Mobile Bill Pay is Small but Growing

Upgrades are Vital to Drive Mobile Bill Payment Adoption

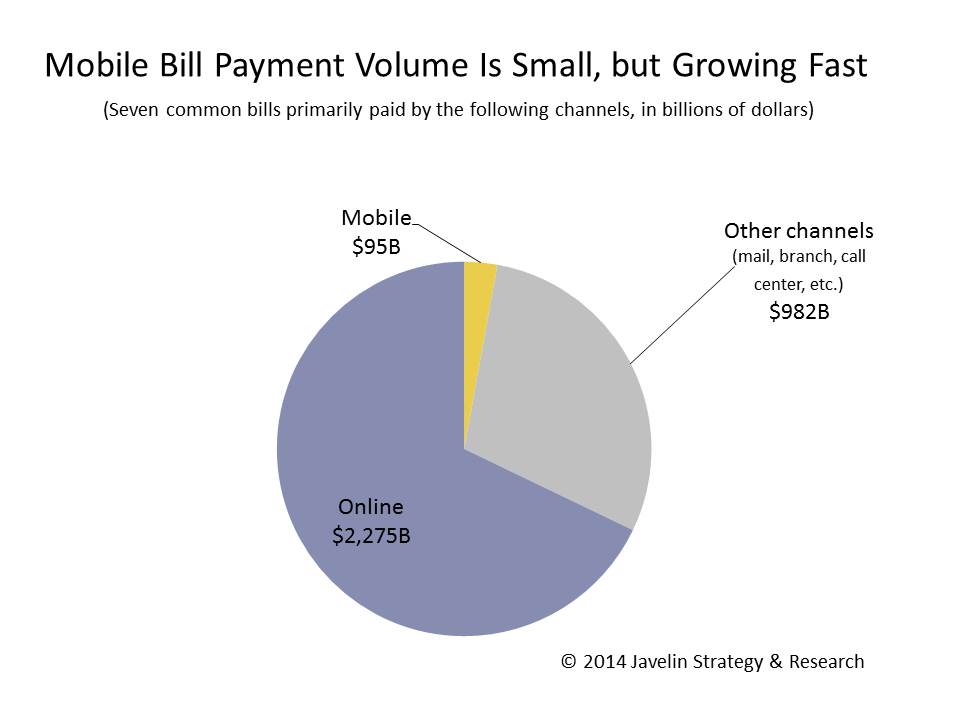

San Francisco, CA, January 15, 2015: The ability to pay bills on smartphones and tablets offers consumers tremendous convenience, while also putting a lot at stake for financial institutions, billers, third-party players, and technology vendors as the trend continues to grow. Americans pay $3.3 trillion annually for just seven important bills, with mobile payments currently making up $95 million. Javelin Strategy & Research’s report, Mobile Bill Pay: Strategies to Grow Adoption and Build Engagement, provides a market-sizing for the bill payments business, and strategies for upgrading and marketing bill payment services to win over four critical customer segments.

More than one in four Americans reached for a mobile phone or tablet to pay bills in the past month, a figure that rises to 3 in 4 of a profitable segment of affluent, mobile-first consumers. But as impressive as the adoption rate is, Americans still treat it as an occasional option, an experiment, or a novelty — not their main method of paying bills. Consumers cite many misgivings that point to a lack of awareness that keeps them from even trying mobile bill payment, let alone distinguishing whether that experience would be better over their current bill payment method.

“Mobile bill payments are primed for rapid growth, but consumers will not scrap their bill-paying habits if mobile bill payment offers little more than another way to pay,” said Mark Schwanhausser, Director of Omnichannel Financial Services for Javelin Strategy & Research. “Paying bills on a smartphone or tablet won’t become their habitual, primary way to pay bills unless mobile bill pay developers offer an obvious upgrade and allay security fears – both of which are areas critical to holdouts.”

The Javelin Strategy & Research report Mobile Bill Pay: Strategies to Grow Adoption and Build Engagement includes a survey of almost 8,800 U.S. consumer’s financial activity preferences as well as their primary banking relationship. The report provides key recommendations to upgrade mobile bill payment in order to drive adoption among four key consumers segments, as well as key features that need to be upgraded to meet consumer’s future mobile bill pay needs.

Related Research

- ‘New’ Moneyhawks: Highly Profitable and Engaged Customers Defining the Future of Banking

- Managing Money in the ‘Mobile-First’ Era: A Blueprint for On-the-Go Personal Finance Management

- Tablet Banking Forecast 2014–2018: Design and Deployment Strategies for Mass Adoption

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research