North American PaymentsInsights – Mobile Payments: Breaking Through

- Date:November 16, 2020

- Author(s):

- Peter Reville

- Research Topic(s):

- North American PaymentsInsights

- PAID CONTENT

Overview

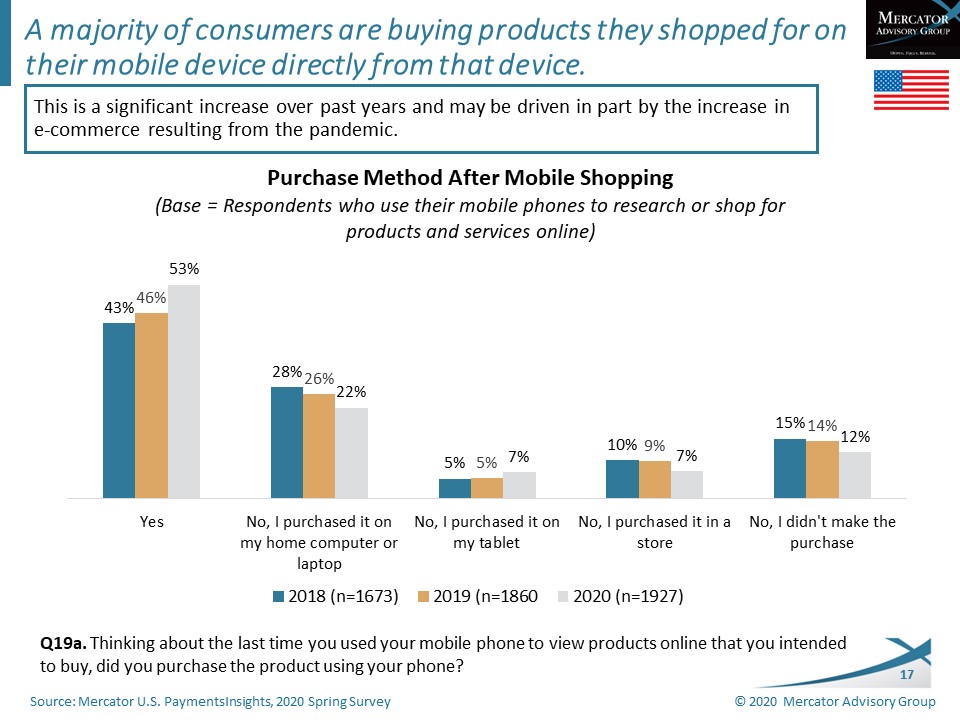

Mercator Advisory Group’s most recent consumer survey report, Mobile Payments: Breaking Through, from the bi-annual North American PaymentsInsights series, reveals that the use of mobile phones is becoming more popular as a way to shop online – at the expense of the computer.

About four in ten have purchased products and services with a mobile phone in the past 30 days. Further, one-half have researched products and services via their smartphone. More consumers are buying products and services with their smartphone compared to last year (39% vs. 33%). Also, more consumers are shopping/researching via their smartphone (52% vs. 45%).

Despite and anticipated lift in mobile payment usage as a result of the pandemic, incidence rates are equal to 2019. In both years, 60% of participants report having made some type of mobile payment. These results are much higher than the previous two years (50% in 2017 and 48% in 2018).

The use of universal wallets varies by channel – Apple Pay is the most often used universal wallet in-store, while Samsung Pay has the highest share among people using a universal wallet online. In-store, Chase Pay and Wells Fargo Wallet are the next most popular. Online, Wells Fargo and Apple Pay are tied for the second most popular.

Mobile Payments: Breaking Through, the latest report from Mercator Advisory Group’s Primary Data Service, is based on a sample of 3,002 U.S. adults surveyed in the annual online Payments survey of Mercator’s North American PaymentsInsights series, conducted in June 2020.

The study highlights consumers’ use and interest in mobile devices, the use of mobile wallets, how people use mobile wallets to shop, and the use of conversational interfaces.

“I don’t think it should come as a surprise that smartphones are starting to become as popular as computers for online shopping, but the numbers are interesting. As apps get better for shopping and consumers rely more and more on their phones, it makes sense that mobile device becomes a more important part of the shopping experience,” stated the author of the report, Peter Reville, director of Primary Data Services at Mercator Advisory Group, which includes the North American PaymentsInsights series.

One of the exhibits included in this report:

Highlights of this report include:

- Reported smartphone ownership over time

- Passwords and other methods for unlocking mobile devices

- Cards loaded into the mobile wallet – credit, debit, prepaid

- Frequency of mobile payments made

- Awareness and usage of the prepaid card websites available

- Motivators to mobile wallet usage

- Comparison of mobile wallets to plastic

- Shopping with mobile

- The use of order-ahead services

- The use of conversational interfaces

- Paying for things with a voice interface

Book a Meeting with the Author

Related content

A Generational Look at Card Network Usage

In this Primary Data Snapshot by Javelin Strategy & Research, a dive into year-over-year usage of the four major U.S. credit card networks shows that generationally targeted approa...

The Bots are Coming: Generational Aspects to AI Adoption

This Primary Data Snapshot—a Javelin Strategy & Research report focusing on consumer payment usage and behavior—shows how consumers, particularly younger ones, are leveraging the p...

2025 North American PaymentInsights: U.S.: Financial Services and Emerging Technologies Exhibit

This report is based on Javelin Strategy’s North American PaymentsInsights series’ annual survey. A web-based survey was fielded between July 14 – 26, 2025, using a US online consu...

Make informed decisions in a digital financial world