Overview

October 2008

Boston, MA

Credit Card Issuer Fraud Management: From Technology Inside To People Inside

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

This report examines the evolving solutions space for issuer fraud management in the credit card industry. Technology-based solutions help issuers to detect fraudulent credit card transactions in near or real time, and have been critical to the containment of issuer fraud losses since introduced in the 1990's. Both outsourcers/processors and card networks serving the industry are also making significant contributions to issuers of all sizes in managing the ever-changing range of fraudulent activities.

Highlights of the report include:

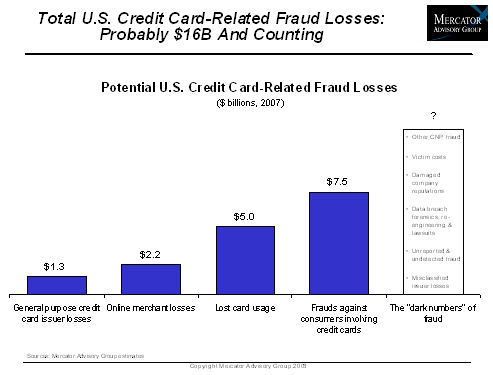

- Credit card issuer losses remain surprisingly well-contained despite the continuing evolution of card fraud. On the other hand, total fraud costs in the U.S. related to credit cards alone are conservatively estimated to exceed $16 Billion annually.

- Purposeful data breaches are providing particular challenges to the industry, as criminals target easily-monetized payment card information.

- Technology providers are enabling greater customization and control capabilities for issuers using their solutions. Outsourcers are filling a critical need for small/medium issuers by both licensing solutions on behalf of issuers and providing the staff support they require.

- The opportunity to grow fully-outsourced fraud management services, including analysts, call centers, fraud strategy consultants, etc..., is significant, and may become attractive to larger issuers struggling with staffing and cost issues.

- The much-vaunted enterprise fraud management vision could have significant value - but traction is low as organizational and implementation barriers remain high.

Ken Paterson, Director of the Credit Advisory Service at Mercator Advisory Group and the author of the report comments that fraud management is more than limiting losses - it is a strategic capability relying on both sophisticated technology and experienced fraud management staff. "Cardholders afraid to use their cards would present a bigger business problem than fraud alone. Issuers afraid to authorize transactions would drive away business. First class fraud case management, cardholder servicing, and fraud model updating are critical to keeping cardholders engaged, as well as managing fraud risk. And all involve experienced fraud analysts and case managers, no what the issuer's size."

One of the 11 Exhibits included in this report.

The report is 30 pages long and contains 10 exhibits

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits.

Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 781-419-1700 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world