Overview

Credit Surcharging and Cash Discounting: Do the Benefits Outweigh the Risks?

Mercator Advisory Group’s most recent report, Credit Surcharging and Cash Discounting: Approaches to Managing Processing Costs, examines the changing regulatory landscape for surcharging and discounting, and offers recommendations on how to effectively adopt either strategy.

Credit surcharging and cash discounting are two approaches to shifting the cost of credit processing from the merchant to the consumer. While either approach can help merchants lower operating expenses and support their bottom line, they both come with challenges and risks. Merchants should be aware of the complex regulatory environment surrounding these strategies and weigh the risk of losing customers to competitors who do not surcharge or offer discounts.

“For small merchants struggling with profitability, two main approaches exist to shift the expense of credit transactions onto consumers. In many ways, credit surcharging and cash discounting are two sides of the same coin: one charges a fee to those who choose to use a credit card, one offers a reward to those who choose cash. Still, these two approaches have experienced dramatically different treatment by state regulators and credit card networks alike,” stated the author of the report, Laura Handly, Research Analyst at Mercator Advisory Group.

This report is 14 pages long and contains 2 exhibits.

Companies mentioned in report include: American Express, Discover, Kroger Inc., Mastercard, QVC Inc., Rite Aid Corp., Riverside Café, Safeway Inc., Visa.

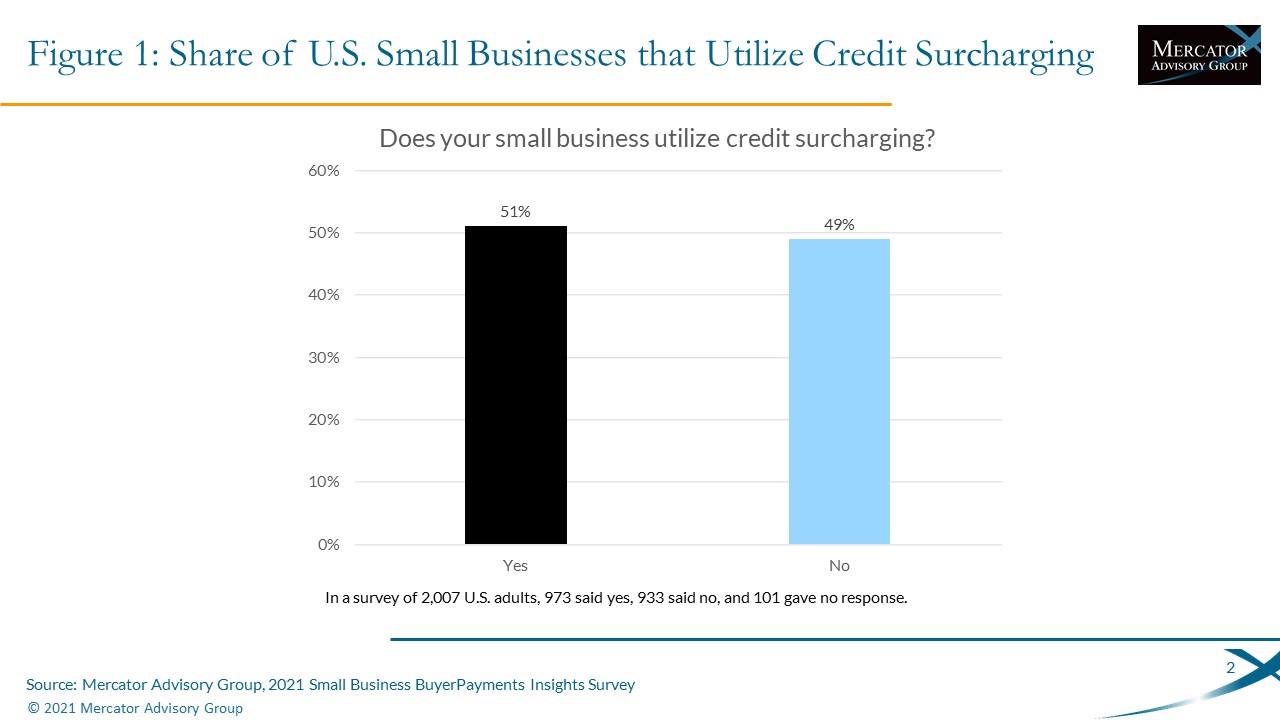

One of the exhibits included in this report:

Credit Surcharging and Cash Discounting: Approaches to Managing Processing Costs

- Definition of Terms

- Overview of Developing Rules and Regulations

- Strengths and Weaknesses of Each Approach

- A Case Study

- Current Trends

- Recommendations for Merchants

Book a Meeting with the Author

Related content

Agentic Commerce: Green Light or Flashing Yellow for Merchants?

Agentic commerce is forecasted to reach $500 billion in sales by 2030, but what’s driving that growth? Consumers will vote with their wallets on which product categories and sales ...

Merchants Should Planogram Payments

Enterprise merchants have increasingly adopted payment orchestration strategies to drive new payment types, increase payment success rates, and optimize platform performance. Howev...

2026 Merchant Payments Trends

As payment technology advances and offers greater options and flexibility for consumers, merchants are put in the position of prioritizing how to manage payment acceptance, what pl...

Make informed decisions in a digital financial world