Banks and Billers Slated to Save $2.2B in Paper Statement Delivery Costs by 2020

JAVELIN Examines Strategies for Banks and Billers to Rethink Digital Services for a Paperless World

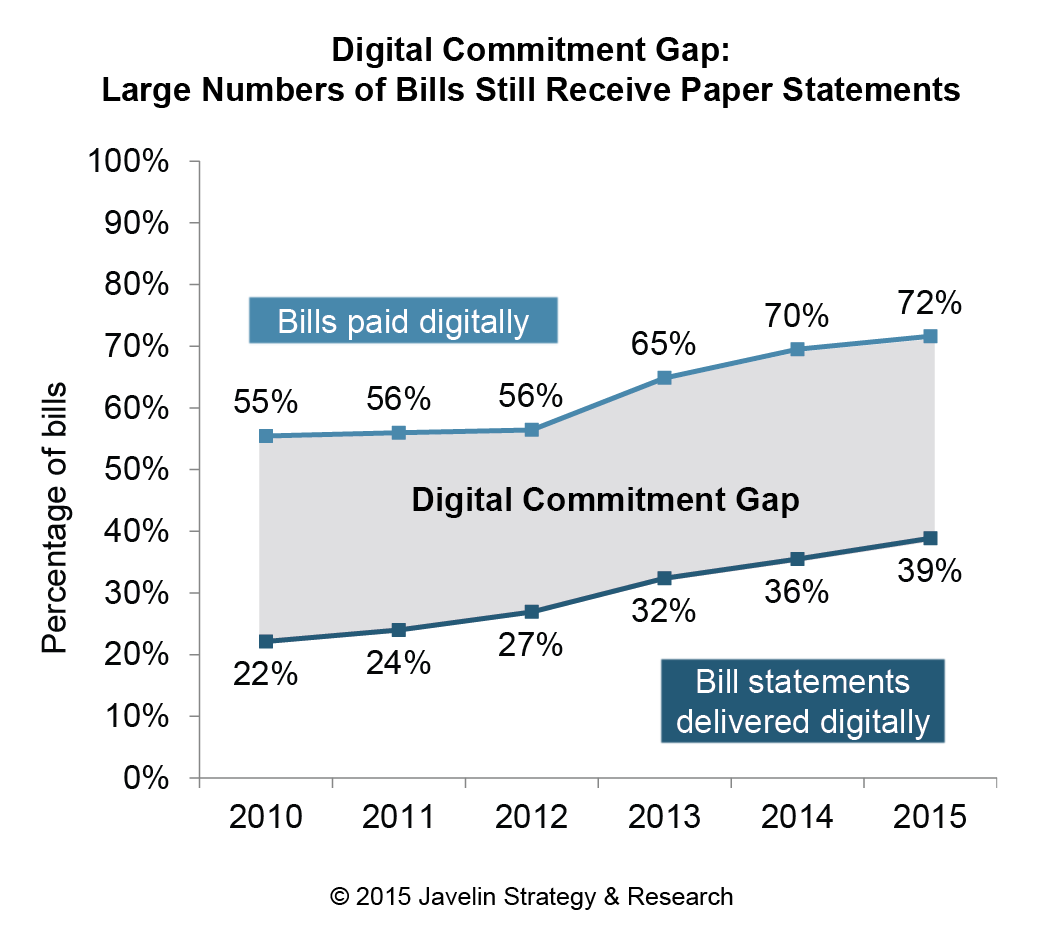

San Francisco, CA, July 1, 2015: Digital banking is a way of life - 72% of bills are paid through online or mobile channels—but only, only 39% of statements are delivered digitally. The potential payoff to financial institutions and billers of closing this “digital commitment gap” is enormous, with $2.2B savings in next five years. Today, JAVELIN released Paperless Banking and Billing 2015: Closing the Digital Commitment Gap, which examines the state of paperless adoption today, explores strategies to target remaining holdouts, and delves into the ROI opportunities for financial institutions and billers.

The number of consumers who receive both a paper and a digital statement remains steady. Nearly 1 in 4 checking account owners and bill payers still receive both online and paper statements each month – that figure has been constant since 2010. Converting double-dippers and paper-only holdouts will not be easy, as FIs and billers have already capitalized on consumers’ desire to eliminate clutter in their financial record-keeping and help the environment.

“FIs and billers must upgrade the digital experience to satisfy customers who seek a paperless lifestyle – or even just a less-paper lifestyle. To achieve greater paper turnoff, FIs and billers must think bigger about the overall digital experience, break down organizational “silos,” and deliver a digital lifestyle that is integrated, complete, and reliable,” said Ian Benton, Research Specialist, JAVELIN.

This report, Paperless Banking and Billing 2015: Closing the Digital Commitment Gap, is based on

- A consumer survey of 8,525 consumers

- Interviews with industry strategists responsible for paperless initiatives at banks, billers, and third party players.

Related JAVELIN Research

- Mobile Bill Pay: Strategies to Grow Adoption and Build Engagement

- Online Banking and Bill Payment Forecast 2014–2019: Tech-Savvy Moneyhawks Foreshadow New Bill Pay Habits

- Push Notifications Change the Game for Financial Alerts

About JAVELIN

JAVELIN, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.