Commercial Credit Cards: North America Market Review and Forecast, 2018-2024

- Date:August 12, 2020

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

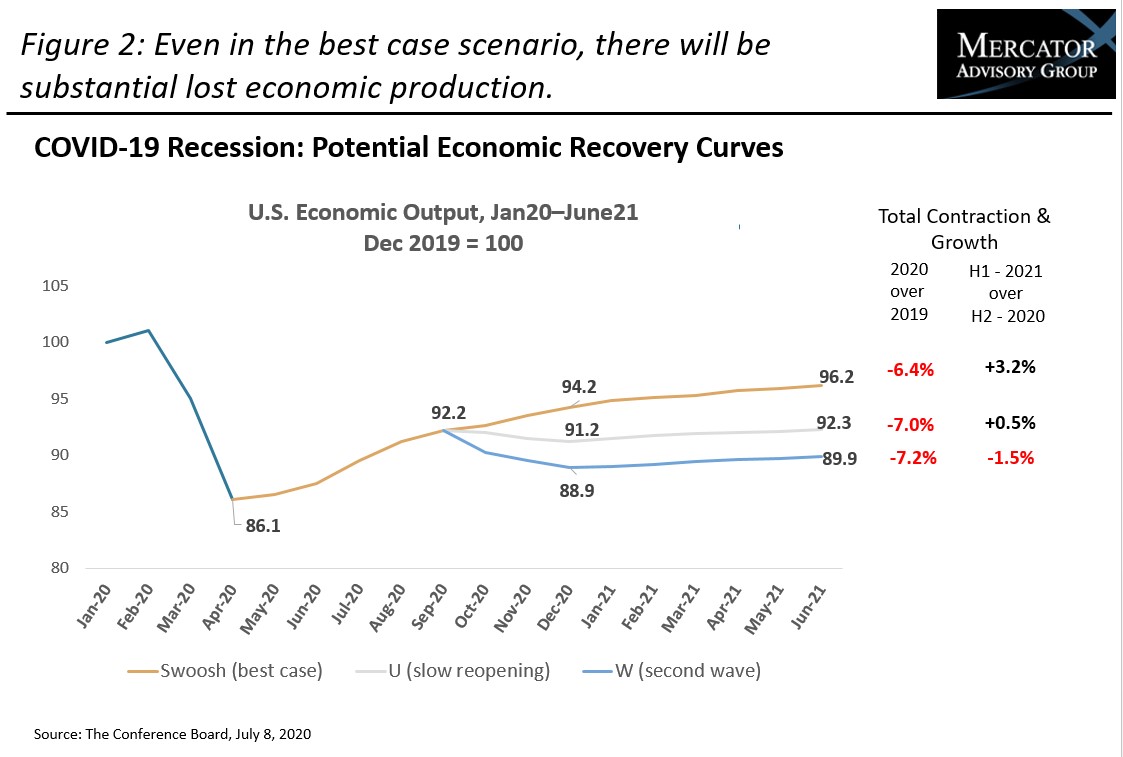

The commercial credit card market for mid-to large corporates in North America has been in a generally strong growth mode for the past several years. In North America, the most mature commercial credit card market, recent growth has been primarily boosted by non-travel spend as the industry continues its transition to B2B payables relevancy. As a result, the extended suspension of business travel, although a damaging blow to issuer bottom lines into 2021, will be somewhat offset by subsequent gains in business-to-business payments as companies accelerate digital adoption. The utilization of purchasing cards (P cards) and non-travel virtual cards is more directly tied to broader economic activity, the growing use of electronic payments methods, and replacement of checks and cash in the payables process.

Mercator Advisory Group’s latest research report, Commercial Credit Cards: North America Market Review and Forecast, 2018-2024, provides a detailed review of the commercial credit card markets in Canada and the United States, including an analysis of how the pandemic impacts spend during 2020-21, as well as recovery expectations through 2024.

“The pre-pandemic growth trajectory was quite good overall in North America, as 2019 virtual card spend exceeded corporate travel card spend for the first time,” commented Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service, author of the report, “so the comeback in spend longer term is going to be more associated with utilization of card rails in payables as the recessionary curve unfolds.”

This report is 17 pages long and has 7 exhibits.

Companies and other organizations mentioned in this report include: American Express, Citi, Coupa, Cvent, Diners Club, Interac, International Monetary Fund (IMF), Mastercard, PNC Bank, R3, SAP Concur, The Conference Board, Visa, World Health Organization.

One of the exhibits included in this report:

Highlights of the report include:

- A review of the economic impact that COVID-19 is having in the region

- Correlation analysis between overall regional credit card spend and the economic downturn through 2021

- Commercial credit card spending forecasts for Canada and the U.S. through 2024

- Key industry trends in technology and client expectations

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world