Overview

Boston, MA – April 23, 2014 – Growth in new credit card accounts has stalled largely because financial institutions’ appetite for risk in their portfolios has not increased significantly since the recession. This sentiment is strongest among tier 1 banks, some of which are still winding down their highest-risk portfolios, having acquired them at the peak of economic turmoil. Several vendors have developed analytics-based solutions that can help issuers profitably lend to potentially risky consumers, but for the most part, they are waiting for issuers to decide the time is right. Mercator Advisory Group’s latest Research Note, Innovative Strategies for Credit Card Account Acquisition, examines how credit issuers are effectively marketing products and originating accounts in the current economic climate.

“Large credit card issuers are almost exclusively marketing products to prime and superprime consumers, but this can only go on for so long as these are very saturated segments,” comments Michael Misasi, Senior Analyst, Credit Advisory Service at Mercator Advisory Group and the primary author of the Note. “Financial institutions have to take on more risk to grow their credit portfolios. The first banks that find a way to profitably serve riskier consumer segments will have the most opportunity for long-term growth.”

This report contains 10 pages and 5 figures.

Companies mentioned in this report include: Equifax, Experian, FICO, FIS, PNC, Zoot, US Bank, and Wells Fargo.

Members of Mercator Advisory Group’s Credit Advisory Service have access to these reports as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

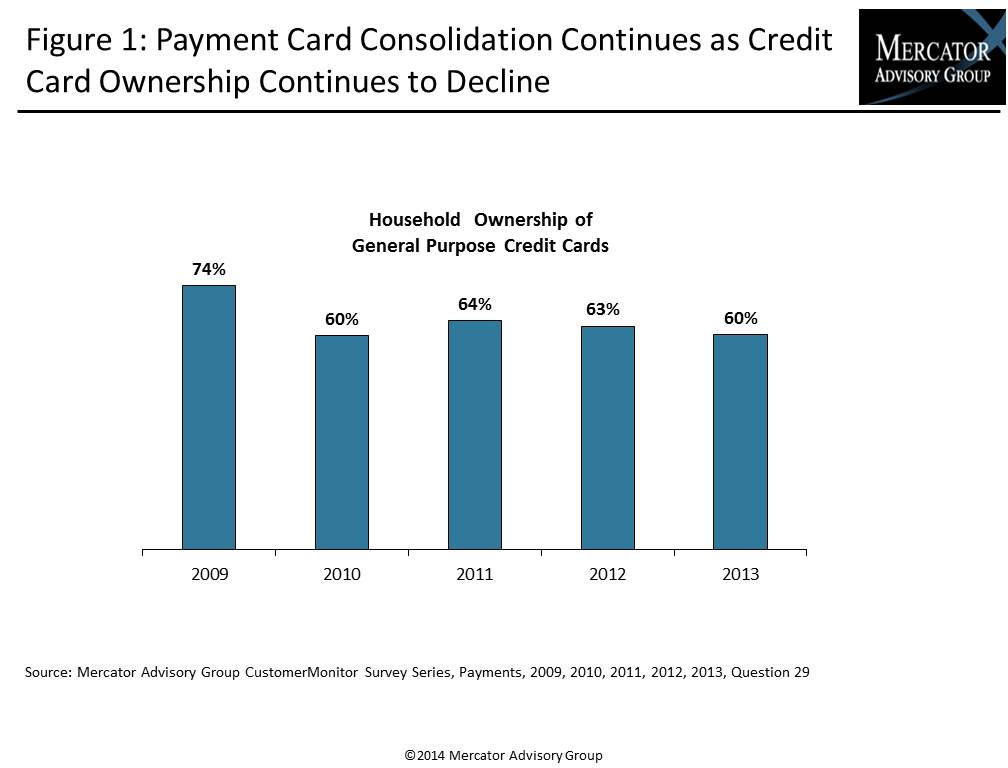

One of the exhibits included in this report:

Highlights of the report include:

- Trends in household ownership of credit cards

- Trends in approval rate for credit cards for consumers of carrying creditworthiness

- Estimated level of credit card ownership for various credit score bands

- A discussion of the role of various banking channels for credit account origination

- Profiles of noteworthy vendor solutions for card account acquisition and origination

Book a Meeting with the Author

Related content

2026 Credit Card Risk: Happy Days are Here Again (For Top Issuers)

The year bodes well as 2026 approaches the end of the first quarter. Economic indicators are strong, the credit card market is growing at a healthy rate, and credit cards rem...

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Make informed decisions in a digital financial world