2018 Online Banking Scorecard: Javelin Spotlights FIs That Do It Best

- Date:September 18, 2018

- Author(s):

- Mark Schwanhausser

- Tyler Brown

- Report Details: 37 pages, 10 graphics

- Research Topic(s):

- Mobile & Online Banking

- Digital Banking

- PAID CONTENT

Overview

Javelin’s Online Banking Scorecard is a follow-up to “Building Better Online Banking,” which detailed strategic principles that will help FIs evolve along Javelin’s Digital Banking Maturity Path and cement long-term banking relationships built on advice and growing trust. In this third annual online banking scorecard, Javelin measures the prevalence of 250 features at 28 top U.S. FIs and spotlights trends, best practices, and features in six categories: Ease of Use, Security Empowerment, Financial Fitness, Money Movement, Customer Service, and Account Opening. Javelin weighted each category based on what consumers say is most important to their satisfaction with online banking and identified three leaders in each category. Bank of America repeated as “Best in Class” overall, ranking as a leader in five categories. Fifth Third, Huntington, Navy Federal Credit Union, SunTrust, U.S. Bank, USAA, and Wells Fargo ranked as leaders in at least one category.

Key questions discussed in this report:

- Which banks are market leaders?

- How many banks offer innovative features that will rejuvenate and transform the workhorse online banking channel in a mobile-first era?

- What are the key trends over the past year?

Methodology

Javelin’s 2018 Online Banking Scorecard measures the availability of 250 criteria at 28 of the nation’s largest retail FIs by total deposits, excluding banks focused on investment banking. Javelin analysts weight individual features based on their strategic value, tactical necessity, and industry and consumer trends, pointing FIs toward strategic opportunities and user experience innovation. The overall score was a composite of six categories weighted by consumers’ responses about what is most important to their satisfaction with online banking: Ease of Use (28%), Security Empowerment (20%), Money Movement and Financial Fitness (17% each), Customer Service (12%), and Account Opening (6%).

Javelin’s 2018 Online Banking Scorecard measures the availability of 250 criteria at 28 of the nation’s largest retail FIs by total deposits, excluding banks focused on investment banking. Javelin analysts weight individual features based on their strategic value, tactical necessity, and industry and consumer trends, pointing FIs toward strategic opportunities and user experience innovation. The overall score was a composite of six categories weighted by consumers’ responses about what is most important to their satisfaction with online banking: Ease of Use (28%), Security Empowerment (20%), Money Movement and Financial Fitness (17% each), Customer Service (12%), and Account Opening (6%).

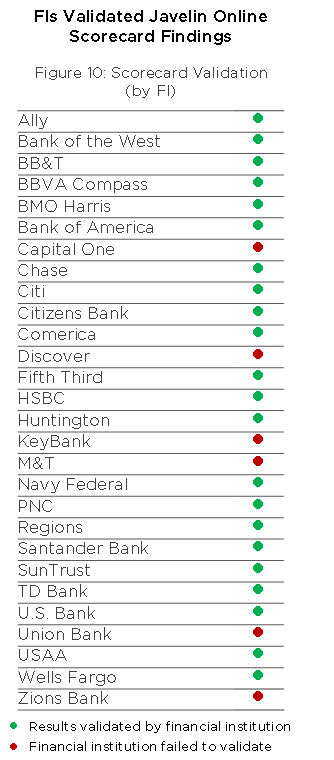

To provide a customer’s perspective, accountholders with seasoned checking and credit card accounts evaluated nearly 250 features in specific locations of the authenticated website and captured screenshots for Javelin’s evaluation. Data was collected from April to June 2018. Each financial institution was invited to validate the results. Twenty-one FIs validated the results. (Figure 10)

Consumer data in this report is based on information gathered in Javelin surveys administered in 2018 and 2017. Data was gathered and weighted to reflect a representative sample of the adult U.S. population:

- A random-sample panel of 10,768 consumers in a June-July 2018 online survey. The margin of sampling error is ± 0.94% at the 95% confidence level. The margin of sampling error is higher for questions answered by subsegments.

- A random-sample panel of 5,000 respondents in an October-November 2017 online survey. The margin of sampling error is ±1.39 percentage points at the 95% confidence level. The margin of sampling error is higher for questions answered by subsegments.

Book a Meeting with the Author

Related content

Data Snapshot: Finances Are Shared, but Digital Banking Isn’t

Financial institutions, with digital banking experiences built largely for individuals, are missing the financial reality of most Americans. Consumers’ finances don’t exist in a va...

2026 Digital Banking Trends

This will be a year in which the industry’s attempts to add investing capabilities, boost digital sales, and simplify money movement will expose deep digital weaknesses and challen...

How Customers Really Feel about Alerts: They’re Annoyed

Javelin’s analysis of verbatim comments from more than 1,000 U.S. customers with modest to low satisfaction with alerts sends a clear message that these communications from financi...

Make informed decisions in a digital financial world