Prepaid 2013: Buying More For Own Use

- Date:October 31, 2013

- Author(s):

- Karen Augustine

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

Mercator Advisory Group is releasing the second in the CustomerMonitor Survey Series 2013 Insight Reports, a series of eight biannual reports based on primary research on consumer payments and banking channels. The series has an expanded panel of 3,000 U.S. adult consumers reflective of the U.S. Bureau of the Census demographic profile of U.S. adult households to gain deeper insight into subsegments of the market.

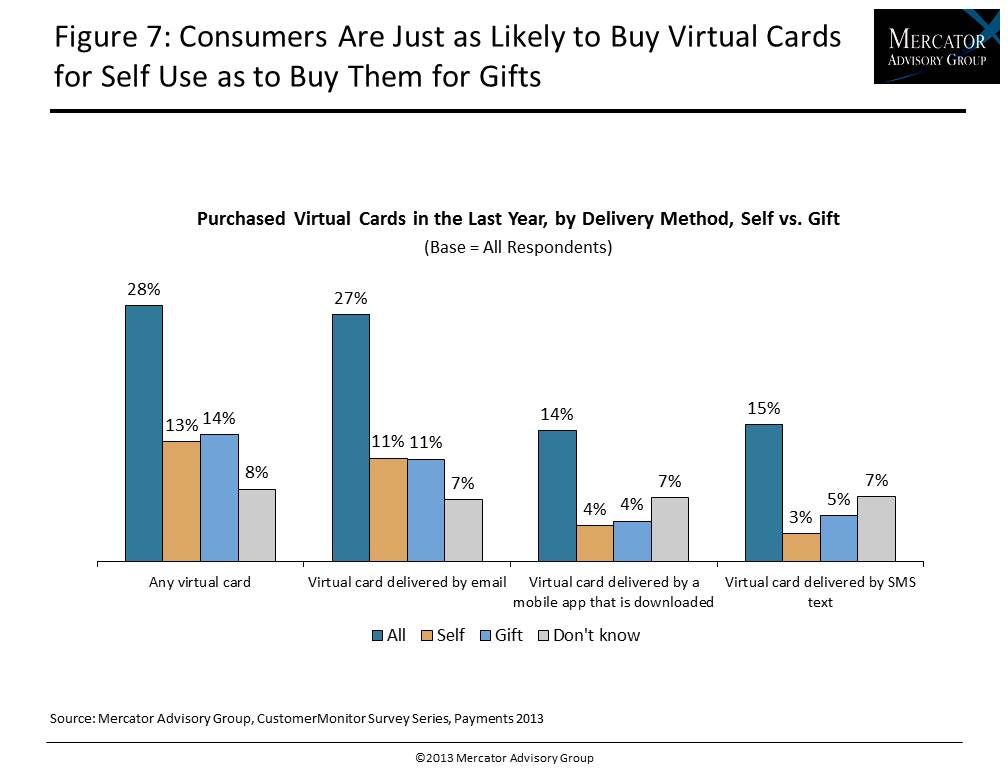

Prepaid 2013: U.S. Consumers Buying More Prepaid Cards for Own Use, the latest report from Mercator Advisory Group, which presents results from the Payments survey, conducted between May 28 and June 6, 2013, reveals that 53 percent of U.S. adult consumers surveyed had bought prepaid cards in the preceding year, up from 47 percent of respondents who recalled buying prepaid cards in the 2012 survey. While more consumers buy prepaid cards for gifts than for their own use, the 2013 survey reveals that the percentage buying for self-use is rising. This trend is even more apparent for virtual cards, which are increasingly delivered by mobile device, either by Short Message Service (SMS) text or through a mobile app. More than 1 in 4 consumers bought virtual cards within the year preceding the survey; half purchasing them as gifts and half for their own use.

This study examines the demographic shift and changing landscape of prepaid card use and recalled loads; reloading awareness, usage, and frequency; distribution channels, importance of feature sets including awareness and use of direct deposit and brand awareness of eight major brands of general purpose reloadable (GPR) cards

“As new U.S. banking regulations force many banks to raise fees on checking accounts and debit card rules continue to be challenged, many in the banking and payments industry are looking to prepaid cards to gauge their use as a preferred payment tool,” states Karen Augustine, manager of CustomerMonitor Survey Series at Mercator Advisory Group and the author of the report. “Prepaid buyers are more likely to be younger, mobile-enabled, and buy cards for their own use. Prepaid cards are becoming more of a primary payment method and not relegated only for gifts.”

The report is 56 pages long and contains 25 exhibits

Companies mentioned in this report are: American Express, Chase, GreenDot, H&R Block, NetSpend, Rush, Walmart.

Members of Mercator Advisory GroupCustomerMonitor Survey Series Service have access to this report as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

Please visit us online at

Year-over-year trending of prepaid card use by type of card, including retailer-specific, general purpose and reloadable cards, as well as consumers’ recollection of cards purchased and monthly load volume

Shift in demographics of prepaid card and virtual card users, the ways consumers are using them, and motivating factors for preferred distribution channels

Purchase behavior regarding GPR cards, including length of time card is in use, load frequency, brand awareness, and purchases by brand

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world