Case Study – How Wells Fargo Builds Confidence in Digital Banking

Control Tower shifts the conversation from “fear” to “control and confidence”

SAN FRANCISCO, March 27, 2019: Wells Fargo released its Control Tower feature to mobile and online banking customers in fall 2018, billing it as “a new digital experience that simplifies customers’ online financial lives.” It is an early attempt to empower consumers so they know at a glance where and how their debit cards, credit cards, and financial information are in play – both inside and outside of digital banking.

Javelin Strategy & Research’s new case study, Why Wells Fargo’s Control Tower Signals the Future of Digital Banking, analyzes one bank’s innovative attempt to provide customers with clearer oversight of their ever-expanding digital footprint. Using Control Tower as a model, Javelin describes three key principles that should guide digital bankers’ strategic and tactical quest for customer confidence, trust, and loyalty.

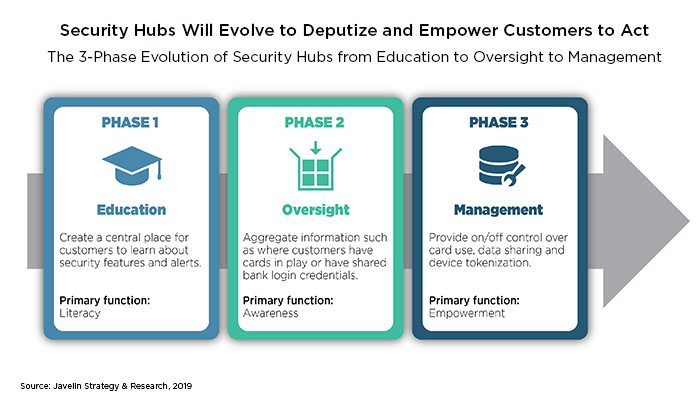

Javelin expects security hubs in general—and Control Tower specifically—to evolve in three phases: from education, to oversight, to management. “To some, these components might seem unrelated, raising questions about whether a security hub is best described as a payments feature, a security feature, or even a financial fitness feature. It is actually all of them and more,” said Mark Schwanhausser, Director of Digital Banking at Javelin Strategy & Research. “These hubs centralize features that together are greater than the sum of their parts. The goal is to boost habitual engagement and cement primary-banking relationships.”

“To some, these components might seem unrelated, raising questions about whether a security hub is best described as a payments feature, a security feature, or even a financial fitness feature. It is actually all of them and more,” said Mark Schwanhausser, Director of Digital Banking at Javelin Strategy & Research. “These hubs centralize features that together are greater than the sum of their parts. The goal is to boost habitual engagement and cement primary-banking relationships.”