E-Commerce Fraud Detection Solutions: Market Overview

- Date:February 25, 2020

- Author(s):

- Tim Sloane

- Research Topic(s):

- Commercial & Enterprise

- Emerging

- Global

- PAID CONTENT

Overview

Machine learning tools have significantly changed the way fraud is detected. Even as machine learning technology advances at a dizzying rate, so do the models that fraud detection platforms deploy to recognize fraud. These models can now monitor and learn from activity across multiple sites operating the same platform or even from data received directly from the payment networks. This ability to model and detect fraud activity across multiple merchants, multiple geographies, and from the payment networks enables improved detection and inoculation from new types of fraud attack as soon as they are discovered. What is more important is that this technology starts to connect identity, authentication, behavior, and payments in ways never possible before.

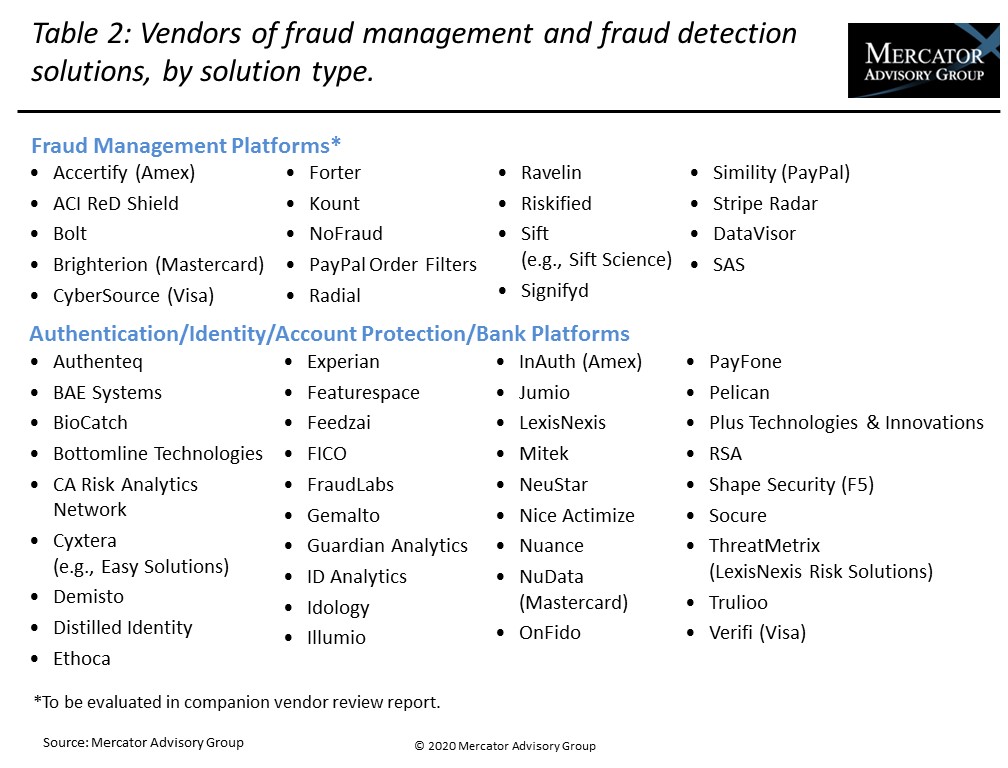

Mercator Advisory Group’s latest research report, E-Commerce Fraud Detection Solutions: Market Overview, provides a foundational framework for evaluating fraud detection technologies in two categories. The first category includes 18 suppliers that have been identified by Mercator as implementing more traditional systems that monitor e-commerce websites and payments, evaluating shopping, purchasing, shipping, payments, and disputes to detect fraud. The second category includes 37 service providers that Mercator has identified as specializing in identity and authentication often utilizing biometrics as well as behavioral biometric data collected across multiple websites to establish risk scores and to detect account takeover attempts and bots. Note, however, that companies in both of these categories are adopting new technologies and their solutions are undergoing rapid change.

“E-commerce fraud rates continue to increase at a rapid rate, with synthetic fraud growing faster than other fraud types. It is time for merchants to reevaluate the tools they currently deploy to prevent fraud,” commented Steve Murphy, Director, Commercial and Enterprise Payments Advisory Service, co-author of the report.

This report is 19 pages long and has 7 exhibits.

Companies and other organizations mentioned in this report include: Accertify (Amex), ACI ReD Shield, Authenteq, BAE Systems, BioCatch, Bolt, Bottomline Technologies, Brighterion (Mastercard), CA Risk Analytics Network, Cybersource (Visa), Cyxtera (Easy Solutions), Datavisor, Demisto, Distilled Identity, Ethoca (Mastercard), Experian, Featurespace, Feedzai, FICO, Forter, FraudLabs, Gemalto, Guardian Analytics, ID Analytics, Idology, Illumio, InAuth (Amex), Jumio, Kount, LexisNexis, Mitek, NeuStar, Nice Actimize, NoFraud, Nuance, NuData (Mastercard), OnFido, PayFone, PayPal Order Filters, Plus Technologies & Innovations, Radial, Ravelin, Riskified, RSA, SAS, Shape Security (F5), Sift (Sift Science), Signifyd, Simility (PayPal), Socure, Stripe Radar, ThreatMetrix (LexisNexis Risk Solutions), Trulioo, and Verifi (Visa).

One of the exhibits included in this report:

- Identifying the total cost of fraud or assigning costs to a specific role in the overall payments value chain is nearly impossible. The difficulty is a result of the complexity of multiple fraud vectors combined with the lack of a consistent methodology for counting fraud loss and assigning liability among merchants, payment networks, and card issuers.

- When expenses related to chargebacks, fees, merchandise restocking, labor and investigation, legal prosecution, and IT/software security are taken into account, the cost for each dollar lost to fraud has increased from $2.40 in 2016 to $3.13 in 2019.

- Networked machine learning models, especially those trained by information gleaned from multiple merchants, payment networks, and issuers, are changing the dynamics of the fraud detection market.

- Online order for store pickup has become a significant new fraud vector, and it requires new models to detect and thwart.

Book a Meeting with the Author

Related content

Faster Funds by Fiat: A Global Comparison of Payment Timing Regulations

Governments want big businesses to pay suppliers faster, and they are using legislation to influence payment timing, with varying degrees of success. This report categorizes the ma...

2025 Commercial Payments Year in Review

The 2025 Commercial Payments Year in Review report distills the headline stories in commercial payments, from stablecoins moving into the mainstream and agentic AI entering network...

2026 Commercial & Enterprise Trends

Commercial payment providers are strategically reimagining their infrastructure, pricing, sales, and risk management strategies. This strategic flexibility ensures they purpose-fit...

Make informed decisions in a digital financial world