2020 North American PaymentsInsights: Debit - Continued Change

- Date:December 31, 2020

- Author(s):

- Peter Reville

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

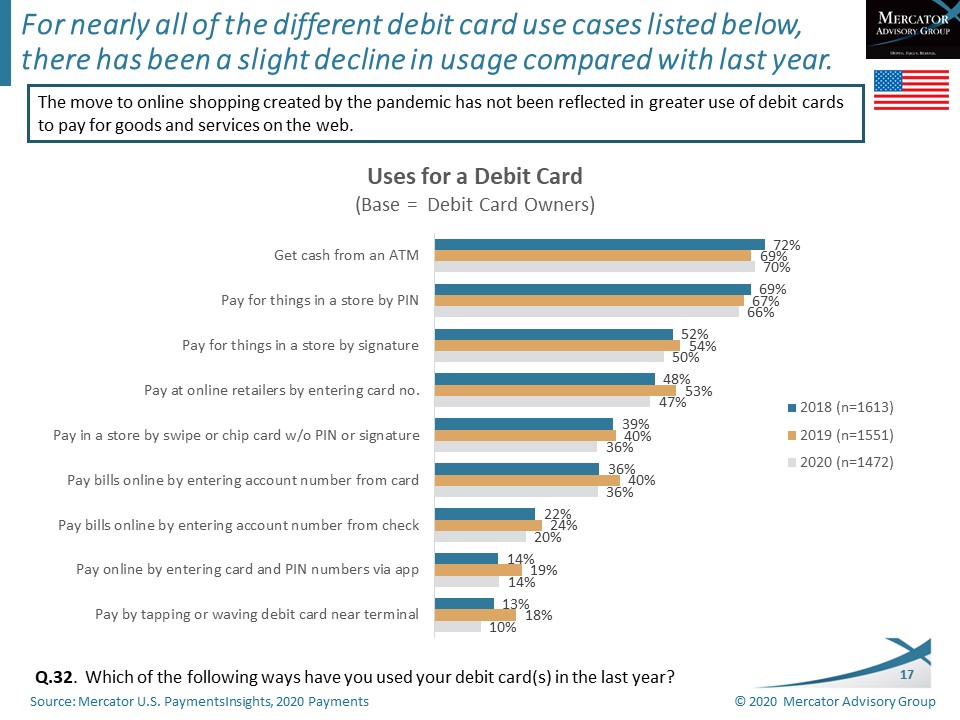

Mercator Advisory Group’s most recent consumer survey report, 2020 North American PaymentsInsights: Debit – Continued Change, from the bi-annual North American PaymentsInsights series, takes an in-depth look at U.S. consumers’ current attitudes and behaviors with regard to debit cards and P2P payments.

While the data from this survey indicate a decrease in the number of debit users, actual debit card volume is increasing in the pandemic era.

Nearly one-half of the consumers surveyed report they currently receive rewards on their debit cards. Many consumers who receive debit card rewards say it motivates them to spend more on these cards. However, while the primary rewards are cash back and/or points, the proportion of customers receiving these two rewards appears to be decreasing when compared with last year.

Debit card fraud is on the rise with one-quarter of debit card owners reporting fraud on their debit card. While this is on par with last year, it is much higher than the 17% reported in 2018.

The use of P2P payment apps continues to gain in popularity. In 2017, 57% of American adults reported using a P2P service. That has increased to 70% in 2020. The market is currently dominated by PayPal, but other P2P services, Venmo, Zelle, Google Pay and Square Cash, have all roughly doubled in reported usage since 2017.

This year, the average frequency of use of P2P services has decreased from 9.0 in 2019 to 8.0 transactions annually. This decline has likely been a result of the pandemic, as fewer people are socializing and thus have fewer opportunities to use P2P payments.

This report explores how technology and fraud impact consumers lives and, in particular, the way they shop and pay for things. This includes detail on not only what they do, but also how they feel about these two important consumer issues.

“This report reveals how consumers use of debit cards and P2P payments have changed over the past year. It goes without saying that they pandemic has materially changed consumer payment behavior, but this report explores changes that are pandemic related, as well as those shifts in behavior that started before the pandemic,” stated the author of the report, Peter Reville, director of Primary Research Services at Mercator Advisory Group, which includes the North American PaymentsInsights series.

Companies mentioned in the survey results shown include: Apple Pay Cash, Facebook Messenger, Google Pay, MoneyGram, PayPal, PeoplePay, PopMoney, Square Cash App or Cash App, Venmo, Western Union (WU) Pay, Zelle

One of the exhibits included in this report:

Highlights of this report include:

- Debit Card Use

- Online Debit Card Use

- Debit Card Rewards

- Use of New Payment Technology

- Debit Card Controls

- Debit Card Fraud

- Banking & Payments Overview

- P2P Services

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world