Overview

Bank Data Is Already Exposed to Quantum Computing and Early Adopters Can Gain Significant First-Mover Advantages

New Mercator research provides an in-depth status and review of quantum computing today, identifies key opportunities for its utilization in financial services, takes a deep dive into the challenges it represents to our data security, and makes recommendations both for its adoption and how to make plans to protect your data and that of your customers.

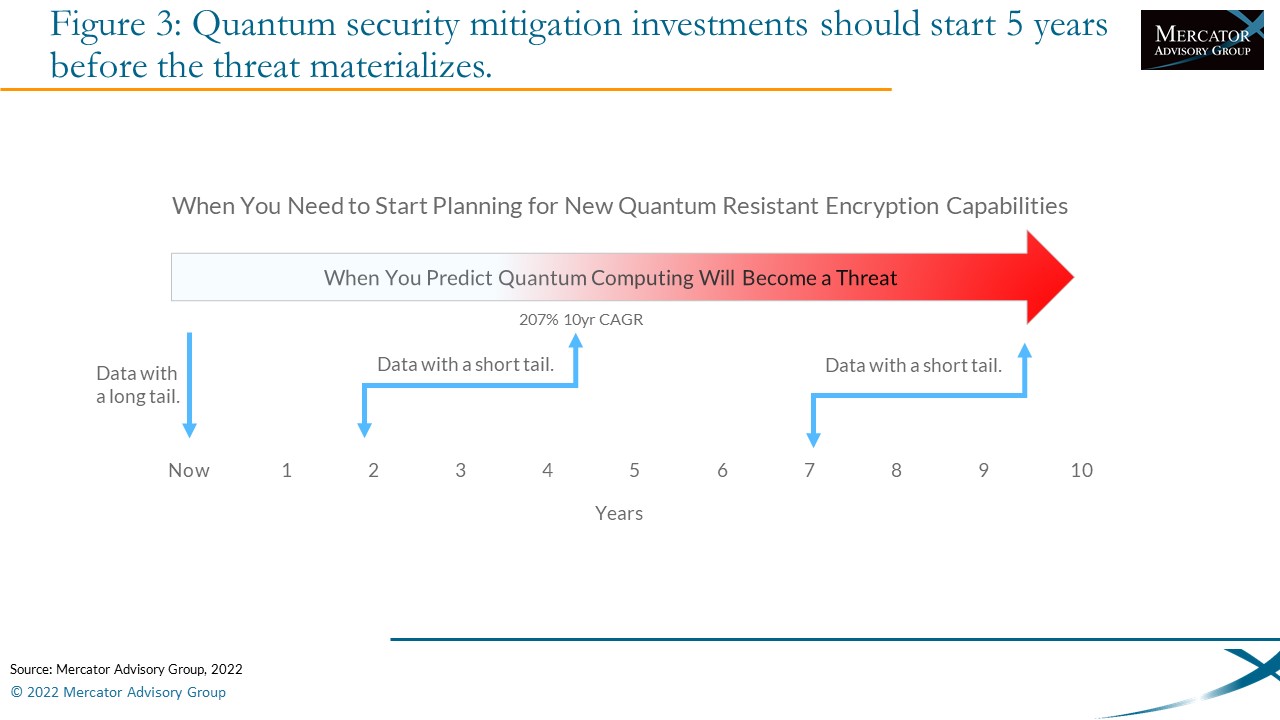

The primary finding of this research is that protecting your data against quantum should start today if that transmitted data will still be valuable in the next five years. Adversaries are recording data now for future decryption and exploitation. An additional finding is that quantum computing is already available through the cloud for optimization problems and new estimates suggest that universal quantum computing may be available in just 5 to 10 years, not 20 as is commonly thought. Financial institutions interested in having a first-mover advantage should start to develop the business and IT resources required for that now. This includes the acumen to select the appropriate business problems that will most differentiate the company and will benefit the most from quantum computing and then finding the talent required to develop those programs, remembering that quantum does not use traditional computing skills.

This research explains the different forms of quantum, including universal quantum computing, annealing solutions that have been applied to optimization problems for several years, and quantum key distribution that can protect our data in motion.

“This research identifies several areas that all companies should be focusing on now to protect their data and the data of their customers from adversaries,” commented Tim Sloane, Vice President of Payments Innovation and Director of the Emerging Technology Services Practice at Mercator Advisory Group. “The research also identifies several areas where quantum computing can deliver a competitive edge for those prepared to implement it, which is important, however, the critical issue for today is to protect all of your long-tail data.”

This report is 26 pages long and has 6 exhibits.

Companies and other organizations mentioned in this report:

Barclays, Battelle, BNP Paribas, Citigroup, Crédit Agricole, D-Wave, Goldman Sachs, Google, Honeywell, HP, HSBC, IBM, QNu Labs, ID Quantique, ING, Intel, Japan Post Bank, MagiQ Technologies, Mitsubishi, NEC, NTT, JPMorgan, NIST, NVIDIA, QNu Labs, QRate (Russia), Quantropi, Quintessence Labs, Royal Bank of Canada (RBC), Toshiba, Wells Fargo

One of the exhibits included in this document:

Highlights of this document include:

- The difference between Universal Quantum Computing and Quantum Annealing

- Quantum computing architecture

- Types of problems

- Specific problems for financial institutions

- Other industries using quantum

- To what level different industries have committed to developing their infrastructure

- Which data communications protocols are most at risk and how they can be made resistant

- What steps a business should take to protect their data

Book a Meeting with the Author

Related content

Agentic Standards: Platform Opportunities and Platform Solutions

The development of open agentic commerce protocols—notably the Universal Commerce Protocol (UCP) and Agent Commerce Protocol (ACP)—represent an expected and necessary alternative t...

Are Consumers Showing Interest in Direct Payments?

Javelin Strategy & Research’s data dives into consumer behavior show that consumers’ usage of and interest in lower-cost payment methods like account-to-account transactions and pa...

2025 Emerging Biometric Authentication at the Point of Sale Scorecard

This inaugural Javelin Strategy & Research scorecard assesses the emerging market for biometric authentication at the point of sale and identifies three Pillars in this emerging te...

Make informed decisions in a digital financial world