The 2021 Credit Card Data Book Part One: Internal Dynamics

- Date:March 30, 2021

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Credit card industry greatly impacted by COVID, but the worst seems to have been avoided.

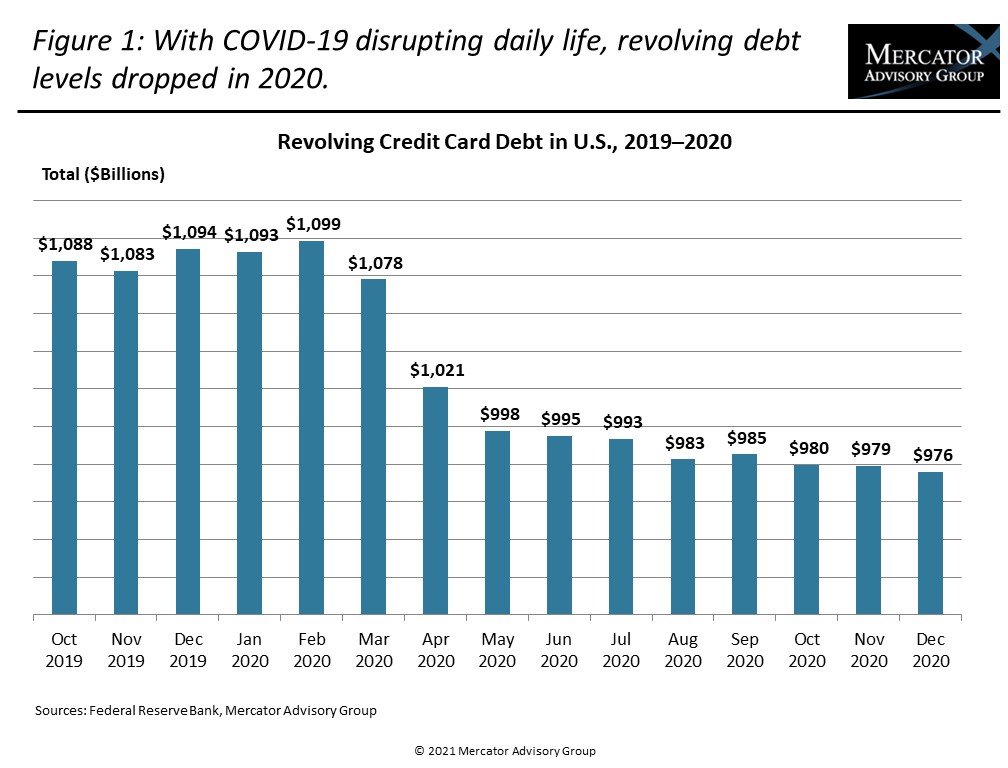

Unlike 2019, which was a banner year for many credit card issuers, 2020 proved to be far more tumultuous. COVID-19 caused widespread disruptions, economic uncertainty, and a steep rise in unemployment. Facing economic uncertainty, consumers largely reigned in their credit usage, causing revolving debt volumes to drop. Despite the potential for an economic disaster, however, the credit card industry remains largely stable, with delinquencies down across all loan types. According to Mercator Advisory Group’s new report, The 2021 Credit Card Data Book Part One: Internal Dynamics, 2021 will likely end with a manageable rise in charge-offs.

“Though the credit cycle risk indicators are artificially low and credit use has dropped considerably, current trends make it unlikely that a tsunami of delinquencies and charge-offs will crash over the credit industry in 2021,” comments Brian Riley, Director, Credit Advisory Service, at Mercator Advisory Group, and co-author of this research report. “We will examine what these trends are in the second part of this credit card data report and analyze what they mean for credit card profitability, consumer interest in opening new credit cards, and lender attitudes on credit policy standards.”

This document contains 26 pages and 16 exhibits.

Companies and other organizations mentioned in this research report include: ACI Worldwide, Bank of America, Chase, Citi, Federal Reserve System, and FICO.

One of the exhibits included in this report:

Highlights of the research report include:

- Key industry metrics to watch in 2021

- Decline in revolving debt

- Drop in average credit card debt

- Disruptions to the normal aging process

- Trillions of dollars in contingent credit card liability

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world