Overview

New research from Mercator Advisory Group sizes the market for a new issuer rewards model

The recession has turned many consumers into value-conscious shoppers, and merchants are seeking ways to exploit this mentality to attract new and retain existing customers. At the same time, issuers have an urgent need to create new revenue streams to compensate for declining balances on credit portfolios and reduced interchange revenue on debit portfolios. The combination of these forces is creating an enormous opportunity for merchant-funded network vendors, which have developed technology that can bring issuers, merchants, and consumers together in a way that benefits all stakeholders.

One of the exhibits included in this report:

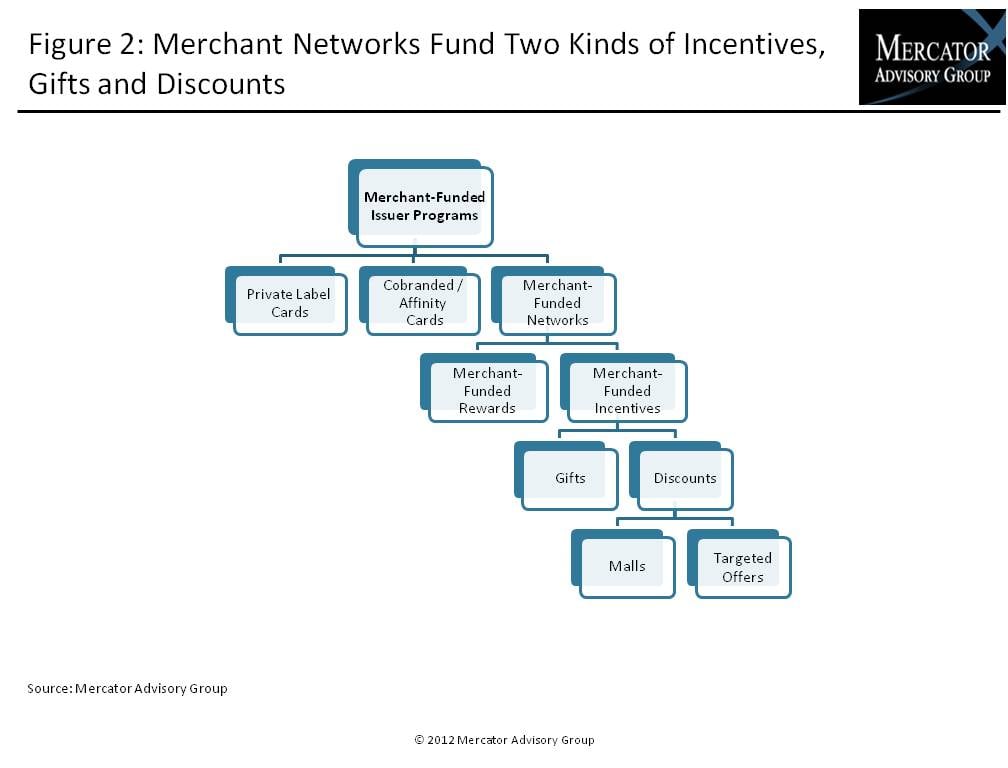

- An overview of the merchant-funded value chain, including major stakeholders, reward types, and the economic framework

- Consumer spending volume and issuer revenue estimates for the two major segments of the merchant-funded incentives, including projections through 2015

- An analysis of the strategies that credit issuers are using to integrate merchant-funded rewards with proprietary reward programs

- A discussion of the major issues that could accelerate or hurt the demand for merchant-funded offers

- Profiles of several leading vendors specializing in merchant-funded discount programs

This report is 36 pages long and contains 20 exhibits.

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world