Asia-Pacific Commercial Credit Cards: Market Review

- Date:February 11, 2016

- Research Topic(s):

- Commercial & Enterprise

- Global

- PAID CONTENT

Overview

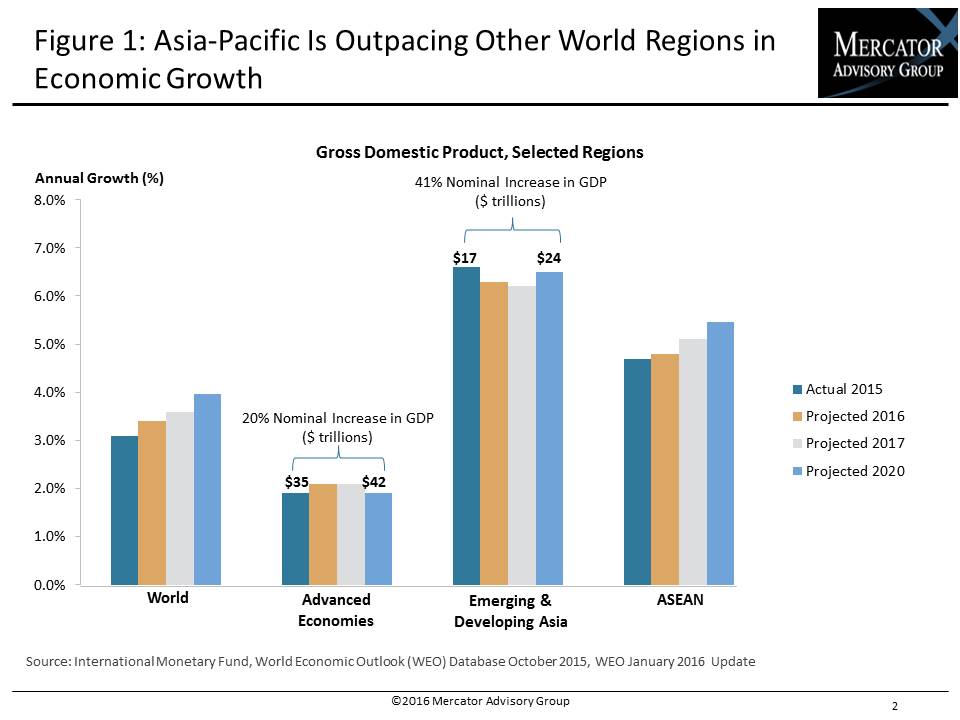

Mercator Advisory Group's research note, Asia-Pacific Commercial Credit Cards: Market Review, discusses the current state and near-term outlook for mid-to-large market commercial credit cards across the region. The economic growth in Asia Pacific during the past 10 years, along with associated business travel spend, has driven general regional spend growth to near 20% annual rates during this decade. There remains substantial opportunity for capturing more of the expected increase in travel spend in formal corporate programs using commercial T&E (corporate) cards. Additionally, the expected market for purchasing cards (P-cards) and single-use accounts (also known as virtual cards or payments) in the corporate procurement space will drive ongoing double-digit growth through 2020.

"There are now a number of established markets and robust capabilities for commercial cards in the Asia-Pacific region, with room for increased spend capture in developed economies through greater middle-market adoption and program compliance” says Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service and author of the report, “but it is a vast and diverse region, with nascent programs in many markets. Great opportunities for volume capture exist in China, India, and the ASEAN member countries.”

The note is 10 pages long and contains 4 exhibits.

Companies mentioned in this research note include Alipay, American Express, China UnionPay, JCB, Diners Club, Invapay, MasterCard, PayPal, Visa, and Yuupay.

One of the exhibits included in this report:

Highlights of the research note include:

- A review of the region’s expected growth and spend opportunities

- Predictions for commercial card growth by product type through 2020

- Estimated network share capture through 2020

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world