2025 Identity Fraud Study: Breaking Barriers to Innovation

- Date:March 25, 2025

- Author(s):

- Jennifer Pitt

- Report Details: 61 pages, 37 graphics

- Research Topic(s):

- Fraud & Security

- Fraud Management

- PAID CONTENT

Overview

Over the past few years, technology has advanced rapidly. Although these innovations are designed to improve life and simplify things, they have also created an environment ripe for fraud.

No-code and low-code platforms allow anyone to easily create applications and websites. AI and machine learning assistance enable people to streamline processes and shift resources. Cloud service expansion allows for scalable storage and data accessibility. Real-time payments enable quicker transaction processing and receipt of payments. It also moves toward a digital component for every aspect of life—including banking, communication, healthcare, retail, and leisure—to allow for seamless experiences with audit trails.

This all has come with a price: Fraudsters have been able to catapult far ahead of the professionals fighting fraud.

In the past few years, the rapid pace of technological innovation has outpaced security, which is often treated as an afterthought to innovation. This has created exploitable gaps for fraudsters, who operate outside legal boundaries and have no qualms about exploiting human vulnerabilities. Additionally, fraudsters excel at collaboration, something fraud professionals have struggled to master, largely due to misunderstood privacy regulations.

Criminals are using these techniques, along with advanced technology, to attack businesses and individuals. Recent years have brought a noticeable increase in data breaches, cyber intrusions, phishing attacks, scams, and deepfake creations, all of which can lead to identity fraud.

Although financial services providers have made considerable strides in the past five years, the advancements aren’t happening fast enough, especially regarding fraud prevention, detection, and investigation. Fraud professionals must begin breaking the barriers to innovation by collaborating and using these technological advancements to help fight fraud.

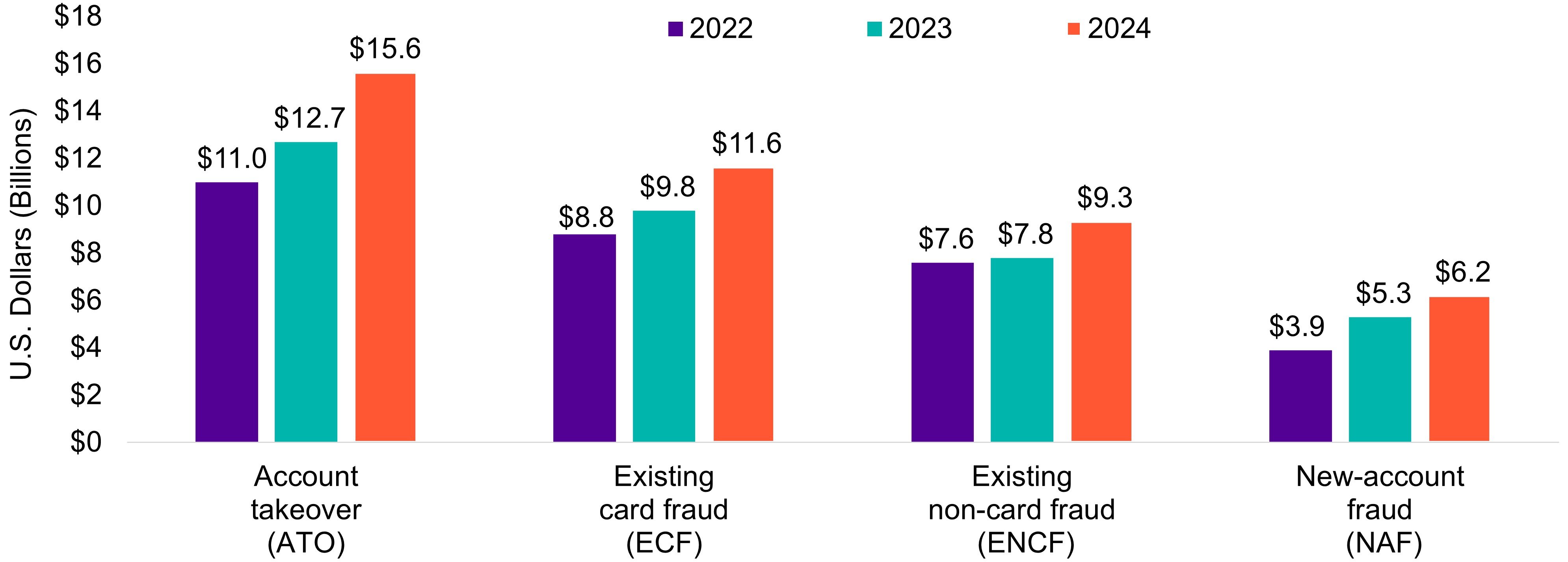

Dollar Losses Rise for All Fraud Typologies

Identity fraud incidence rates and dollar losses also skyrocketed. Consumers lost a total of $27.2 billion in 2024, a 19% increase from the prior year. Not surprisingly, most consumers reported that their identity fraud incidents happened in the summer months, when spending is at an all-time high. This increase in identity fraud—which encompasses new-account fraud, account takeover fraud, existing card fraud, and existing non-card fraud— is most likely due to the increase in cyber intrusions and successful data breaches, particularly with cloud service providers and data brokers. And with lackluster U.S. privacy laws, organizations often share or sell data without even consulting consumers. This widespread, unfettered access makes it difficult for consumers to protect their own information.

2025 Identity Fraud Study Sponsors

The Javelin Strategy & Research 2025 Identity Fraud Study provides a comprehensive analysis of fraud trends amid a changing landscape for technology and payments. Its goal is to inform consumers, financial institutions, and businesses about the most effective means of controlling identity fraud.

The annual study began in 2003 and serves as the nation’s longest-running analysis of identity fraud, with more than 110,000 consumers surveyed. This study is independently produced by Javelin and made possible with support from the following sponsors:

Interested in sponsoring a future study?

Methodology

The Javelin Identity Fraud Study provides businesses, financial institutions, government agencies, and other organizations with an in-depth and comprehensive examination of identity fraud and the success rates of methods used for prevention, detection, and resolution.

Survey Data Collection

This ID fraud survey was conducted online among 5,023 U.S. adults over the age of 18; this sample is representative of the U.S. census demographics distribution. Data collection took place Oct. 11-Oct. 30, 2024. Data is weighted using 18-plus U.S. population benchmarks on age, gender, race/ethnicity, education, census region, and metropolitan status from the most current CPS targets. Due to rounding errors, the percentages on graphs may add up to 100% plus or minus 1%. To preserve the independence and objectivity of this annual report, the sponsors of this project were not involved in the tabulation, analysis, or reporting of final results.

Book a Meeting with the Author

Related content

Data Transparency in the Age of Cyber and Privacy Risk

As open banking and new privacy regulations accelerate, financial institutions face rising pressure to enhance privacy and cybersecurity transparency to strengthen consumer trust. ...

Crypto Investment Scams: How Banks Can Disrupt These Criminal Operations

Cryptocurrency investment scams have evolved into organized, global operations that are stealing billions of dollars from consumers. Recent enforcement actions and platform disrupt...

Quishing and the Resurgence of BYOD Cyber-Attack Exposure

North Korean attackers’ latest efforts to target foreign policy experts through a technique known as quishing expose long-standing bring-your-own-device vulnerabilities that U.S. o...

Make informed decisions in a digital financial world