- PAID CONTENT

Overview

Mercator Advisory Group’s latest research report, Private Label Credit Cards: A Market, Not Just a Niche, sizes the market for private label credit cards and analyzes the growth potential of this often-overlooked market segment.

“The wheels fell off the private label credit card business in the 1990s as general purpose credit cards simplified the consumer’s wallet with a single solution,” commented Brian Riley, Director, Credit Advisory Service, at Mercator Advisory Group, author of the research report. “As the economy soured, retailers needed cash on their books to purchase new inventory, rather than supporting consumer credit,” Riley continued. “Large financial institutions now dominate the space and partner with retailers to relieve the demands of consumer credit. There is plenty of room to grow with smaller retailers as e-commerce and mobile payments develop.”

This research report is 21 pages long and has 9 charts and 4 tables.

Companies mentioned in this research report include: ACI Worldwide, Albertsons, Alliance Data Systems, Aldi, Amazon, American Express, Apple, Bank of America, Barclays, Bridgestone America, Capital One, Carlyle Group, Chase, Chevron/Texaco, Citi, Comenity Bank, Costco, Credit First National Association (CFNA), CVS, Dollar Tree, Exxon, Federated Stores, First Data, Fiserv, Ford Motor Company, GM, H-E-B Grocery, Home Depot, Kohl’s, Kroger, Macy’s, Mastercard, McDonalds, Mercedes Benz, Nordstrom, Publix, Rite Aid, Royal Ahold, Sears, Synchrony, TD Bank, Target, Toyota, U.S. Bank, Verizon, Visa, Walgreens, and Wal-Mart.

One of the exhibits included in this report:

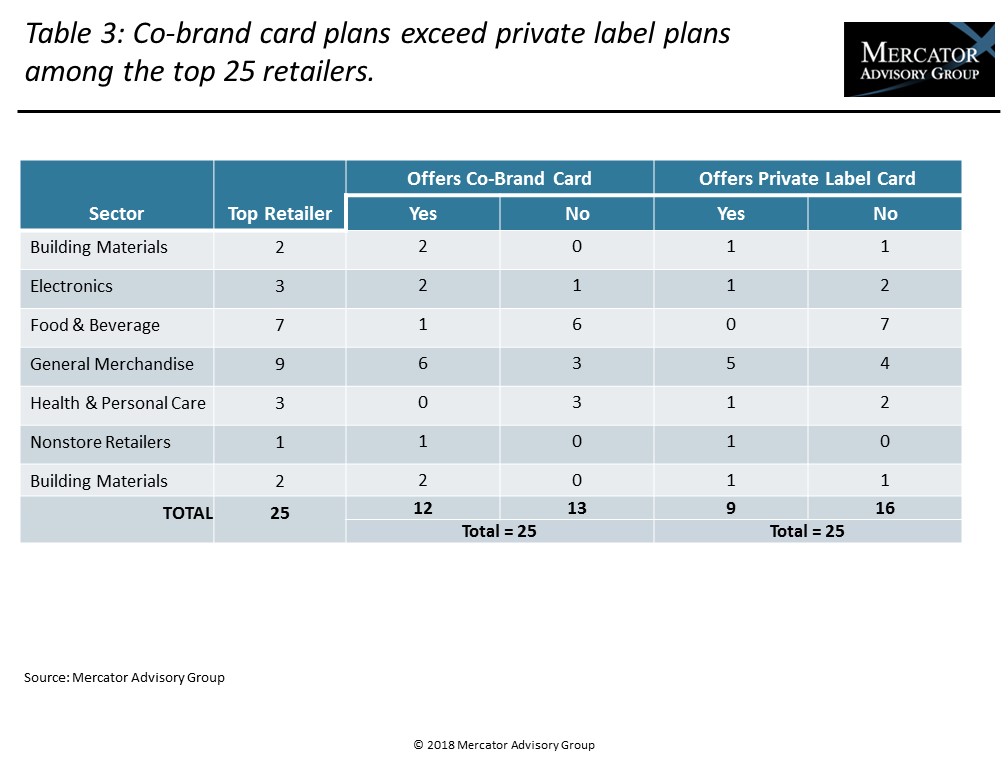

- A comparison of merchant co-branded general purpose credit cards and private label credit cards

- Estimates of the private label credit card market through 2022

- Leading providers of co-branded credit cards and private label credit cards

- Market opportunities and measures to counter fintech models

- Credit underwriting standards for private label credit cards

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world