Overview

Boston, MA

December 2003

Account Acquisition Strategies:

Profitability Drivers and Market Analysis

NEW RESEARCH REPORT BY MERCATOR ADVISORY GROUP

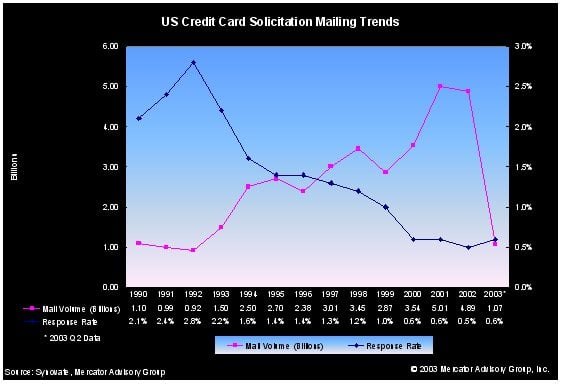

Allocation of resources and determining best possible way to get the highest return is a challenging problem in the B2C marketing environment. Credit card marketing is no exception. Issues such as the DNC Registry, decreasing response rates in direct mail, and growing concerns about unsolicited email are eroding effectiveness of these channels making this picture more challenging.

This new research report by Mercator Advisory Group takes a closer look and examines the credit card industry with a focus on the account acquisition strategies. Included in the report is a comparison of domestic media spends for selected top tier firms, which are placing a significant emphasis on brand building.

Evren Bayri, Director of Credit Advisory Service and author of the report says "...channels such as email, internet, and event marketing will hold a higher percentage in the marketing mix and represent a substantial area of investment for issuers as DNC Registry enforcement takes effect".

Despite industry consolidation led by the top ten firms, the credit card industry remains highly competitive. In an economy coming out of recession, where personal bankruptcies are at record high levels, issuers can sustain growth by incorporating new technologies into their marketing processes. Marketing Optimization solutions such as those from Fair Isaac and Marketswitch address the challenges of B2C marketing environment, and exploit the existing value in marketing campaigns. Using these solutions issuers can achieve 10-30% increase in campaign profitability.

This report is 23 pages long and contains 10 exhibits.

Members of Mercator Advisory Group have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access and other membership benefits. Please visit us online at www.mercatoradvisorygroup.com.

For more information call Mercator Advisory Group's main line: 508-845-5400 or send email to [email protected].

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world