The 2020 Credit Card Data Book: Good Times Roll a Bit Longer

- Date:February 19, 2020

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

2019 was a banner year for many credit card issuers, as the stars aligned. Unemployment and inflation were low, interest margins were at a peak, collection results were favorable, and total open accounts grew slightly. And according to Mercator Advisory Group’s new report, The 2020 Credit Card Data Book: Good Times Roll a Bit Longer, 2020 will likely be slightly better, and more profitable, assuming the economic tides do not turn.

“Credit card risk is fragile right now. Times have been good, but that “sooner or later” economic shift draws closer every month. Use Mercator’s 2020 Credit Card Data Book to see where sensitivities exist,” comments Brian Riley, Director, Credit Advisory Service, at Mercator Advisory Group, the author of this research report. “As an example, if there is a sudden shift, warning bells will ring at credit card issuers and they will quickly tighten credit to protect their balance sheets. As that happens, delinquency will start to climb. This ends up as high credit losses and increased non-interest expense.” Riley continues: “Right now, infrastructure and credit management are as important as portfolio growth. Risks are higher than ever, and issuers must ensure that their credit management policies and systems are ready to react. Overflow and diversion strategies, champion/challenger testing, and a battle-ready credit management team are the order of the day.”

This document contains 29 pages and 20 exhibits.

Companies and other organizations mentioned in this research report include: ACI Worldwide, Bank of America, Chase, Citi, Federal Reserve System, and FICO.

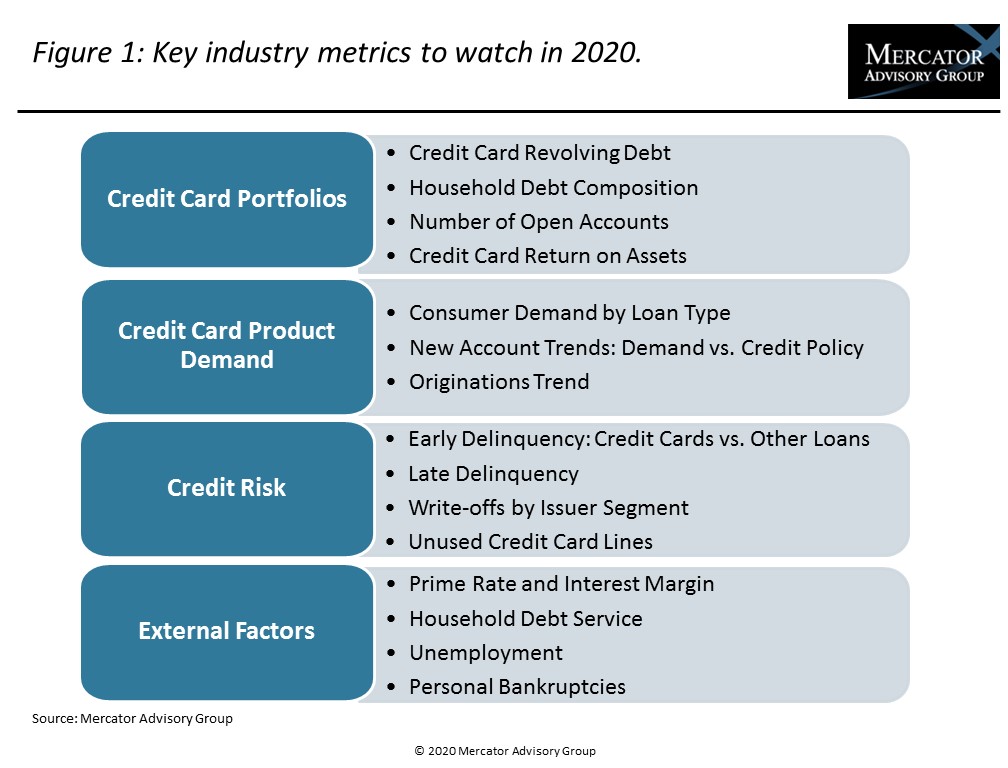

One of the exhibits included in this report:

- Key industry metrics to watch in 2020

- Growth in revolving debt

- Average credit card debt

- Credit card return on assets

- Originations and total active accounts

- Trillions of dollars in contingent credit card liability

- Interest rate margins

- Household debt burdens

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world