U.S. Fleet Card Market Review and Forecast, 2018–2023

- Date:December 30, 2019

- Research Topic(s):

- Commercial & Enterprise

- Merchant

- PAID CONTENT

Overview

The fleet (fuel) card market saw continued growth during the past year, but headwinds are forming through fuel efficiencies and increasing alternative vehicle growth. Industry leaders are adapting in several ways, with technology and tactical policy/product changes creating potential new growth opportunities.

In a new research report, U.S. Fleet Card Market Review and Forecast, 2018–2023, Mercator Advisory Group reviews the estimated current market size and network share, projecting spending through 2023. The report delves into the issues and trends affecting this niche portion of the payments industry.

“The closed loop network portion of the spending continues to predominate since industry legacy approaches reside with larger fleets and the specialized controls associated with the more abundant data capabilities in these systems,” commented Steve Murphy, Director of Mercator Advisory Group’s Commercial and Enterprise Payments Advisory Service, author of the report. “As the service providers attempt to broaden their reach into small businesses and midsized fleets, collaboration with open loop network products will increase. This is one way to offset fuel price volatility and efficiency impacts in the shorter term, while a looming change is also there from the effects of alternative vehicles. Industry participants recognize the challenges and a need to adapt to the latest-generation technology, and there is general optimism that challenges will be met successfully.”

The document is 16 pages long and contains 5 exhibits.

Companies and other organizations mentioned in this report include: American Express,AT&T,Comdata, CyntrX, EFS, FleetCor, Geotab, GlobalStar, GPS Insight Mastercard, MSTS, Navistar, OmniTracs, Spireon, Teletrac Navman, Tom Tom, Trimble, UPS, U.S. Bank, WEX, Verizon, and Visa.

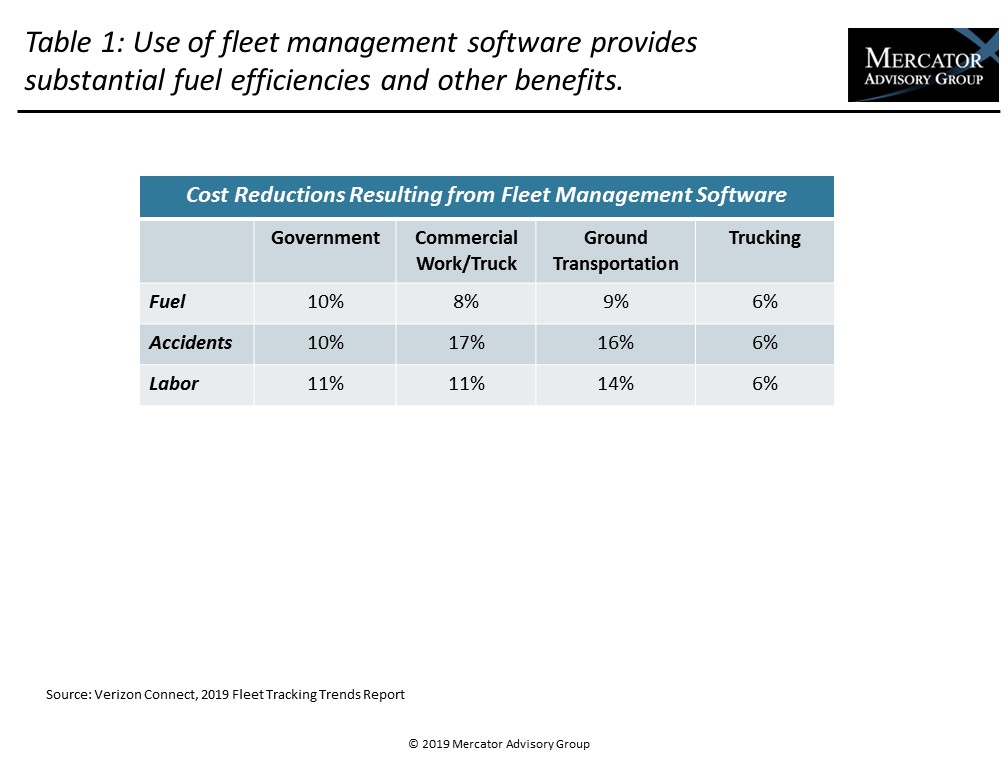

One of the exhibits included in this report:

- Estimated share of closed and open loop network spending in fleet cards in the United States.

- Review of key challenges facing the industry service providers, including the mandate for electric logging devices (ELD) and the upcoming EMV liability shift.

- Projected U.S. overall open and closed loop spending through 2023.

- Analysis of the future trend toward electronic vehicles and adoption across fleets in the U.S.

Book a Meeting with the Author

Related content

One Year On: Tariff Impacts on U.S. Imports and What They Mean for Treasury and Payments

The 2025 tariff regime triggered sharp, policy driven shifts in U.S. import patterns, with tariffs reliably pushing trade away from high duty lanes and toward lower duty or exempte...

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

Make informed decisions in a digital financial world