Credit Card Products for a New User Environment

- Date:September 04, 2020

- Author(s):

- Brian Riley

- Research Topic(s):

- Credit

- PAID CONTENT

Overview

The pandemic changed life as we know it for credit card lenders and cardholders. Being a lender is not so simple anymore. Profitability is under siege, driven by loss provisioning, declining outstandings, changing spending patterns, debit competition, erosion in the power of rewards, and a deep recessionary environment. Primarily driven by the externality of the COVID pandemic, many behavioral changes among cardholders are likely to be long term, if not permanent.

Mercator Advisory Group research, Credit Card Products for a New User Environment, indicates a shift in credit and debit patterns. Contactless payments mean more to merchants, consumers, and issuers than ever. Durable spending is down; consumptive spending is up. And, credit card deferrals do not seem to carry the stigma they once did. Rewards consume a large portion of interchange, and in a shifting market, all costs must receive consideration.

"You cannot simply throw rewards at consumers and expect profitable market share,” comments Brian Riley, Director, Credit Advisory, at Mercator Advisory Group, and the author of the research note “Credit Card Products for a New User Environment.” Riley adds that "Credit cards are certainly not going away, but expect lower returns, higher risks, and shifting purchase patterns at least through 2025. And, do not forget the investor. It might be balance sheet lending or asset-backed securitizations enabling the credit card lender, but without the investment, card lending will cease. Lending is a risk-based business; it requires a return for tolerating the risk.

This document contains 20 pages and 13 exhibits.

Companies mentioned in this research note include: American Express, Discover, Mastercard, and Visa.

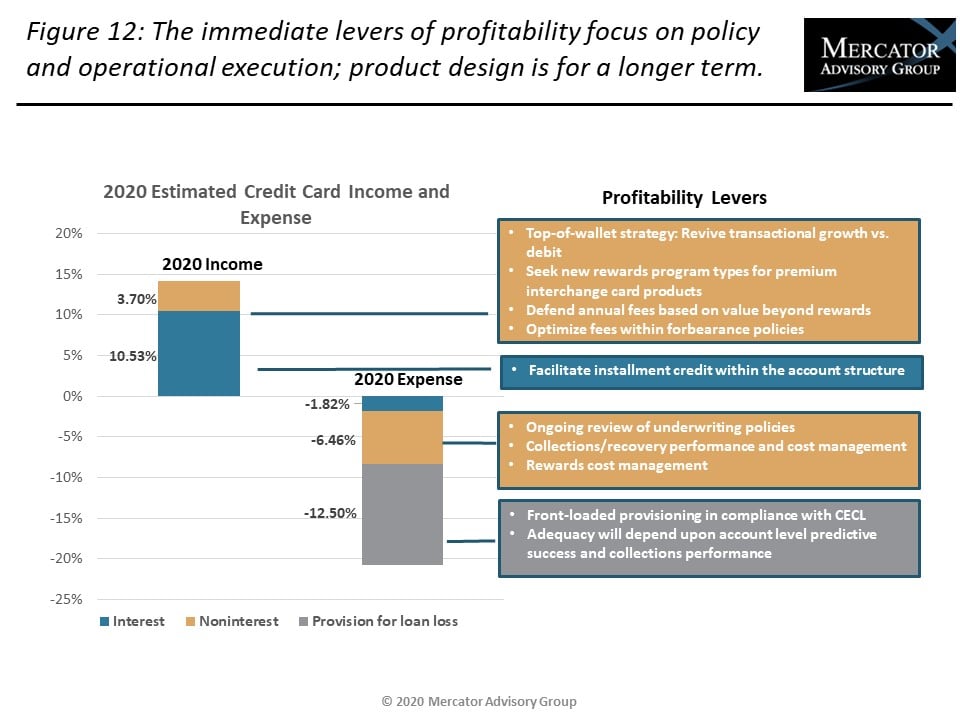

One of the exhibits included in this report:

Highlights of the research note include:

- Credit and debit purchase transactions

- Credit and debit average ticket

- Consumer panel data on usage and alternative payments

- Changing payment methods since COVID-19

- New payment technology usage

- Estimated Income and expenses, 2018 versus 2020

Book a Meeting with the Author

Related content

Credit Card Databook 2026

The credit card market, which appeared to be a candidate for saturation in recent years, continues to grow amid a resilient economy. Purchase volume reached $1.28 trillion in 2025,...

Chase Bites on Apple: Big Gets Bigger (and Probably Better)

JPMorgan Chase’s deal with Goldman Sachs to take over stewardship of the Apple Card sends both banks in the direction of their greatest strengths. JPMorgan Chase knows how to run a...

Evolutions in Secured Cards: Not Ready for Traditional Lenders

An emerging fintech payment card is a variation of the long-established secured credit card, with a significant twist. Instead of requiring a credit-challenged consumer with a weak...

Make informed decisions in a digital financial world