Overview

“The digital future is rushing toward us. Today mobile phones collect consumer activity data and utilize machine learning to provide a range of conveniences before the user even asks—from helping find where one parked one’s car to describing the weather in a destination city. Users now make Internet queries by simply asking Google, Siri, or Alexa the question. This is the tip of the iceberg, and institutions that fail to provide the consumer value in this environment will lose customers to institutions that do,” comments Tim Sloane, VP, Payments Innovation, and author of report.

This report is 24 pages long and contains 5 exhibits.

Companies mentioned in this report include: Apple, DCU, Emotient, Even, Facebook, FIS, Google, Level, Merrill Lynch, Mvelopes, Paygoal, Salesforce.com, Triggerhood.

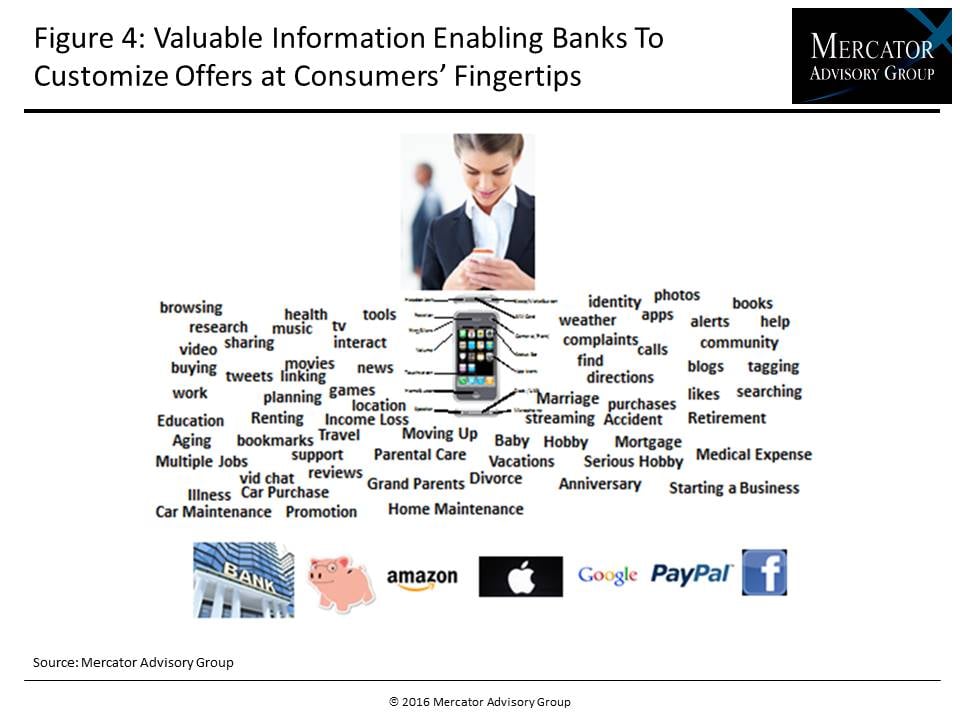

One of the exhibits included in this report:

- Proposal of a new engagement model makes customer asset growth the underlying principle for every interaction, including spend and loan products

- Detailed steps to implement the new engagement model and offer personalized financial guidance cost-effectively through use of technology that automates each phase

- Automated techniques to engage consumers at a personal, individual level to identify and address their financial goals

- Use of key lifestyle indicators and big data to identify customers’ needs and engage the customer toward long-term goals, not just to cross-sell products

- Strategies that protect the institution and the consumer from consumer privacy concerns while deepening the relationship at a pace the customer finds comfortable and builds trust by offering the customer opt-in’s that are transparent regarding data collection and use and multiple opportunities to opt out

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world