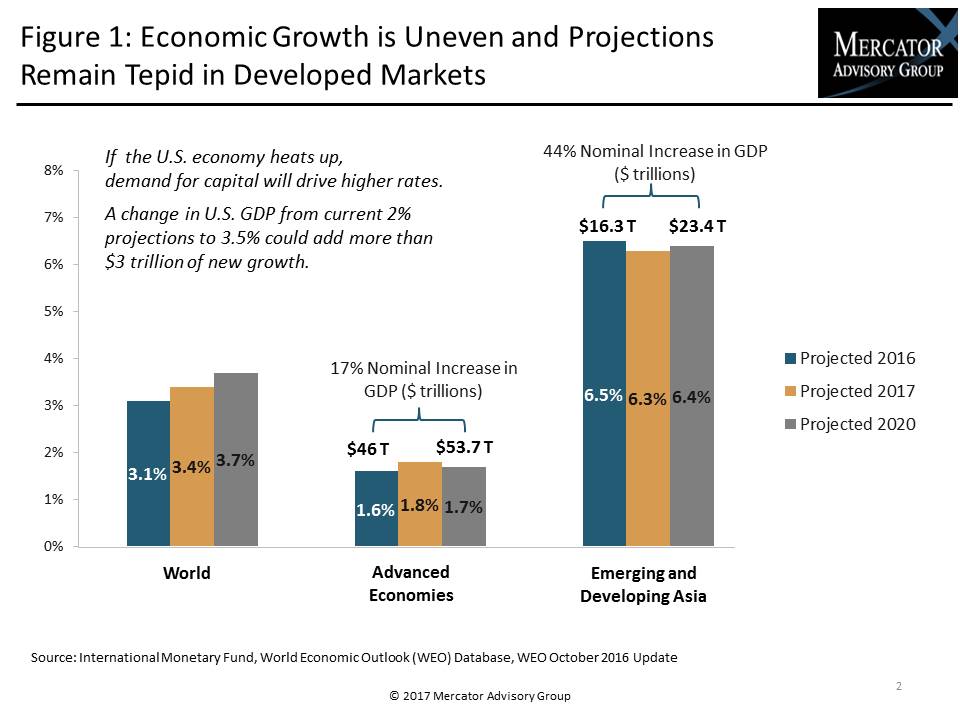

One of the exhibits included in this report:

- A discussion of the reasons that working capital efficiency is paramount in a potentially higher-growth era with changing fiscal and monetary policies

- Drivers of the increasing visibility and adoption of digital processes

- A review of the technology domains that are being digitally connected across the business cash cycle

- A view of the vendor landscape with its often evolving solution providers

- A discussion of how digital transformation occurs

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world