Commercial Cards in Europe: Stagnating or Growing?

- Date:March 22, 2016

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

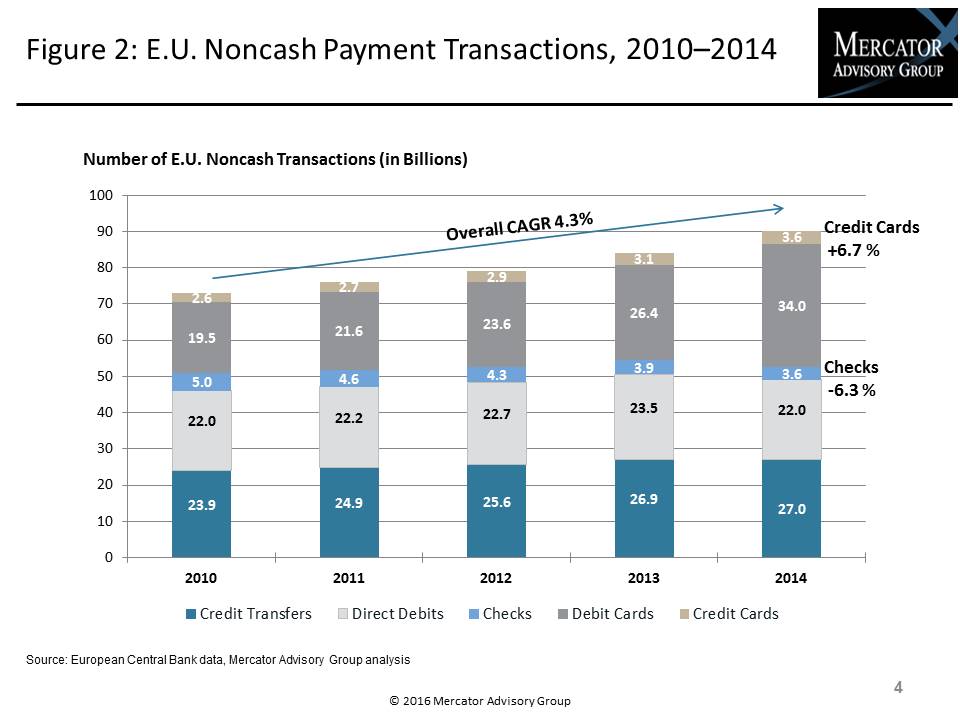

In a new research note, Commercial Cards in Europe: Stagnating or Growing? Mercator Advisory Group reviews the status of European mid-to-large market commercial credit cards. Whilst regional spending volumes have historically been driven by business travel, Mercator sees growth in procurement-related spend finally taking off by virtue of single-use accounts.

"The major opportunity should be in the virtual card/SUA space, although starting from a small base, given the inherent advantages to this product,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report. “The European Union’s new Interchange Fee Reform (IFR) regulations will have some impact on corporate card growth, but whether that is a shifting of spending to other payment types or simply a redistribution of card spending share remains to be seen.”

The note is 14 pages long and contains 4 exhibits.

Companies mentioned in this research note include Airplus International, American Express, Conferma, Diners Club, Ixaris, JCB, MasterCard, UnionPay, and Visa.

One of the exhibits included in this report:

- A review of the European Union new Interchange Fee Reform regulations enacted in December 2015 by the European Parliament and Council of the European Union in Regulation (EU) 2015/751 IFR, which is a part of Payment Services Directive 2 (PSD2).

- Estimates of growth of commercial credit card spend by product type through 2020

- Mercator’s analysis of potential impacts of E.U. IFR on commercial credit cards by product/scheme

- Discussion of the virtual account opportunity in business-to-business, or B2B, payments

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world