Identity Fraud Losses Totaled $43 Billion in 2022, Affecting 40 Million U.S. Adults

SAN FRANCISCO, Tuesday, March 28, 2023 — Today Javelin Strategy & Research, an Escalent company, published the 20th edition of its landmark Identity Fraud Study, titled “The Butterfly Effect.” It comes with encouraging news and a note of caution: Overall dollar losses are down $9 billion from the previous study year, but two decades of studying identity fraud show that the ups and downs require financial services providers and consumers’ ongoing vigilance to protect personally identifiable information.

The report sponsors share Javelin’s commitment to fraud prevention and education. Sponsors are AARP, Equifax, and FIS at the platinum level; TransUnion at the gold level; and BioCatch at the silver level. Javelin maintains independence in its data collection, analysis, and reporting.

The downward movement of the loss figures is a testament to the relentless efforts of the financial services industry to keep criminals at bay. However, criminals continually adjust their tactics, so much work remains to dramatically reduce the impact of identity fraud across the industry.

"Describing the current state of identity fraud trends as the butterfly effect is fitting,” said John Buzzard, Javelin's lead fraud and security analyst and the report's author. "Even minor occurrences can set off a chain reaction that has a significant impact on the daily lives and habits of identity fraud victims who may also be feeling ambivalent in the wake of a handful of recent bank failures such as Silicon Valley Bank."

Highlights From This Year’s Report:

- Total identity fraud losses were $43 billion. That’s down from $52 billion the year before, a decline of 17%.

- Identity fraud scams victimized fewer people. Javelin credits this to consumer outreach by financial services and consumer advocacy groups, and stronger fraud prevention tactics at banks and credit unions. The decline in number of victims was 2 million, even as significant challenges persist in the overall battle against identity fraud and scams.

- Identity fraud has a disproportionately severe impact on non-white households. Exposure to data breaches affects 27% of Hispanic households and 26% of Black households—a considerable difference from White households—and the gap widens when compared with Asian households. The report describes the heavy toll identity fraud exacts on its victims, explores several contributing factors, and provides recommendations based on these findings.

- Significant reduction in new-account fraud. This is an indication that financial service providers are focusing more intently on identity and authentication practices through the use of fraud detection technology.

