Overview

The good news for online merchants, large and small, is that they have a wide choice among payment gateway vendors in the U.S. market. This bodes well for businesses who gain negotiating power as they deal with many gateways competing to offer the best array of online payment services. A downside for merchants is that the gateways have a propensity to check the same boxes of online payment acceptance features in marketing their services. So, distinguishing among a list of gateway vendors can become a tedious exercise for many merchants. A new research report from Mercator Advisory Group, Crowded Payment Gateway Landscape Offers Much To Online Merchants, Part 2: U.S. Market Company Profiles, features U.S. market payment gateways and provides a process and decision making criteria for merchants to use in a payment gateway selection.

“The e-commerce sales channel has grown exponentially, and the number of payment gateways in the U.S. market has followed the demand. Many are fintechs that began in the last 10 years, while others are found within legacy merchant acquirers, processors, card networks, and issuers. Further, new entrants are coming into the market via the start-up route or from overseas competitors. Online merchants are winners in that they have never had such a large choice of vendors to choose from. But many merchants find the selection process among payment gateways to be daunting,” commented Raymond Pucci, Director, Merchant Services Practice at Mercator Advisory Group, the author of this report.

This report is 18 pages long and has 4 exhibits.

Companies and other organizations mentioned in this report: 2Checkout, ACI Worldwide, Adyen, Authorize.Net, Bambora, Bank of America, BigCommerce, BlueSnap, Bolt, Braintree, CardPointe, Chargebacks911, Checkout.com, Clover, Converge, Cybersource, Elevon, First Data Payment Gateway, FIS, Fiserv, Global Payments, Ingenico, JPMorgan Chase, Kount, NCR Payments, NMI, OLB Group, PayPal, Paysafe, Shopify, Spreedly, Stripe, WePay, TSYS, US Bank, Verifone, Visa, Worldline, Worldpay from FIS

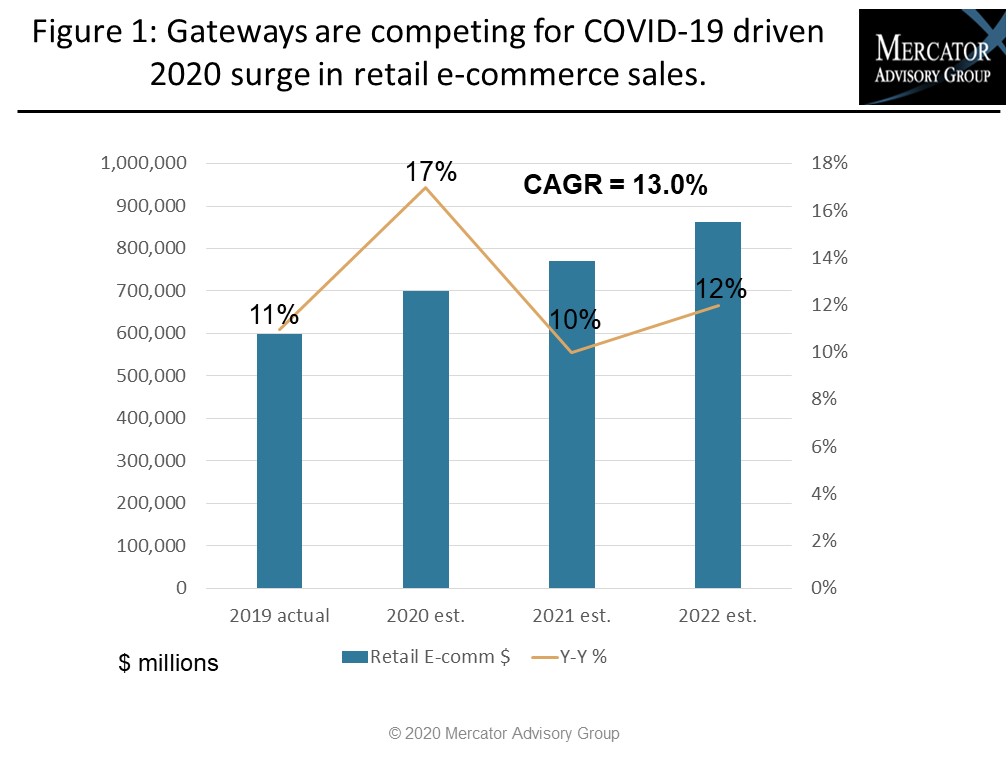

One of the exhibits included in this report:

Highlights of this research report include:

- Key findings summary from prequel Gateway Report Part 1

- E-commerce sales surge data that drives payment gateway competition

- Specific vectors for merchants to use in assessing payment gateways

- Process for merchants in payment gateway selection

- Profiles of 24 U.S. market payment gateway vendors

Book a Meeting with the Author

Related content

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

2026 Merchant Payments Trends

As payment technology advances and offers greater options and flexibility for consumers, merchants are put in the position of prioritizing how to manage payment acceptance, what pl...

Make informed decisions in a digital financial world