Overview

Credit card issuers’ interest in mass affluent and high-net-worth cardholders has not waned in the wake of the recession. Indeed, leading premium card issuers have redoubled their efforts to acquire these consumers as a source of high-volume, low-risk credit card spend.

Mercator Advisory Group's report, Premium Credit Cards: How to Hit a Small, Moving Target, updates key statistics on affluent and high-net-worth consumers. It analyzes statistics that are fundamental to card product development in the U.S. market such as market growth, product ownership, and monthly and yearly card spending by cardholder segment. The report also reviews recent developments in the major card networks’ product platforms and provides an update on new features and benefits of leading issuers’ superpremium offerings.

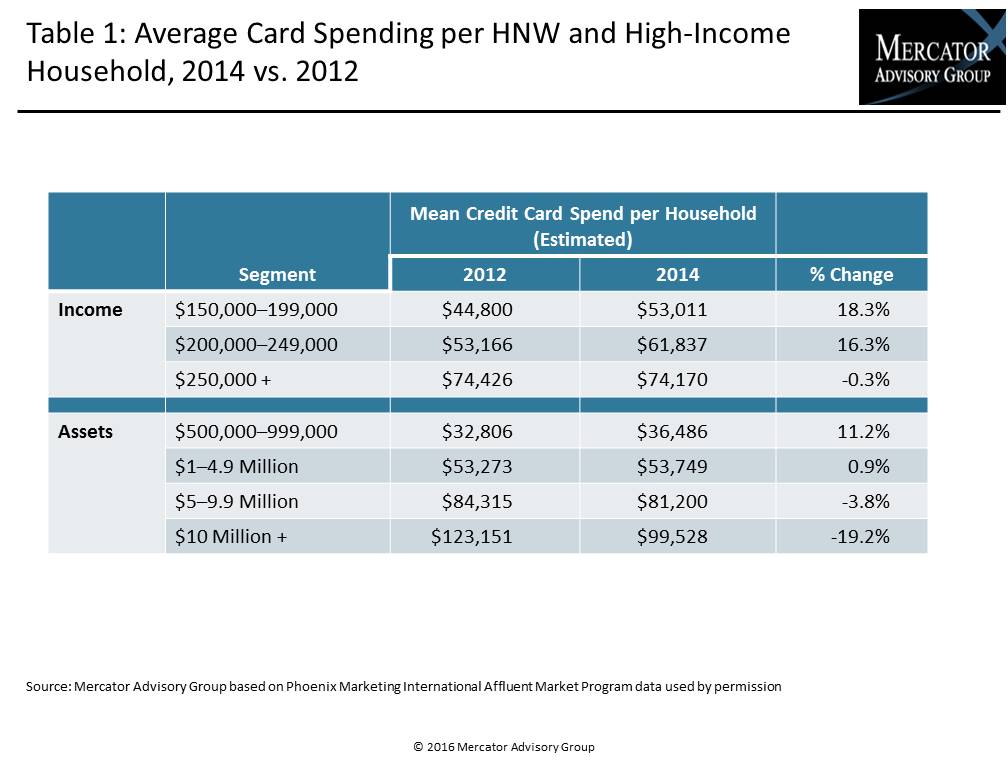

“Growth in the overall number of high-net-worth and mass affluent households has remained modest,” comments Alex Johnson, Director of Mercator Advisory Group’s Credit Advisory Service and author of the report. “The biggest area of growth, in terms of card spend, is occurring in the lowest tier of the mass affluent segment, and this is motivating issuers to invest in the features and rewards of cards targeted at that segment.”

This report contains 27 pages and 14 exhibits.

Companies mentioned in this report include: American Express, Citibank, City National Bank, Discover, Facebook, JPMorgan Chase, MasterCard, and Visa.

One of the exhibits included in this report:

Highlights of the report include:

- Estimates, trends, and penetration rates in premium credit card spending

- Tactics that leading issuers have employed to differentiate premium card brands and products

- An overview of premium product platforms offered at the network level

- Comparison grids of the features/benefits of the most popular premium card offerings

- Strategic considerations for premium card issuers

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world