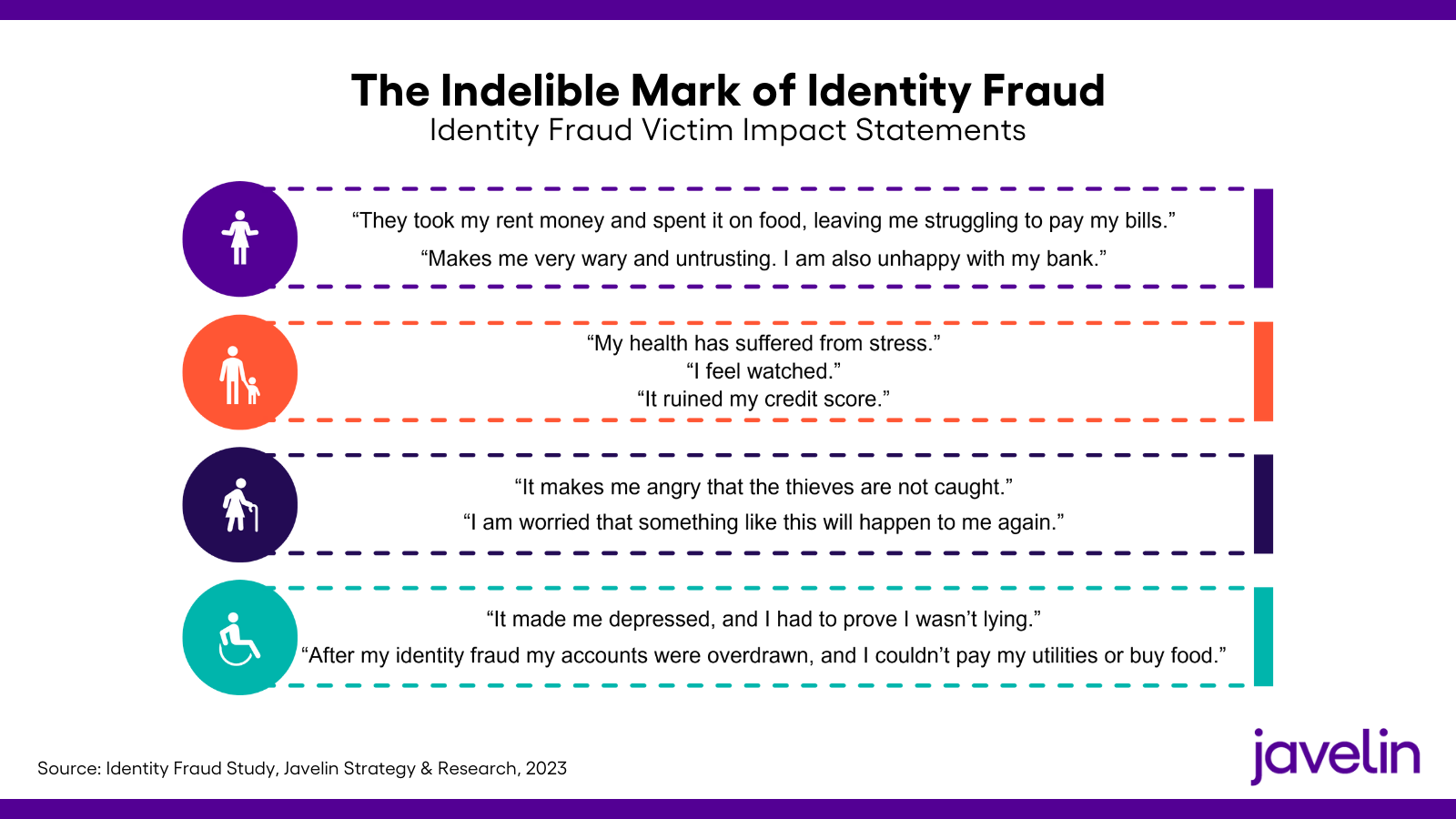

This year, for the first time, the report gathered victim impact statements, putting a human face to crimes that often shatter confidence, shred credit, and harm long-term financial well-being.

“It’s devastating to read impact statements from identity fraud victims, especially people who say things like, ‘After my identity fraud experience, my accounts were overdrawn, and I couldn’t pay my utility bills or buy food,’” added Buzzard.

This year’s report includes a 20th-anniversary retrospective that illustrates how technical innovations, societal changes, and economic indicators have influenced the past two decades of identity fraud activity and Javelin’s subsequent research.

Javelin’s Identity Fraud Study is an essential guide to understanding the financial impact and emotional devastation caused by identity fraud in the United States. The online survey of 5,000 U.S. adults is conducted every autumn and publishes the following spring. The study continues to be the standard-bearer in bringing context to identity fraud.

Interested in sponsoring a future study?

About Javelin Strategy & Research

Javelin Strategy & Research, part of the Escalent family, helps its clients make informed decisions in a digital financial world. It provides strategic insights to financial institutions, including banks, credit unions, brokerages and insurers, as well as payments companies, technology providers, fintechs, and government agencies. Javelin’s independent insights result from a rigorous research process that assesses consumers, businesses, providers, and the transactions ecosystem. It conducts in-depth primary research studies to pinpoint dynamic risks and opportunities in digital banking, payments, fraud & security, lending, and wealth management. For more information, visit javelinstrategy.com. Follow us on Twitter and LinkedIn.

PLATINUM SPONSORS

AARP

Equifax

At Equifax (NYSE: EFX), we believe knowledge drives progress. As a global data, analytics, and technology company, we play an essential role in the global economy by helping financial institutions, companies, employers, and government agencies make critical decisions with greater confidence. Our unique blend of differentiated data, analytics, and cloud technology drives insights to power decisions to move people forward. Headquartered in Atlanta and supported by nearly 14,000 employees worldwide, Equifax operates or has investments in 24 countries in North America, Central and South America, Europe, and the Asia Pacific region. For more information, visit Equifax.com.

FIS

FIS is a leading provider of technology solutions for merchants, banks and capital markets firms globally. Our employees are dedicated to advancing the way the world pays, banks and invests by applying our scale, deep expertise and data-driven insights. We help our clients use technology in innovative ways to solve business-critical challenges and deliver superior experiences for their customers. Headquartered in Jacksonville, Florida, FIS ranks #241 on the 2021 Fortune 500 and is a member of Standard & Poor’s 500® Index. To learn more, visit www.fisglobal.com. Follow FIS on Facebook, LinkedIn and Twitter (@FISGlobal).

GOLD SPONSOR

TransUnion

TransUnion is a global information and insights company with over 12,000 associates operating in more than 30 countries. We make trust possible by ensuring each person is reliably represented in the marketplace. We do this with a Tru™ picture of each person: an actionable view of consumers, stewarded with care. Through our acquisitions and technology investments we have developed innovative solutions that extend beyond our strong foundation in core credit into areas such as marketing, fraud, risk and advanced analytics. As a result, consumers and businesses can transact with confidence and achieve great things. We call this Information for Good®—and it leads to economic opportunity, great experiences and personal empowerment for millions of people around the world. http://www.transunion.com/business

SILVER SPONSOR

BioCatch

BioCatch is the leader in Behavioral Biometrics, a technology that leverages machine learning to analyze an online user’s physical and cognitive digital behavior to protect individuals online. BioCatch’s mission is to unlock the power of behavior and deliver actionable insights to create a digital world where identity, trust and ease seamlessly co-exist. Today, BioCatch counts over 25 of the top 100 global banks as customers who use BioCatch solutions to fight fraud, drive digital transformation and accelerate business growth. BioCatch’s Client Innovation Board, an industry-led initiative including American Express, Barclays, Citi Ventures, and National Australia Bank, helps enable BioCatch to identify creative and cutting-edge ways to leverage the unique attributes of behavior for fraud prevention. With over a decade of analyzing data, more than 70 registered patents, and unparalleled experience, BioCatch continues to innovate to solve tomorrow’s problems. For more information, please visit www.biocatch.com.

Media Contact

Tejas Puranik

Senior Marketing Manager

[email protected]