Overview

Payments Data and Customer Experiences Are Key to Better Loyalty and Rewards Programs.

Mercator Advisory Group’s most recent report, How Payments Can Drive Better Loyalty and Rewards Programs, provides insight into the new technology driving increased personalization and better customer experiences with loyalty programs, and the important role that payment data can play.

Traditional loyalty programs were a source of data for merchants, better enabling them to identify the repeat customers and track the shopping patterns by rewarding their repeat purchases. The digital environment now gives us an abundance of data that is captured in many ways and in many places, moving these programs to become a use of data that provides a better understanding of customer behavior and the more targeted rewards.

Strategic operating decisions that merchants make in key payments areas including orchestration, tokenization, and service provider selection will affect the ability of the marketing team to mine the loyalty data from payments and has the potential to either enhance or detract from the effectiveness of the loyalty program.

“This is a highly relevant and impactful report,” stated Don Apgar, Director of the Merchant Services and Acquiring practice at Mercator Advisory Group, and author of the report. “We are following this among a number of growing trends that are making payments a frictionless and invisible part of our everyday activities.”

This report is 18 pages long and contains 7 exhibits.

Companies mentioned in this report: Experian, Facebook, Fiserv, Paytronix, Radius 8, Starbucks, Stuzo, Yotpo

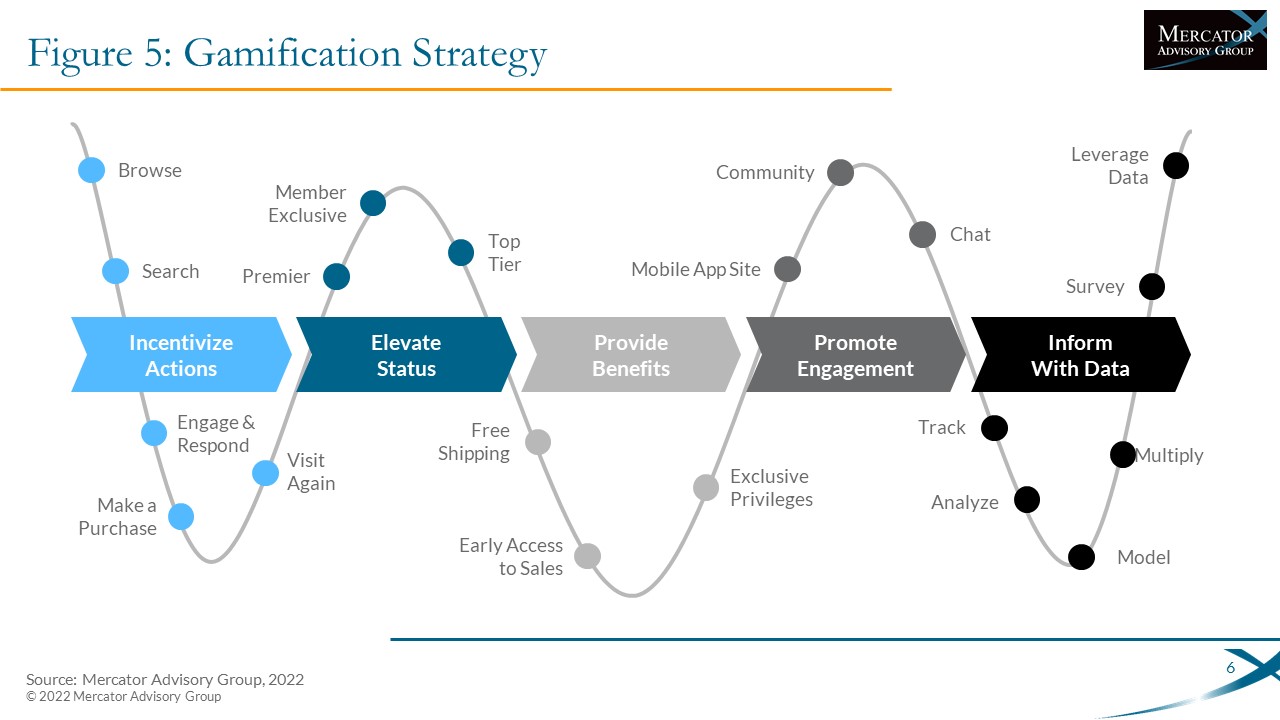

One of the exhibits included in this document:

Highlights of this document include:

- Survey data on participation by vertical market

- Factors affecting loyalty enrollment and participation

- In-depth discussion on the role of data in loyalty programs

- Current trends

- Recommendations for merchants currently operating or considering launching a loyalty program

Book a Meeting with the Author

Related content

Vertical SaaS: Best Practices for Monetizing Payments

Electronic payments are increasingly important to businesses of all types and were one of the first value-added features software companies brought to their platforms. Ironically, ...

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

Make informed decisions in a digital financial world