Commercial Credit Cards North America, 2017–2023: Growth and Change Continue

- Date:August 22, 2019

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

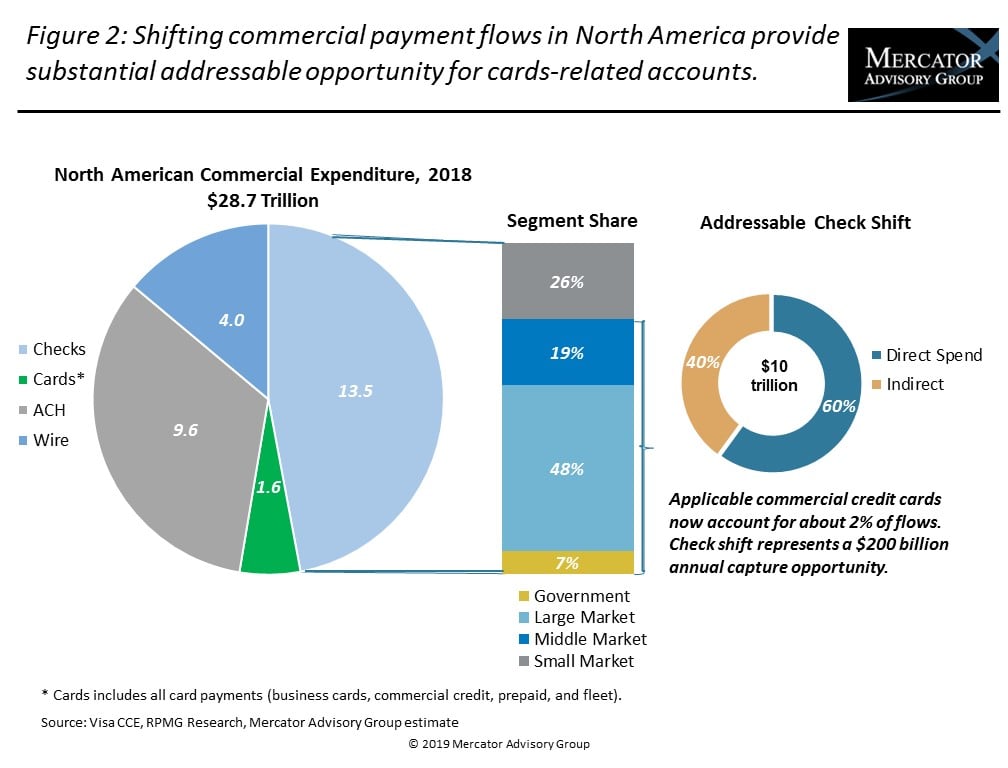

The analysis finds that the steady increase in U.S. commercial credit card spend continued in 2018 driven by a combination of factors, including continued growth in noncash payments, a reasonably strong economy, and what may be an accelerating trend away from paper and toward digital cash cycle solutions.

“If one thinks of the roughly $600 billion in North American B2B payment flows associated with commercial credit cards in the mid-to-large market space alone (not including other commercial card products), annual gross revenues are in the range of $15 billion, which is a substantial business. We have consistently maintained that there is a large opportunity available for cards-based payments to gain share above the 2% level given the unique underlying credit structure and ubiquity of the networks, availability of data, and relative speed of settlement,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service, author of the report. “The major hurdles to gaining double or triple the share of commercial payments flows remain pricing and ease of use, including acceptance and automated handling of receivables.”

The document is 19 pages long and contains 6 exhibits.

Companies mentioned in this report include: ACOM Solutions, American Express, Bill.com, Billtrust, Capital One, Comdata, Earthport, Interac, Mastercard, Microsoft, NAPCP, National Center for the Middle Market, Nets, Open Text, Payments Canada, RPMG, SAP Ariba, Synaptic, Transfast, Visa, Wells Fargo, and WEX.

One of the exhibits included in this report:

- A spending forecast in each major product category through 2023 for the United States and Canada

- First-time summary and forecast for the Canadian market

- Analysis of overall commercial payments flows and opportunities for cards to capture greater share

- Review of latest trends, expectations, and innovations during a time of technology disruption

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world