Commercial Prepaid North America Market Review and Forecast, 2018–2023

- Date:October 15, 2019

- Research Topic(s):

- Commercial & Enterprise

- Prepaid

- PAID CONTENT

Overview

Mercator Advisory Group has been covering the U.S. prepaid market since 2004. The market includes both personal and business uses. Commercial prepaid cards are a subset of this broader space. Commercial prepaid products are typically distributed through a corporate or a business banking arm of a commercial bank rather than a retail or wealth management business unit. In effect, a business or government entity is providing this particular payment product as a service for employees, citizens, business partners or consumers (as in the case of incentives).

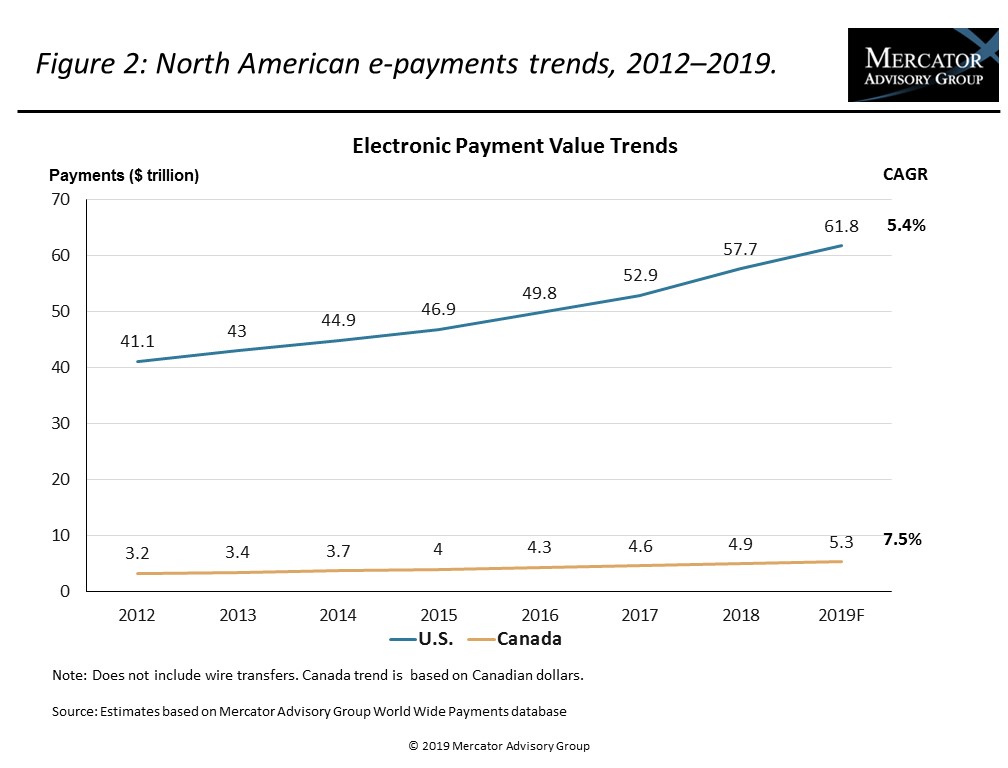

In a new research report, Commercial Prepaid North America: Market Review and Forecast, 2018–2023, we review commercial prepaid cards across all product types, systems, and business sectors which account for about $1.5 trillion of business spending in certain portions of business-to-business (B2B) spend. Mercator Advisory Group analyzes the detailed categories and segments of prepaid card spending loads. In this research report, we also provide updated trends and forecasts through 2023 in the U.S. market and for the first time also add our high-level views on the commercial prepaid market in Canada.

“Of the 16 segments associated with commercial prepaid spending loads in the U.S. market, we expect continued growth in almost all of them during the next few years, commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and co-author of the report. “The exceptions are those few segments related to improved personal income reducing the government program sizes, but of course this is a fluid situation and things can change.”

The document is 19 pages long and contains 11 exhibits.

Companies mentioned in this report include: Blackhawk, Capgemini, ChexSystems, Chime, Green Dot, Early Warning, Monzo, Netspend, and TeleCheck.

One of the exhibits included in this report:

Highlights of the report include:

- Spending forecasts and comparisons across 7 categories and 16 segments of prepaid commercial cards in the United States

- First-time summary and spend load estimates forecast for the Canadian market

- Analysis of key trends resulting in growth or decline in various segments

- Case analysis of the implementation of a global prepaid card program

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world