Overview

“Sometimes changes in technology and consumer adoption occur so slowly that both the nature of the change and the magnitude of the change are misjudged.” said Tim Sloane, VP, Payments Innovation, and author of report. “On-demand payments may appear to be a simple extension to traditional card-on-file solutions, but nothing could be further from the truth. On-demand payments are a significant shift in the way that consumers prefer to shop and buy and the way that merchants push the payment process into the background. With the issuer’s brand almost invisible at the point of purchase, issuers need to identify new strategies to remain relevant to consumers.”

This report is 21 pages long and contains 7 exhibits.

Companies mentioned in this report include: Airbnb, Amazon, American Express, Apple, Betterment, Braintree, Capital One, Facebook, Final, Google, IBM, Lyft, MasterCard, Mint, Netflix, PayPal, Personal Capital, Snapchat, Spotify, Square, Stripe, Trim, Twitter, Uber, Visa, and Wealthfront.

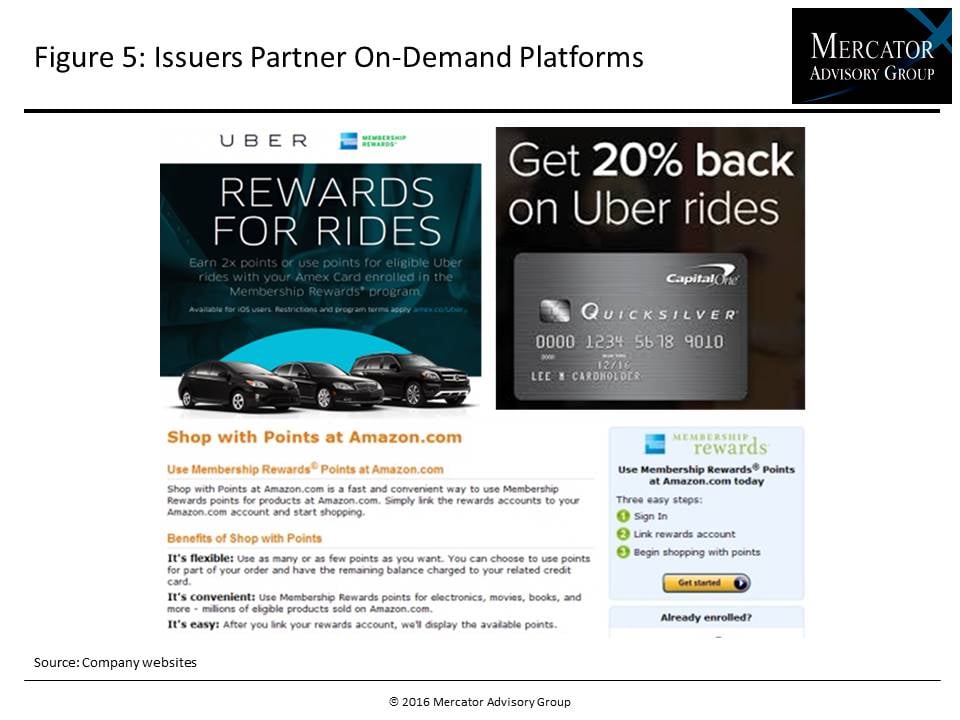

One of the exhibits included in this report:

- Identification of industries once thought to be impervious to disruption that are now being radically reshaped due to smartphones and on-demand services

- Evidence that the on-demand payments model is the primary driver of the explosive growth in digital payments volume, further displacing cash and check transactions

- Explanation of the three trends that drive the growth for on-demand payments

- Examples of third-party services that have captured cardholders by providing services that enable the consumer to better manage on-demand payments

- Specific steps that issuers should take to move from the tactical efforts in place today to a strategic response required to remain relevant with cardholders in the long term

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world