Overview

As economic conditions improve across Europe, micro, small, and medium enterprises (MSMEs) are starting to rebound. With consumers’ payment card use growing, accommodating their shifting payment preferences is increasingly valuable to merchants. As a result, the European merchant acquiring field has seen a surge in providers, old and new, offering mobile point-of-sale (m-POS) devices and attempting to differentiate themselves.

The diversity of acquirers providing m-POS devices stems from the devices’ potential to generate new revenue streams, bolster acquiring relationships, and enhance the electronic payment experience for both consumers and retailers. To date, the devices represent only a small portion of the installed POS terminal base, but signs point to their rapidly becoming the preferred checkout instrument of retailers of all sizes due to the cost and efficiency savings of these handheld terminals.

Mercator Advisory Group’s latest research note, European M-POS Providers, examines the opportunity among enterprises across the Europe Union that are most likely to use m-POS devices. The note compares leading providers in terms of price, functionality, and other features and comments on future prospects for m-POS providers in Europe and beyond.

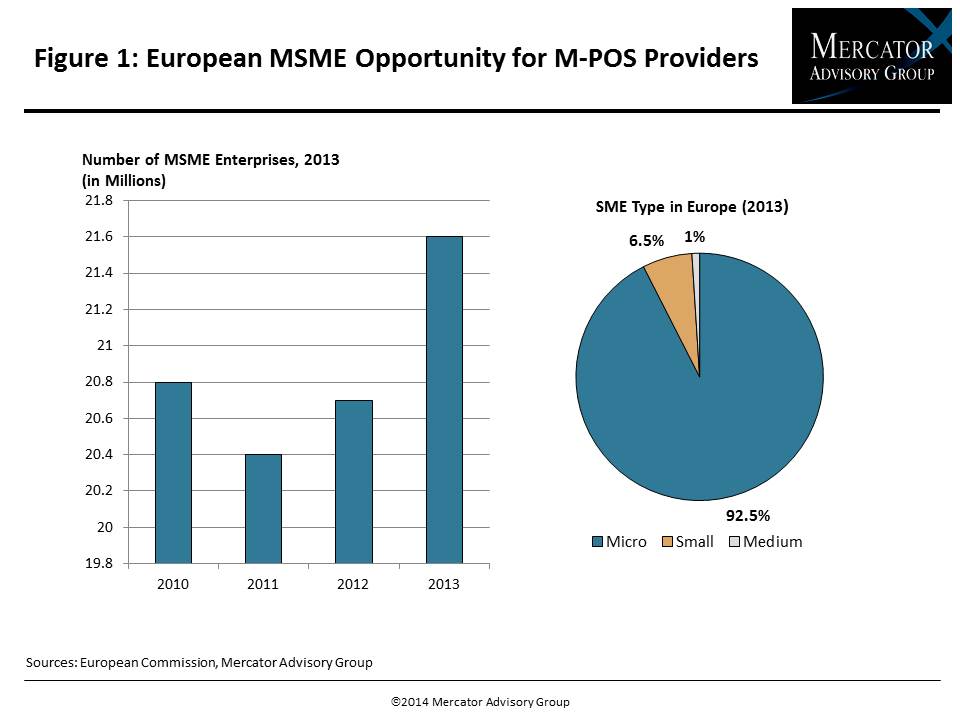

“The European m-POS market is extremely competitive, with traditional merchant acquirers and new entrants competing to provide payment acceptance hardware among Europe’s more than 21 million MSMEs. Providers of this relatively new technology and payment product are seeking to differentiate themselves in a number of ways and will the field will no doubt consolidate in the next few years, but opportunity exists in Europe and beyond,” comments Tristan Hugo-Webb, Associate Director of the International Advisory Service and the author of the note.

This research note contains 10 pages and 3 exhibits.

Companies mentioned in this note include: Visa Europe, BarclayCard, Elavon, First Data, Intuit, PayPal, WorldPay, Adyen, Eirpoint, Handpoint, Optimal Payments, iZettle, Santander UK, Payleven, SumUp, UBS, Paymax, and Wallet-E.

Members of Mercator Advisory Group’s International Payments Advisory Service have access to these notes as well as the upcoming research for the year ahead, presentations, analyst access, and other membership benefits.

One of the exhibits included in this report:

Highlights of the note include:

- Statistics that highlight the potential for m-POS devices among small and medium-sized enterprises around in Europe

- Comparison of the product offerings including distribution partnerships, hardware costs, processing fee structures, system operability, card network operability and other notable features

- Commentary on the future prospects of European m-POS providers in Europe and around the world

Book a Meeting with the Author

Related content

Payment Hubs Stand at a Crossroads

Payment hubs promised to simplify payments, but many never lived up to that vision. As real-time payments, open banking, and platform modernization reshape the landscape, banks are...

Stablecoins vs. Tokenized Deposits

Stablecoins and tokenized deposits are redefining how banks participate in digital money. Much of the current discussion centers on which of these instruments banks should emphasiz...

Real-Time Payments: Use Cases in Acquiring

The real time payments made possible through The Clearing House’s RTP and the Fed’s FedNow payment rails are making headlines, with promises of efficiency and lightning fast paymen...

Make informed decisions in a digital financial world