Gen Z and Debt: Education, Yes, but Also Plastic Surgery, Vacations, and Crypto

SAN FRANCISCO, Monday, April 24, 2023 — Gen Z adults are taking on more debt for big-ticket discretionary items, such as vacations, powersports vehicles, and cosmetic procedures, according to a new Javelin Strategy & Research report, Plastic Surgery, Start-Ups, Motorcycles, Crypto, EVs: What’s Ahead for Specialist Lenders.

But it’s not all fun and games, as the youngest U.S. adults are also borrowing to cover medical expenses, further their education, and fund businesses.

“Intrepid Gen Zers are not afraid to invest in themselves,” said Babs Ryan, lead analyst for the Digital Lending practice at Javelin Strategy & Research. “They’ve emerged from the pandemic more entrepreneurial and less afraid of debt.”

Gen Zers don’t balk at getting deeper in the red to purchase luxury products or services. Bloated 2020 savings accounts have been rapidly drained for have-it-now purchases. Loans, including buy now, pay later, with faceless digital applications are the low-guilt go-to when cash runs low.

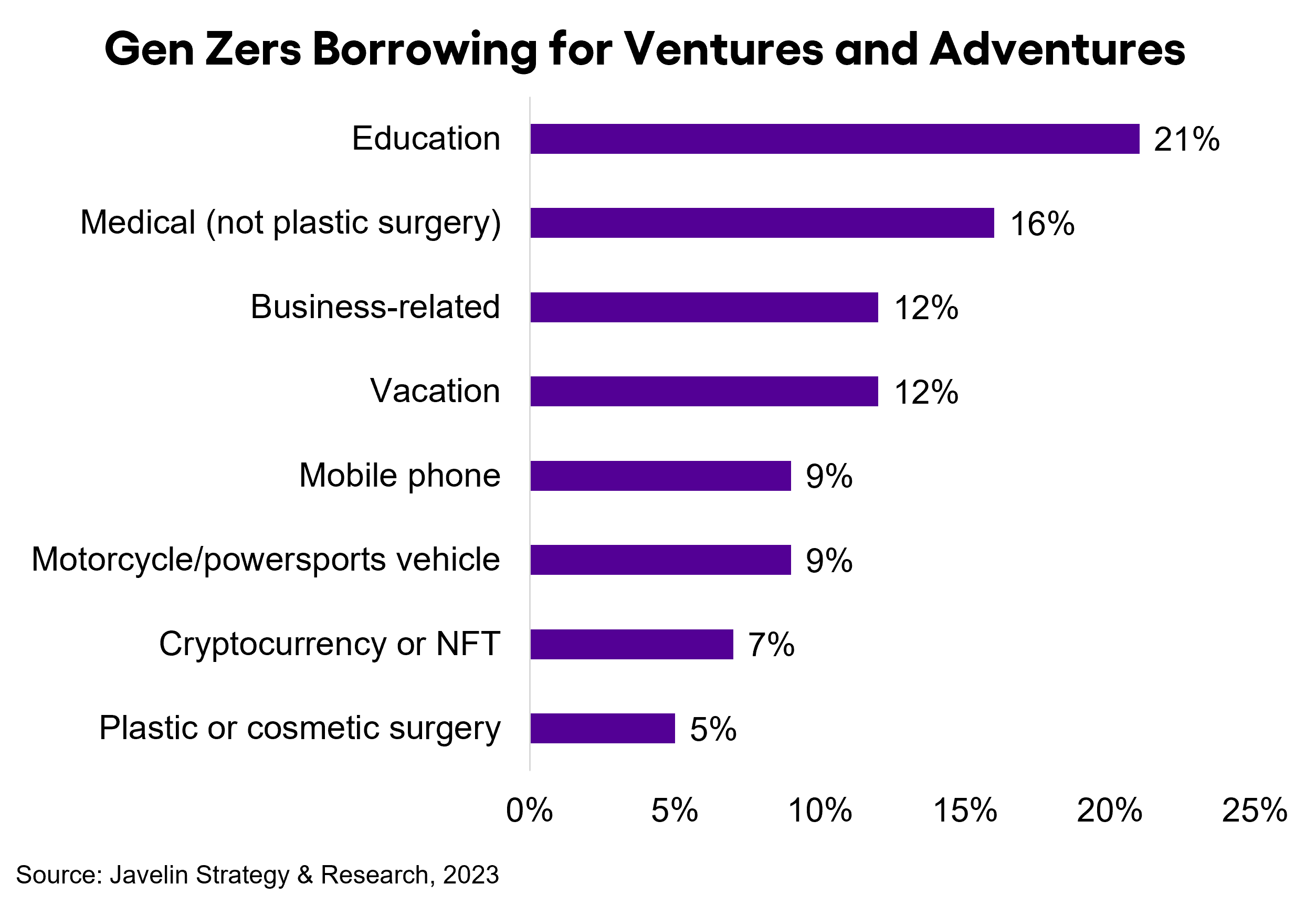

Although more than a third of Gen Zers are saddled with student debt, Javelin’s 2022 national survey reveals that they aren’t hesitating to take out loans for vacations (12%), motorcycle or powersports vehicles (9%), cryptocurrency or NFTs (7%), and even cosmetic surgery (5%). And they’re finding fintech lenders who have a passion for those pursuits, embedding themselves at the beginning of the shopping experience to focus on the buying journey rather than the borrowing journey. Javelin’s survey data reveals that Gen Zers aren’t particularly interested in who funds their dreams.

For start-ups showcasing everything from beauty products and barbershops to gaming studios and Etsy crafters, specialist lenders are at the ready. Twelve percent of Gen Z borrowers reported that their most recent loan was for business-related reasons, a significantly higher rate than reported by other age segments. Although so much is written about student debt, young people may need as much help with medical bills, often related to self-employment health insurance or mental health. Sixteen percent of Gen Zers, more than double other age segments, reported their most recent loan was for medical expenses.

To learn more about Javelin Strategy and Research’s digital lending practice, visit https://javelinstrategy.com/digital-banking/digital-lending.

About Javelin Strategy & Research

Javelin Strategy & Research, part of the Escalent family, helps its clients make informed decisions in a digital financial world. It provides strategic insights to financial institutions, including banks, credit unions, brokerages and insurers, as well as payments companies, technology providers, fintechs, and government agencies. Javelin’s independent insights result from a rigorous research process that assesses consumers, businesses, providers, and the transactions ecosystem. It conducts in-depth primary research studies to pinpoint dynamic risks and opportunities in digital banking, payments, fraud & security, lending, and wealth management. For more information, visit javelinstrategy.com. Follow us on Twitter and LinkedIn.

Media Contact

Tejas Puranik

Senior Marketing Manager

[email protected]