Overview

BIN Sponsorship: New Revenue Opportunities for

Financial Institutions in Prepaid

Special combined report and pre-recorded webinar provides guidance to financial institutions on managing prepaid card programs

Boston, MA -- Due to recent legislation, financial institutions are facing increased pressure to find new sources of revenue as they face a world without income derived from interchange and overdraft fees. Prepaid cards may be the answer to financial institutions' desire to develop an alternative revenue source.

Although the role of the financial institution in the prepaid value chain is critical, without understanding the complexities associated with prepaid programs a financial institution cannot manage a successful and profitable program.

"Prepaid is a dynamic and creative industry with exciting growth potential. With all of the possible applications for prepaid, clients and prospective clients will frequently present their financial institution partners with new ideas for consideration. In order to manage this barrage of creativity, it is important for the issuer to understand the parameters of the business," states Ben Jackson, Senior Analyst in Mercator Advisory Group's Prepaid Advisory Service and co-author of the BIN Sponsorship: New Revenue Opportunities for Financial Institutions in Prepaid report.

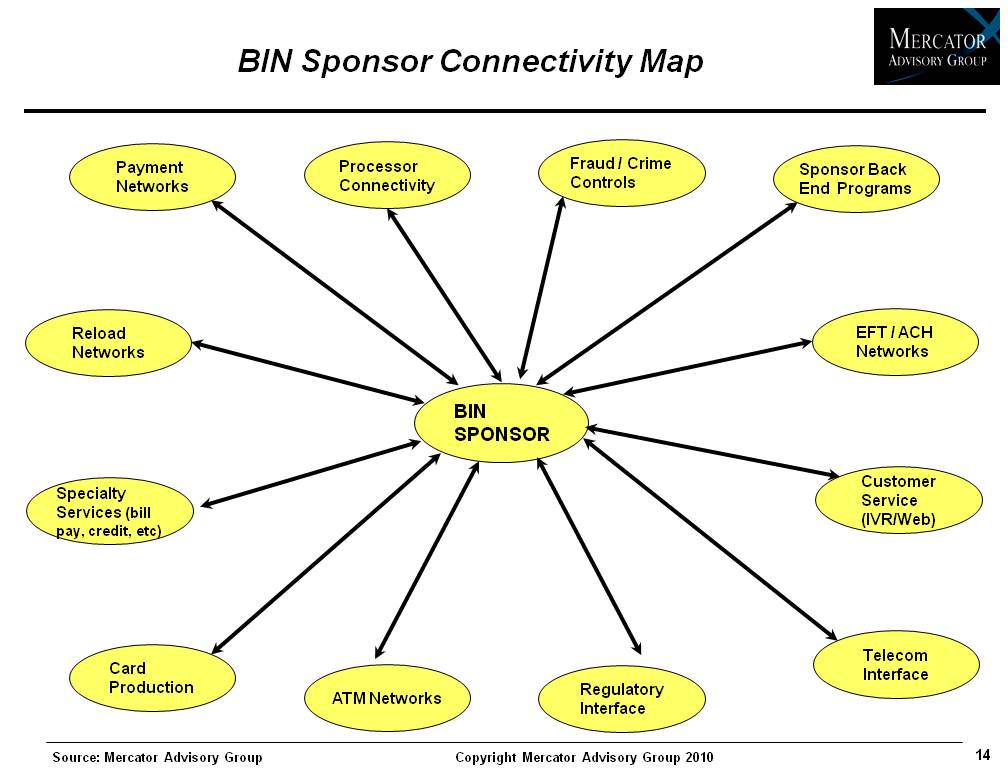

This special in-depth report explains the role of the BIN-sponsor in the prepaid value chain, explores the ways in which a BIN-sponsor makes money, and reviews the market opportunity that exists now for financial institutions interested in this space.

This report includes a 50-minute prerecorded Webinar presented by Tim Sloane, Director of the Mercator Advisory Group's Prepaid Advisory Service and Ben Jackson, Senior Analyst with the Prepaid Advisory Service.

Highlights of the report include:

Financial Institutions need to find new sources of revenue because of the reduction of overdraft and interchange income, and prepaid cards may provide some of that new revenue.

Now is a good time to look at options in the prepaid industry due to the loss of income and because program managers want to have a variety of issuers to manage risk.

Financial institutions' primary functions in a prepaid program are to provide regulatory and network oversight while delivering access to major payment networks and settling transactions for all the parties in the value chain.

Risk management is a major concern for BIN-sponsoring financial institutions, so they must establish policies and procedures to avoid unnecessary and unmanageable risks.

Financial institutions earn income in prepaid by charging fees to program managers for the services they provide. They must make sure they are sufficiently compensated for the risks they manage in addition to the operational work they perform.

One of the 26 exhibits in the report:

This report is 50 pages long and has 26 exhibits.

Companies mentioned in this report include: NetSpend, MetaBank, The Bancorp Bank, H&R Block, FIS, American Bankers Association, Green Dot, Simon Malls, Ace Cash Express, Star.

Members of Mercator Advisory Group's Prepaid Advisory Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information and media inquiries, please call Mercator Advisory Group's main line: (781) 419-1700, send E-mail to [email protected].

Follow us on Twitter @ http://twitter.com/MercatorAdvisor.

About Mercator Advisory Group

Mercator Advisory Group is the leading, independent research and advisory services firm exclusively focused on the payments and banking industries. We deliver pragmatic and timely research and advice designed to help our clients uncover the most lucrative opportunities to maximize revenue growth and contain costs. Our clients range from the world's largest payment issuers, acquirers, processors, merchants and associations to leading technology providers and investors.

Book a Meeting with the Author

Related content

2026 State of the Industry: Commercial Prepaid Cards

The commercial prepaid market continues to provide overall growth, with concern continuing in government verticals. Providers would be well-positioned to focus on business-to-busin...

2026 Prepaid Payments Data Book

The Prepaid Card Data Book creates a baseline to highlight key metrics for the prepaid industry in brief, consolidated updates. This evaluation of the prepaid and stored-value mark...

22nd Annual U.S. Open-Loop Prepaid Card Market Forecast, 2025-2029

Open-loop prepaid programs show resilience and positive growth opportunities across nearly all market verticals. Javelin Strategy & Research continues its annual assessment of open...

Make informed decisions in a digital financial world