How to Attract & Keep Affluent Customers: Step One – Upgrade Digital Banking Features

Javelin Finds $2.3 Trillion in Investable Assets and $347 Billion in Bank Deposits at Risk

San Francisco, CA, December 17, 2014: Affluent and high net worth consumers are highly educated, tech-proficient customers that control a game-changing portion of assets for financial institutions of all sizes. Not only is attracting high-income customers important for banks and credit unions, but staying up-to-date on their habits, preferences and attitudes is critical to keep their assets in-house. Javelin Strategy & Research’s report, The Digital Approach to Affluent and High Net Worth Customers, examines the demographics and behaviors of four segments of wealthy customers based on investable assets and annual income— and defines best practices for serving these customers.

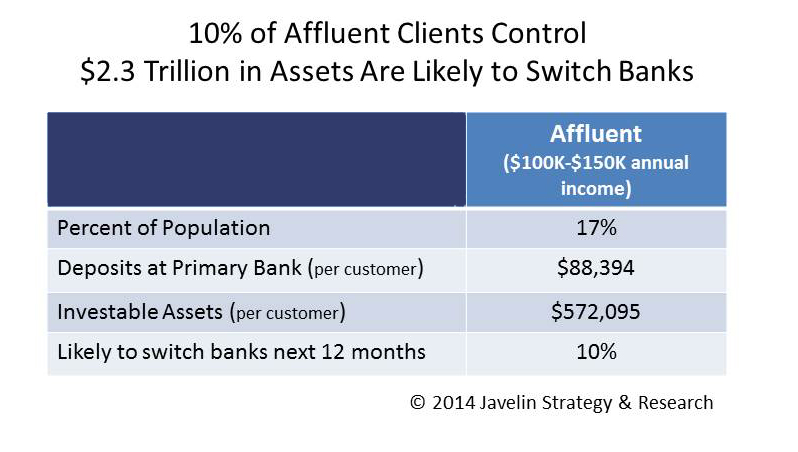

Time is of the essence, as approximately one in every 10 wealthy customers is likely to switch financial institutions in the next 12 months. This puts 57 million bank products and services, $2.3 trillion in investable assets, and $348 billion in bank deposits at risk — just for those with $100k-$150K annual income.

The digital banking platform is the key to servicing affluent and high net worth customers, as they are increasingly using digital channels to open and service their accounts. Wealthy customers gravitate toward online banking tools, at twice the rate of in-person banking on a weekly basis (68% to 27%).

“It is critical that banks work to understand the customer’s entire portfolio of accounts, assets, and loans across institutions,” explained Mary Monahan, Director of Mobile for Javelin Strategy & Research. “Wealthy customers often have credit cards with over $20K in annual spending, but many of these cards are not located at the primary bank – this is a huge lost opportunity.”

The Javelin Strategy & Research report, The Digital Approach to Affluent and High Net Worth Customers, analyzed consumer data and preferences from 6,000 U.S. adults and financial institutions where these consumers have a primary banking relationship.

Related Research

- Mobile Banking, Tablet and Smartphone Forecast 2013-2018: Smart Device Adoption Drives Mobile Banking Boom

- How to Upgrade Online and Mobile Account Opening for an Omnichannel Era 2013

- 'New' Moneyhawks: Highly Profitable and Engaged Customers Defining the Future of Banking

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.

Media Contact

Nancy Ozawa

Marketing Communications

(925) 219-0116

[email protected]

www.javelinstrategy.com/research