Credit Card Profitability: Interest Spreads and Credit Quality Set the Course for 2020

- Date:December 31, 2019

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

Credit cards remain one of the most profitable offerings by retail banks in the United States. Still, margins began to slip between 2014 and 2017 as credit card issuers rebuilt their portfolios after the recession and normalized strategies in response to the Credit Card Accountability Responsibility and Disclosure Act of 2009 (the CARD Act). Return on Assets (ROA) for credit card banks fell from 4.94% to 3.37% during that period.

The tides turned in 2018, when the ROA metric improved 42 basis points to 3.79%. Credit card issuers increased their lending margins and benefited by improved credit quality.

The analysis presented in Mercator Advisory Group’s latest research report, Credit Card Profitability: Interest Spreads and Credit Quality Set the Course for 2020, explains the Return on Assets metric, illustrates which components affect the results, and describes why momentum should keep top credit card issuers profitable in the coming decade.

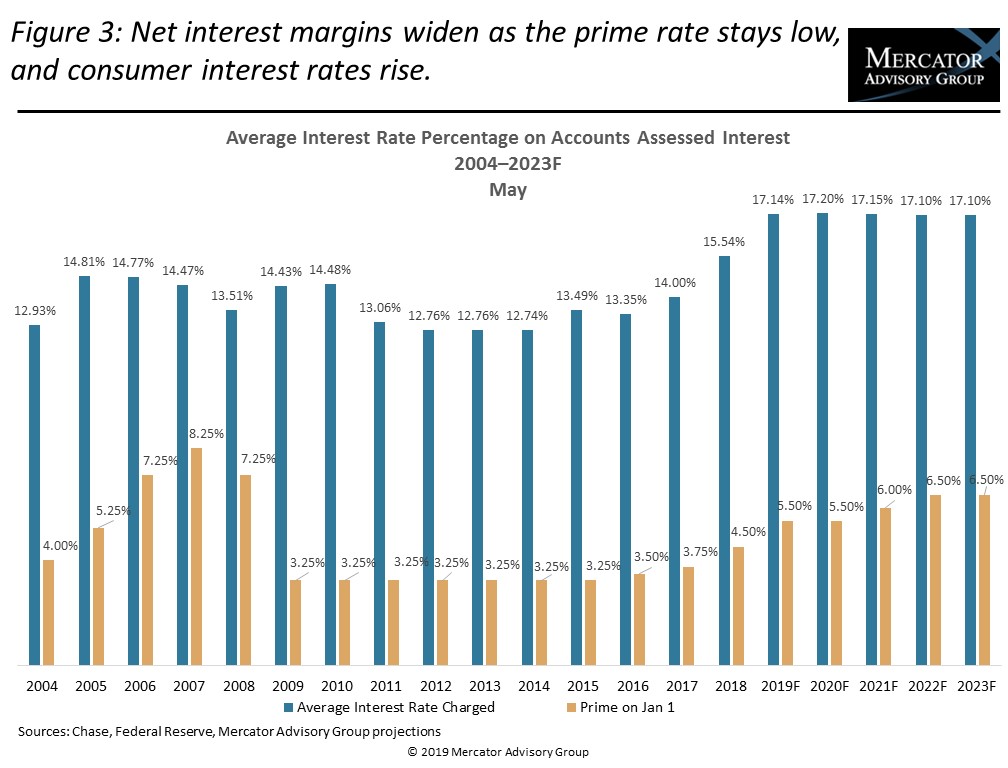

“Credit card issuers began to increase credit card interest margins in 2017 when the prime rate was 3.75%, and they continued to improve their margins in 2018. Indications are that the interest spread., or margin, will rise slightly into 2020,” Brian Riley, Director, Credit Advisory Service at Mercator Advisory Group. “The momentum will likely continue through 2020 as almost 200 million cards were issued since 2017.” Riley also notes that the increased margin protects the credit card Return on Assets metric and helps shield against credit losses if the U.S. market should experience a downturn.

This research report contains 20 pages and 9 exhibits.

Companies and other organizations mentioned in this research report include: American Express, Barclaycard, BMO, Capital One, Chase, Citi, Discover, Equifax, Experian, Scotiabank, TD, TransUnion, U.S. Bank, and Wells Fargo

One of the exhibits included in this report:

- An explanation of how credit card interest rates increased at a time when the prime rate has been low

- A detailed explanation of the Return on Assets model in the credit card industry

- Reasons why credit card profitability will be strong through the beginning of the new decade, and where risk exists

- A comparison of credit card ROA to all commercial bank ROA

- Suggestions of ways for credit card issuers to protect their Return on Assets

- A working model to compare any financial institution results to the Federal Reserve’s Report to Congress on the Profitability of Credit Card Operations of Depository Institutions

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world