Digital Wallets: Moving Beyond Payments With Expanding Options

- Date:June 15, 2022

- Author(s):

- Jordan Hirschfield

- Research Topic(s):

- Emerging

- PAID CONTENT

Overview

Digital Wallets Are Adapting in an Evolving Marketplace

The continuing evolution of digital wallets, also known as mobile wallets, highlights the growing importance of broadening functionality coupled with consumer confidence in security. Universal wallets — which are wallets that support multiple and unrelated items — and merchant-supported wallets, which are wallets that narrowly focus on a specific brand, are experiencing increased use as more consumers favor contactless payments. In addition, the digital wallet market is experiencing a bifurcation, with a split between rising super apps and dedicated single- or limited-purpose wallets.

This new Mercator research delivers an in-depth look at the current state of digital wallets, where they are headed in the future, and actions that may need to be taken now.

"The marketplace continues to define itself as use cases evolve and consumers develop more sustainable preferences. The table stakes of payments through digital wallets provide an opportunity to expand how those payments are processed, and serve as a gateway to digitize other items commonly found in physical wallets," commented Jordan Hirschfield, Research Director at Mercator Advisory Group.

This report is 21 pages long and has 10 exhibits.

Companies and other organizations mentioned in this report: American Express, Apple, BMW, Bonvoy, Cash App, Diners Club, Early Warning Services, Genesis, Goldman Sachs, Google, Hilton, Hyatt, JCB, Kia, Mastercard, Paypal, Samsung, Schlage, Starbucks, Target, Tesla, The Walt Disney Company, Venmo, Visa, WeChat

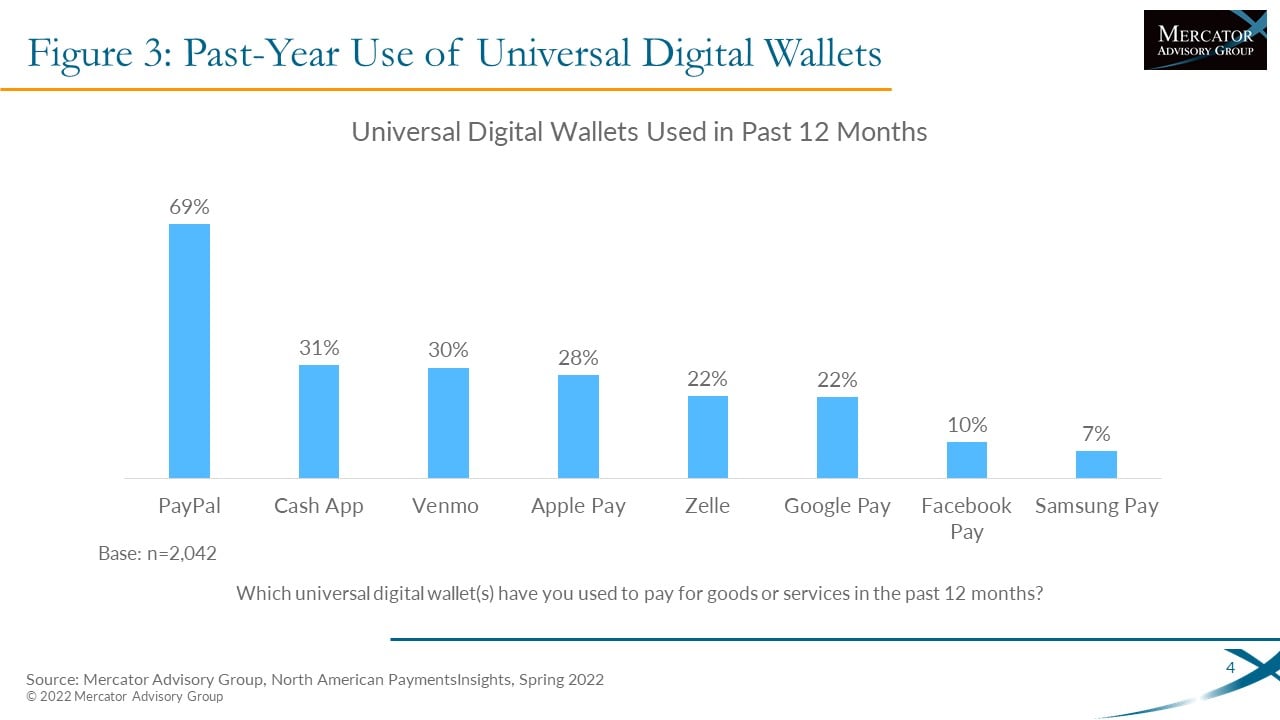

One of the exhibits included in this document:

Highlights of this document include:

- Current State of Digital Wallets

- Making Payments Remains the Primary Use of Wallets

- The Convergence of Digital Wallets and P2P Services

- Card on File

- Buy Now Pay Later (BNPL)

- Merchant Acceptance

- Near-Term Next Steps: Crossing Into Super Apps

- Cryptocurrency

- Digital Identification

- Physical Entry

- Transit

- Wearables as Extension

- Long-Term Next Steps

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world