Mobile Payments Could Increase EMV Adoption Among Small Businesses

JAVELIN Assess Apple Pay and Other Mobile Payment Providers as Incentive to Drive EMV Adoption

San Francisco, CA, August 20, 2015: As the EMV chip card replaces the magnetic stripe many consumers will be reaching for their new cards at the POS. Unfortunately, deterred by equipment costs, small and micro businesses have avoided upgrading their terminals. Because of the upcoming fraud liability shift in October, failure to upgrade will leave these businesses vulnerable to fraud costs. Today, JAVELIN released its first report from its new small business practice area. The report, Small Business EMV Readiness, assesses the readiness and current state of transition of small and micro merchants to EMV.

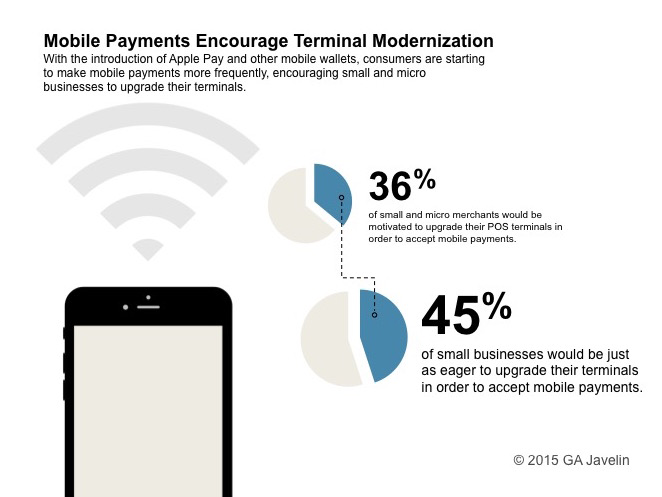

With the introduction of Apple Pay and other mobile wallets, consumers are starting to make mobile payments more frequently and the trend is catching the attention of small businesses. Among small and micro merchants, 36% would be motivated to upgrade their existing POS terminals to accept EMV if new systems would also facilitate acceptance of mobile payments. Small merchants are even more willing to upgrade their terminals; 45% indicated they would be motivated to update their current POS stations if their new systems would enable them to accept mobile wallets like Apple Pay or Google Wallet.

“Many small and micro businesses are dependent on POS transactions for their livelihood, but only 1 in 3 claims to have knowledge of EMV. The government and banks need to do a better job of preparing business owners for the impact EMV fraud liability shift,” said Michael Moeser, Director of Payments at JAVELIN. “Otherwise, small businesses will be the weakest link in the EMV chain and will bear a significant portion of today’s counterfeit card fraud costs, which could cause some to go out of business.

The report, Small Business EMV Readiness, includes a random-sample panel of businesses with sales from $100K to $10M in annual revenue.

Related JAVELIN Research

- EMV in USA: Assessment of Merchant and Card Issuer Readiness

- Fixing CNP Fraud: Solutions for a Pre- and Post-EMV U.S. Market

- ‘New’ Moneyhawks: Highly Profitable and Engaged Customers Defining the Future of Banking

About JAVELIN

JAVELIN, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

(925) 219-0116

[email protected]

www.javelinstrategy.com/research

Twitter: @JavelinStrategy