$1.1 Trillion in Deposits are at Risk Among Mobile-Minded Consumers With an Itch to Switch Banks

Javelin Strategy & Research Examines ‘Moneyhawks’—Coveted Consumers Who Are Young, Affluent, and Tech-Savvy but at High Risk of Changing Banks

San Francisco, CA, October 1, 2014: Bankers covet a segment of tech‐savvy, mobile‐minded consumers called Moneyhawks. These Moneyhawks have a demanding appetite for anytime, anywhere, cutting-edge digital access to banking products and yet their combined lack of loyalty and wealth of assets can cause them to be a tricky segment to attract and retain. Javelin Strategy & Research’s report ‘New’ Moneyhawks: Highly Profitable and Engaged Customers Defining the Future of Banking warns that 20% of Moneyhawks are at high risk of leaving their primary bank or credit union — putting an estimated 103 million financial accounts and $1.1 trillion in deposits into play.

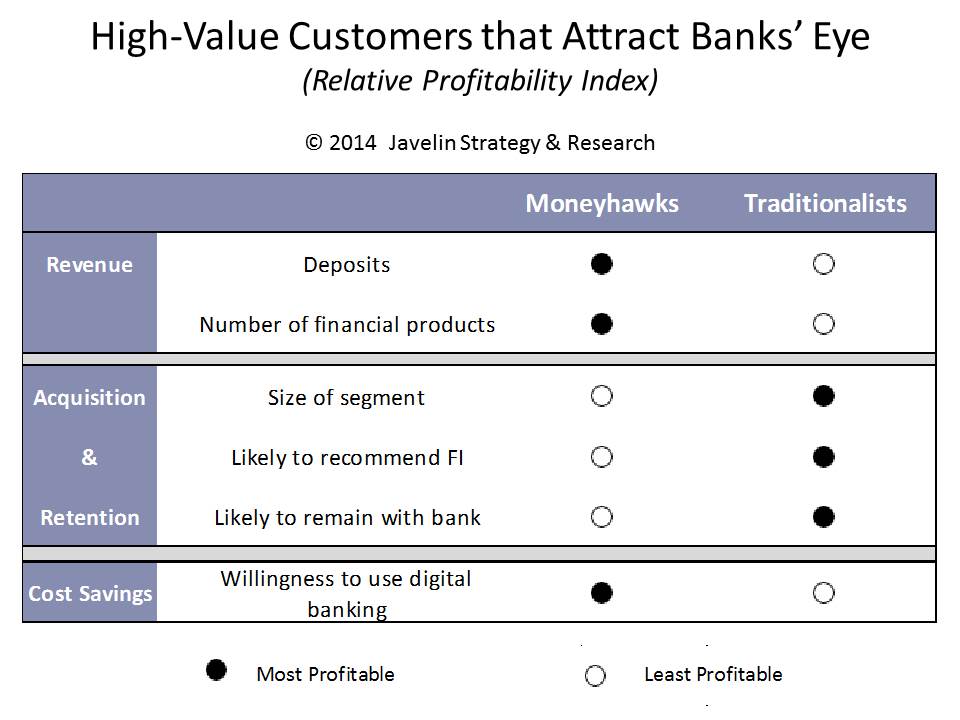

The 31 million Moneyhawks are a top target for financial institutions (FIs) for a variety of reasons that promote profitability, including revenue, cost savings, and acquisition and retention. They have significantly greater bank deposits, and they oversee a much larger portfolio of revenue -- generating financial accounts such as car loans, mortgages, credit cards, and more. Yet Moneyhawks present a bit of a conundrum on cost savings. On one hand, they are expensive to serve because they engage more frequently through all channels. But their “mobile-first” mindset — the reflex to reach for a smartphone rather than logging in or visiting a branch — opens the door for FIs to trim costs.

“The goal is not to devise digital services that satisfy a broad spectrum of customers, it is to target your highest‐ value, most profitable customers — the Moneyhawks. They not only are the most profitable customers today, but they also will pioneer the behavior that others will adopt in time,” said Mark Schwanhausser, Director of Omnichannel Financial Services at Javelin Strategy & Research. "To compete, FIs not only must cater to their existing Moneyhawks, but they must also strive to win a disproportionate share of these demanding, fickle consumers and entice other segments to adopt their digital behavior.”

The Javelin Strategy & Research consumer segmentation detailed in ‘New’ Moneyhawks: Highly Profitable and Engaged Customers Defining the Future of Banking goes beyond traditional consumer analysis based on demographics or behavior. Developed in concert with Greenwich Associates, it profiles not only who the Moneyhawks are and what they do, but also why they bank the way they do. This report also profiles three other critical customer segments, each with their own financial needs and definition of what they value most in a bank or credit union. It is based on a consumer survey of more than 8,700 consumers.

Related Javelin Research

- Managing Money in the ‘Mobile‐First’ Era: A Blueprint for On‐the‐Go Personal Finance Management

- A Tale of Two Gen Ys: On the Road to Long‐Term Banking Profitability

- 2013 Online Banking and Bill‐Payment Forecast: 29 Million Holdouts Primed for FI Bill Pay

About Javelin Strategy & Research

Javelin Strategy & Research, a Greenwich Associates LLC company, provides strategic insights into customer transactions, increasing sustainable profits for financial institutions, government, payments companies, merchants and other technology providers. Javelin’s independent insights result from a uniquely rigorous three-dimensional research process that assesses customers, providers, and the transactions ecosystem.