2022 North American PaymentsInsights, Canada: The Rise of Digital Payments Emerging from COVID

- Date:March 16, 2022

- Author(s):

- Jordan Hirschfield

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group Releases Payments Industry Research - The Rise of Digital Payments Emerging from COVID

From bartering to bank notes, innovations have led to changes in consumer behavior. Methods considered conventional soon give way, just as barter and cash converted to debit cards and credit cards as the most convenient way to complete transactions. The pandemic spurred further innovation in our ways to transact for goods and services through the rise of digital payments, contributing to the decline of legacy payment methods. Circumstances surrounding COVID encouraged people to adopt various forms of contactless payments with greater frequency.

Mercator Advisory Group's most recent report, 2022 North American PaymentsInsights, Canada: The Rise of Digital Payments Emerging from COVID, analyzes the impact of COVID within Canada on consumer payment preferences. The report reveals generational differences in the use of a range of payment forms including cash, cheques, cards, and digital payments.

The report is based on the North American PaymentsInsights survey, administered in 2021 to a nationally representative sample of 1,002 Canadian consumers, ages 18 years or older.

“Payment technology is creating rapid shifts in consumer payment preferences, with COVID acting as a direct change agent, resulting in declines in use of paper payments via cash or cheques. At the same time, we are seeing emerging technologies such as peer-to-peer payments making a large impact on the consumer payment market,” says Amy Dunckelmann, VP, Research Operations at Mercator Advisory Group.

This report in slide form is 37 pages long.

One of the exhibits included in this report:

Highlights of this report include:

- Decline of Cheques and Cash

- Mobile/Digital Payments: Frequency and Use

- Trends for Three Major Mobile Wallets

- Apple Pay

- Google Pay

- Samsung Pay

- Payment App via Wearables

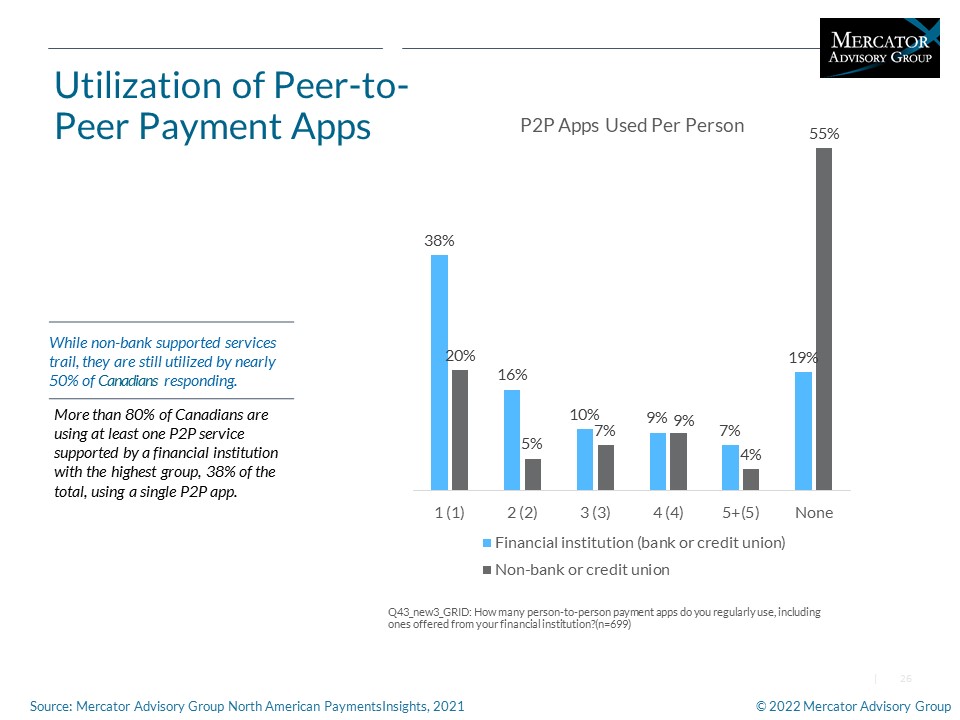

- Peer-to-Peer Payments

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world